October 23, 2025

Thematic investing has become a defining feature of modern portfolio construction. Rather than simply owning sectors, investors are targeting structural trends — from artificial intelligence and renewable energy to cybersecurity and space exploration — seeking asymmetric returns tied to long-term technological or policy shifts. Yet beneath the narratives, these themes differ sharply in how they behave under changing market regimes. Some are clearly risk-on trades that thrive on liquidity, innovation, and momentum, while others have risk-off traits rooted in recurring cash flows and policy support.

An examination of returns, valuations, and volatility across major thematic ETFs reveals where each theme sits on the risk spectrum.

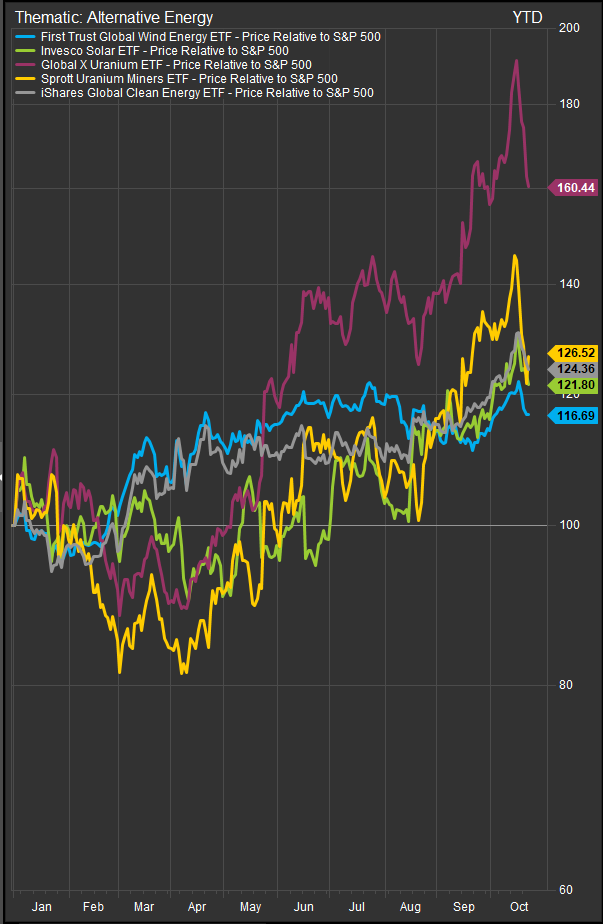

Alternative Energy: Policy-Driven Risk-On Exposure

Renewable energy remains a risk-on theme, highly sensitive to rates and subsidies. The iShares Global Clean Energy ETF (ICLN) shows a -0.15% one-year return, -10.4% over three years, and a modest +2.3% over five, with a 24% standard deviation, nearly double that of the S&P 500. The Invesco Solar ETF (TAN) rebounded 27.5% in the past year but remains down -10.4% over three.

Earnings remain volatile and policy-driven. Although valuations have compressed (ICLN trades near 15.5× forward earnings), profitability remains thin, and cost-of-capital sensitivity is extreme. This theme performs best in environments of lower yields, generous subsidies, and risk appetite for green capex — quintessentially risk-on conditions.

Nuclear Energy: Structural Risk-On Growth with Defensive Undercurrents

Nuclear energy has re-emerged as one of the most compelling risk-on structural trades in the global energy complex — yet it carries a subtle risk-off foundation rooted in policy stability and baseload demand. The Global X Uranium ETF (URA) and the Sprott Uranium Miners ETF (URNM) have surged more than 65% over the past year and roughly 28% annualized over three years, reflecting renewed investment in reactor restarts, next-generation SMR (small modular reactor) development, and rising uranium prices above $90/lb. Volatility remains high (~30% standard deviation), characteristic of commodity-linked equities, but unlike solar or wind peers, the nuclear industry benefits from durable regulatory momentum and constrained supply chains. Valuations for core holdings such as Cameco and NexGen Energy trade near 15–20× forward earnings, reasonable given multi-year contract visibility. This mix of policy support, decarbonization alignment, and earnings leverage gives nuclear a dual identity — cyclical enough to reward risk-on positioning, yet fundamental enough to act as an energy-sector stabilizer within a thematic portfolio.

