January 8, 2026

As 2026 begins, thematic investing is entering a more disciplined phase. The exuberance that once lifted entire themes indiscriminately has given way to greater selectivity, sharper dispersion, and a clearer divide between ideas driven by durable capital cycles and those reliant on sentiment or policy support. Investors are no longer asking whether a theme matters, but where along the value chain returns are most likely to accrue—and how long that process will take.

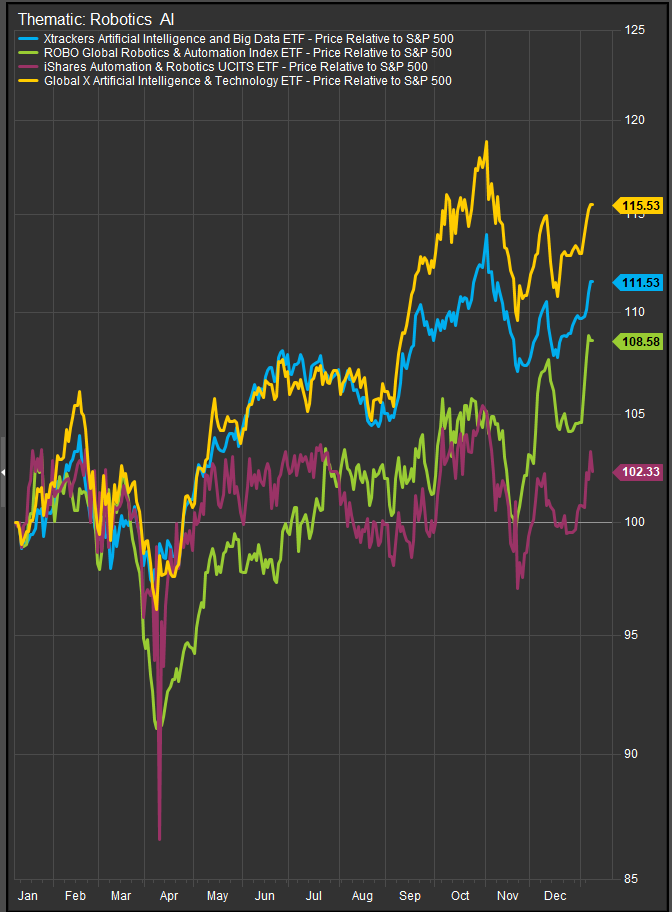

Artificial Intelligence remains the gravitational center of thematic capital, but the emphasis has shifted decisively from abstract potential to tangible infrastructure. In 2025, returns clustered around semiconductors, networking, power, cooling, and data-center real estate rather than application-layer software. Entering 2026, investors are increasingly focused on ROI, utilization rates, and monetization timelines, favoring companies embedded in long-lived capex cycles over those selling aspirational productivity gains. The AI theme is maturing into a multi-year industrial buildout rather than a purely digital disruption.

Robotics and automation are benefitting from this same transition. As AI models move closer to real-world deployment, robotics has emerged as a practical extension of the productivity narrative. Factory automation, logistics robotics, and process automation are drawing renewed interest, particularly where labor scarcity, reshoring, and margin pressure intersect. The theme is no longer framed as futuristic—it is increasingly positioned as a cost-control and efficiency solution, which gives it greater resilience as the economic cycle matures.

