February 27, 2025

This week we’re looking at Crypto ETFs. The coins and related equities were strong through last November’s election but have been retracing gains over the past 3 months. We evaluate the trends to determine where we think opportunities may lie.

Bitcoin Near-term Oversold

The BTC:USD chart (below) shows the coin bouncing from near-term oversold conditions. Overhead resistance likely stops the near-term rally near the 50-day moving average at $98K. We are expecting a deeper retracement to play out given some signs of consolidation in the Growth trade, and developing uncertainty about tariffs and the direction of the economy. We’re looking for an accumulation opportunity to develop below current prices.

Longer-term (chart below) we are looking for Bitcoin to retrace to support near the $73679 level. Absent a compelling set of fundamentals, Bitcoin trades on behaviors or “animal spirits” in the parlance of Wall Street. It is no surprise then that intermediate term support for the coin price lines up with a 38% Fibonacci retracement of the long-term move off the 2022 low. The Fibonacci sequence has been observed as one of nature’s instinctual guide posts for proportionality. That’s a high minded way of saying, we think the average Crypto bro will be looking at this similarly to the sale rack at the clothing store. >40% off likely moves the needle.

BLOK trading down to Support

The Amplify Transformational Data Sharing ETF has traded down to intermediate-term support near $40. As seen on the chart below, trend and momentum have turned negative in the near-term (panels 2 and 3), but we are also near-term oversold. We expect consolidation to continue in the near-term.

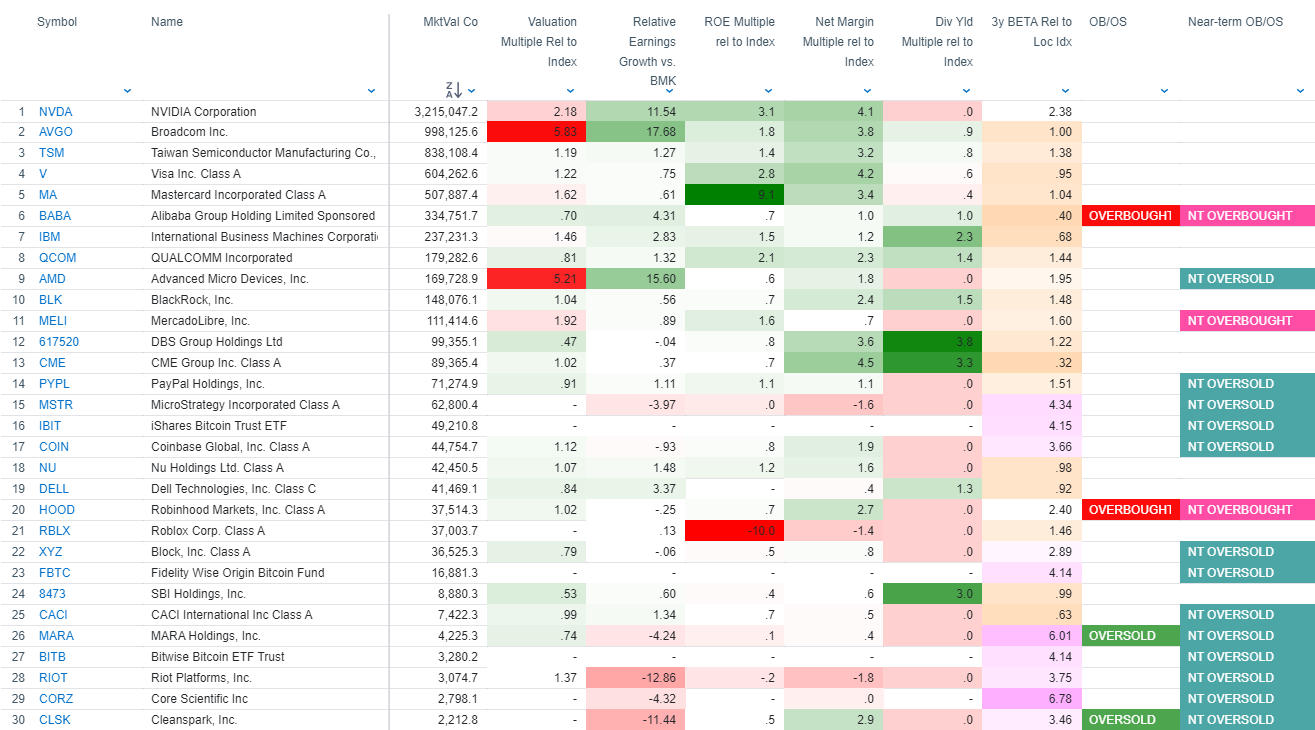

BLOK’s holdings are representative of the Crypto ecosystem. We have established crypto pure plays like MSTR, COIN and XYZ along with big compute names NVDA and AVGO. Big cap. financials are the other cornerstone component of the biggest bitcoin ETFs, adding a level of stability to the funds. Top 20 holdings as sourced from Factset are below.

High Valuation and High Earnings Growth Projections

When we analyze BLOK’s holdings with our ETFSector.com proprietary metrics (below) we are seeing plenty of oversold conditions developing in the Small/Midcap trade while Large Cap. semiconductor co.’s remain fully valued. HOOD, MELI and BABA are notable outperformers in the near-term. We’d be looking for an accumulation opportunity in MSTR here as well if Growth sellers get too aggressive.

Strong Trends Persist over the Intermediate-term

Some more obscure names that are likely hot among the set that actively trades their personal account…

OPRA

CMPO

DBS Group

Data sourced from FactSet Research Systems Inc.