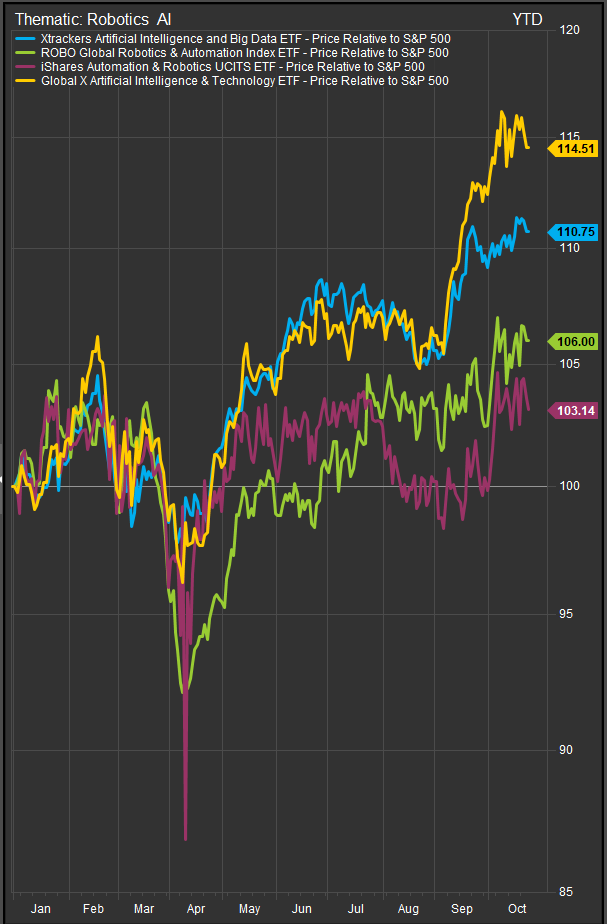

Artificial Intelligence and Robotics: The Core of The Global Risk-On Trade

AI and robotics define the current equity bull market’s risk-on core. The Global X Robotics & Artificial Intelligence ETF (BOTZ) has returned 10.5% over one year and 25.3% annualized over three, fueled by soaring demand for automation, semiconductors, and generative AI applications. Its 21.7% volatility and ~35× portfolio P/E underscore premium valuations tied to forward expectations.

Earnings momentum remains robust — particularly from NVIDIA, TSMC, and ABB — yet these stocks remain leveraged to liquidity and cyclical tech spending. AI leadership offers asymmetric upside but limited downside defense. When risk sentiment fades, these names correct quickly. Within the thematic universe, AI is one of the purest expression of risk-on positioning.

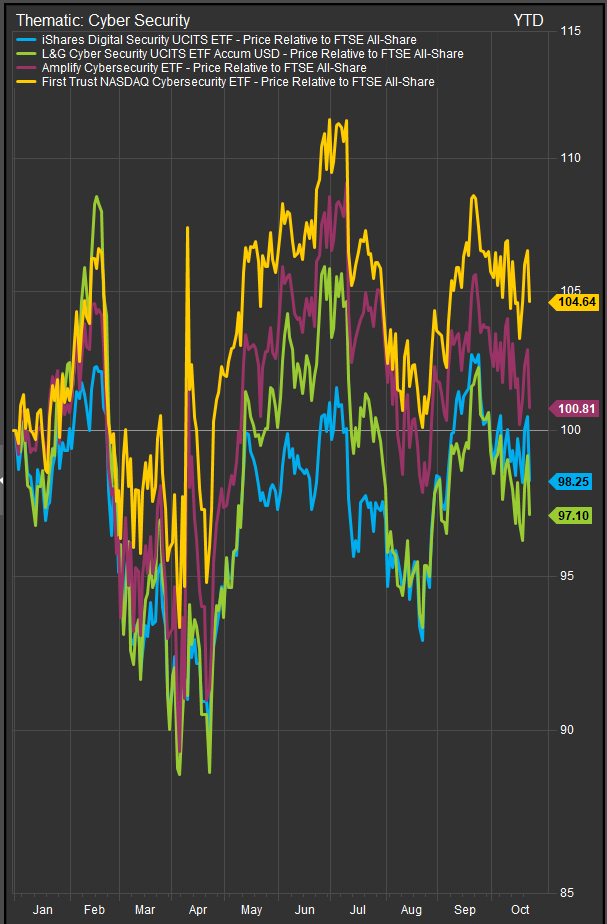

Cybersecurity: Growth with Risk-Off Stability

Cybersecurity stands apart as a risk-off-tilted growth theme. Demand for digital protection is largely non-discretionary, giving the sector a steady cash-flow base even when macro conditions soften. The First Trust Nasdaq Cybersecurity ETF (CIBR) has compounded 28.5% over one year, 25.8% over three, and 17.4% over five, with a manageable 16.2% standard deviation.

