March 6, 2025

US equities are in risk-off mode. Uncertainty around US implementation of Tariffs has opened the door for more speculative money to flow overseas as US equities continue what is developing into a deeper correction in the near-term.

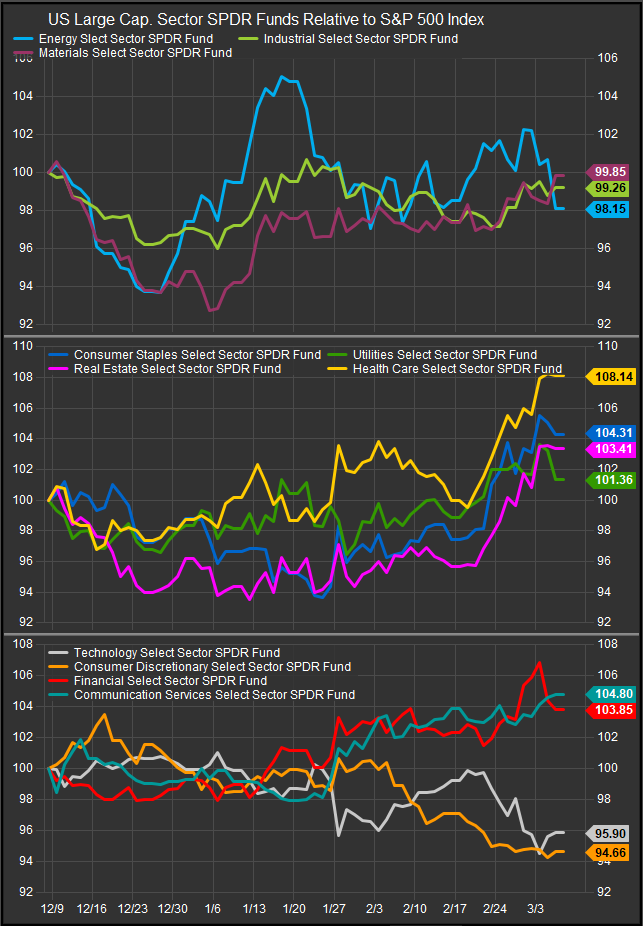

Utilities, Real Estate, Staples and Healthcare stocks are outperforming Large, Mid and Small Cap. benchmarks since the middle of February. The sector performance chart of the S&P 500 (below) tells the story concisely.

However, while Gold, zero-day options and short-term bonds tick higher, there have also been rotations into higher risk areas. Chinese Internet stocks have caught a bid on news that BABA is getting more involved with AI integration. Chinese shares in general and internet shares in particular started a volatile bullish reversal in September of 2024. The first bullish impulse was kicked off by Chinese economic reforms. The bid reemerged with revelations around “DeepSeek” and its AI achievements that were achieved with far more modest resources than domestic AI companies were operating with.

We take a look at the KraneShares Chinese Internet ETF (KWEB) this week (chart below).

At first glance this looks like a very aggressive entry point with shares up 30-40% since mid-January, but the price structure shows a bullish reversal signature with sequential higher-highs and higher-lows. The best part about the technical setup for Chinese internet names is apparent when looking at a longer-term price chart of KWEB. Here’s the 5yr picture (below). This shows the long-term basing process that Chinese internet shares have travelled since the heady days of 2020-21. Despite the recent upwards surge in absolute and relative terms, shares are just now emerging from a sideways consolidation after shares retraced 80% of their value relative to the S&P 500 from 2020-2022.

In the context of that big decline, September 2024’s initial price surge triggered a long-term buy signal on the weekly chart by sending the RSI study into overbought territory above the 70 level. That kind of momentum surge in a long dormant security is typically a signal of longer-term bullish trend change. Given the steep discounting and the multi-year basing process, we think Chinese internet shares are likely to be a going concern past the short-term now that the buyer has demonstrated renewed interest.

KWEB includes many well known names including PDD, Tencent and BABA, but we are now seeing off-shoots of those companies attract bids. JD Health and Alibaba Health IT are shown below. Both are testing upside resistance and have charted long-term bullish reversal patterns vs. The S&P 500 as well as EM and Chinese benchmarks.

Conclusion

With US equities under pressure in the near-term, the speculative impulse has migrated overseas. Chinese Growth stocks have based out over the past 5 years and are now showing bullish reversal. While Chinese internet stocks are overbought in the near-term, the long-term setup is attractive and we expect buyer interest will persist.

Data sourced from FactSet Research Systems Inc.