Valuations are elevated but reasonable (~30× P/E) relative to recurring-revenue growth models. Key holdings like Palo Alto Networks and CrowdStrike continue to expand margins even amid tighter budgets. This is the defensive growth allocation within technology — resilient during pullbacks, yet still capable of compounding through digital-security tailwinds.

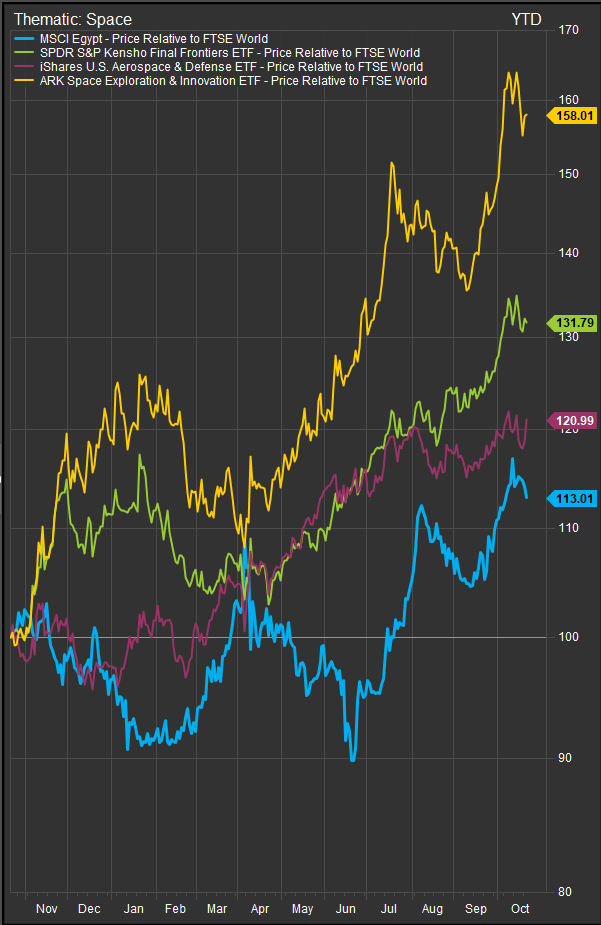

Space Exploration: Speculative Frontier and Pure Risk-On

The space trade is an unambiguous risk-on frontier. The ARK Space Exploration & Innovation ETF (ARKX) and the Procure Space ETF (UFO) surged 75% to 100% over the past year, making them some of 2025’s top-performing funds. Yet they carry 27–30% volatility and little fundamental support: many holdings are pre-profit, dependent on government contracts or venture-style capital flows.

Valuations swing with headlines about satellite launches, defense budgets, or private-sector milestones. For investors seeking speculative convexity, space is a high-beta thematic exposure; for most, it’s best kept as a small, risk-on tactical position, not a portfolio core.

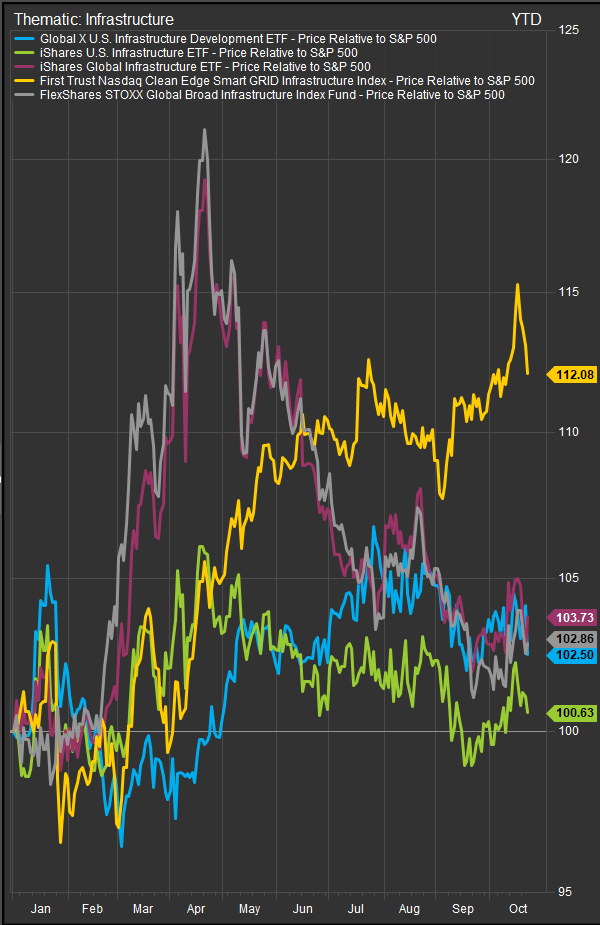

Infrastructure: The Leading Risk-Off Theme

In contrast, infrastructure investing offers the most compelling risk-off profile among major themes. The Global X U.S. Infrastructure Development ETF (PAVE) has posted 16.4% one-year, 28.2% three-year, and 23.9% five-year gains with a 21.8% standard deviation — a solid balance of growth and stability.

Backed by U.S. fiscal stimulus and long-term capital-spending cycles in transport, utilities, and construction, infrastructure names generate predictable earnings and often regulated returns. Valuations (P/E near 26×) reflect steady growth expectations rather than hype. This theme functions as a risk-off anchor in a thematic portfolio — capturing economic renewal without the volatility of speculative tech or crypto.

Cloud Computing: Moderate Risk-On Exposure in Transition

Cloud computing remains moderately risk-on, but its profile is maturing. The Global X Cloud Computing ETF (CLOU) returned 13.2% in the past year and 13.5% over three, while modestly negative (-0.15%) over five years, with volatility near 28%. The sector’s fundamentals — recurring revenue and scale efficiency — have stabilized, yet smaller SaaS firms still face multiple compression.

Investors increasingly differentiate between cash-flow-positive hyperscalers (Microsoft Azure, AWS) and higher-growth, less profitable cloud providers. The theme remains growth-oriented but no longer speculative. It behaves like measured risk-on exposure within a broader technology allocation.

Crypto and Blockchain Equities: The Extreme of Risk-On

Crypto-linked equities remain the market’s purest risk-on play — high momentum, high beta, and extremely cyclical. The Amplify Transformational Data Sharing ETF (BLOK) rose 81% over one year and 61% annualized over three, while the iShares Blockchain & Tech ETF (IBLC) gained 24.6% and 48.5%, respectively. Their volatility levels — 41% for BLOK and 67% for IBLC — dwarf other themes.

Earnings and valuations track digital-asset cycles almost one-for-one. Profits are sparse, regulation remains fluid, and performance hinges on crypto liquidity. This exposure can deliver outsize returns in risk-on phases but collapses when sentiment or liquidity turns. For prudent investors, it belongs only in small, speculative allocations.

Risk Regimes and Thematic Allocation Strategy

Across these themes, performance dispersion is immense. Average three-year standard deviation across all ETFs reviewed is roughly 28%, more than twice that of the S&P 500. Returns range from triple-digit annual gains in space and blockchain to losses in renewables.

This divergence reinforces a crucial principle: risk-on themes are regime-dependent, thriving during liquidity expansions and growth acceleration, while risk-off exposures offer ballast when markets turn defensive. Cybersecurity and infrastructure provide the most reliable compounding and downside resilience, while AI, space, and crypto dominate in momentum phases.

The optimal strategy is to treat thematic allocations as satellites around a diversified core — scaling risk-on exposure when financial conditions ease and rotating toward risk-off themes when volatility or rates tighten. The goal is not to chase every trend, but to align risk posture with the market regime.

Bibliography and Data Sources

- iShares Fund Fact Sheets — ICLN, IGF, IBLC performance, volatility, and valuation data.

https://www.ishares.com/us/products - Invesco ETFs — TAN Solar ETF performance and standard deviation data.

https://www.invesco.com/us/financial-products/etfs - Global X ETFs — BOTZ, CLOU, PAVE, BUG performance, valuation, and holdings data.

https://www.globalxetfs.com/funds - First Trust Portfolios — CIBR Cybersecurity ETF returns, volatility, and fundamentals.

https://www.ftportfolios.com/retail/etf/EtfSummary.aspx?Ticker=CIBR - ARK Invest — ARKX Space Exploration & Innovation ETF performance and holdings.

https://ark-funds.com/funds/arkx - Procure AM — UFO Space ETF performance data and methodology.

https://procuream.com/ufo-etf/ - Amplify ETFs — BLOK Transformational Data Sharing ETF performance and volatility data.

https://amplifyetfs.com/funds/blok - Morningstar Direct & ETFdb — multi-year total return and volatility metrics (as of September 30 2025).

https://www.morningstar.com/ | https://www.etfdb.com/ - Acuity Knowledge Partners (2025) — “Thematic ETFs: Recent Trends and Competitive Landscape.”

https://www.acuitykp.com/blog/thematic-etfs-recent-trends-and-competitive-landscape - Richardson Wealth (2025) — “Thematic ETFs: Exciting and Challenging.”

https://richardsonwealth.com/insights/marketethos/thematic-etfs-exciting-and-challenging

Charts and additional data sourced from Factset Research Systems Inc.