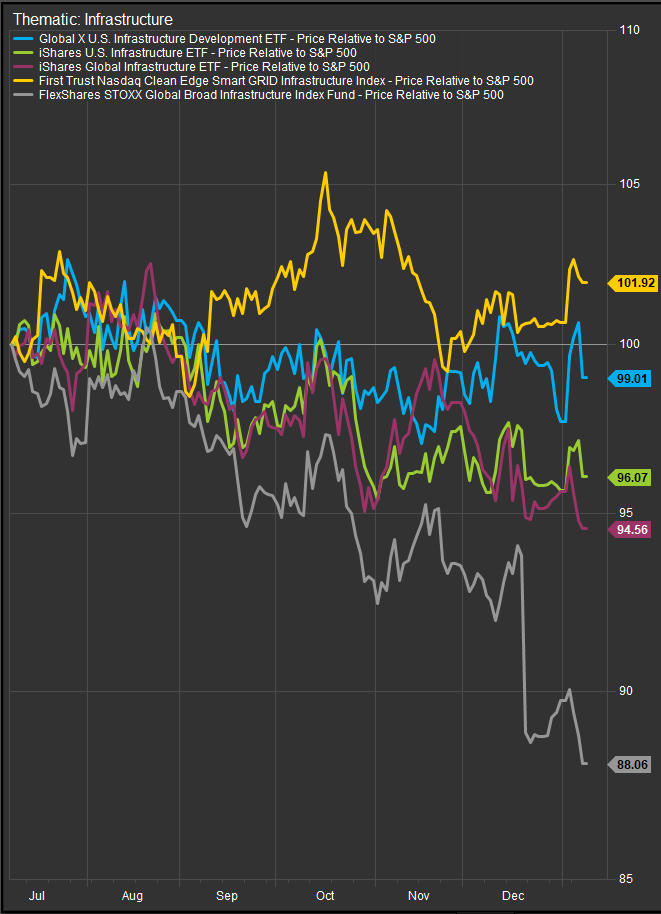

Infrastructure has quietly become one of the most structurally compelling thematic backdrops entering 2026. Electrification, grid hardening, AI-driven power demand, defense spending, and physical resilience have converged into a broad, long-duration investment cycle. Unlike many themes, infrastructure is supported by visible funding pipelines, multi-year projects, and relatively predictable cash flows, making it attractive even as valuation sensitivity increases elsewhere. The market’s growing focus on power availability and transmission capacity has only reinforced infrastructure’s relevance.

GRID (chart below) has been a top performing infrastructure ETF in this cycle.

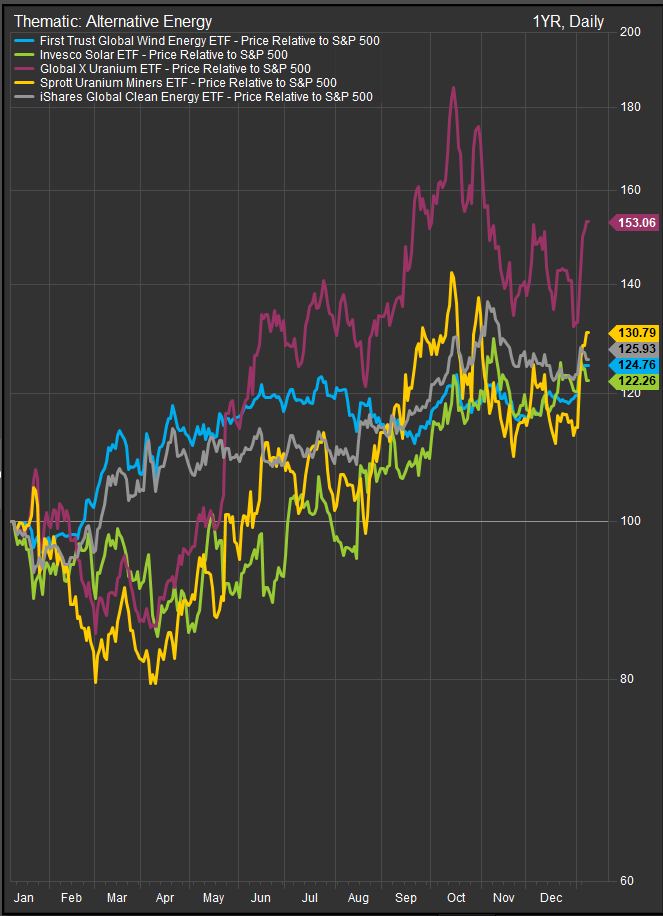

Alternative energy enters 2026 from a weaker position, but with a more balanced setup. Clean energy themes struggled in 2025 under the weight of higher real rates, oversupply, and policy uncertainty. As a result, valuations have reset and investor expectations are far more subdued. The opportunity case now hinges less on broad enthusiasm and more on selectivity within the theme—favoring grid-connected assets, energy storage, nuclear-adjacent technologies, and companies with clearer paths to cash flow rather than pure capacity expansion plays.

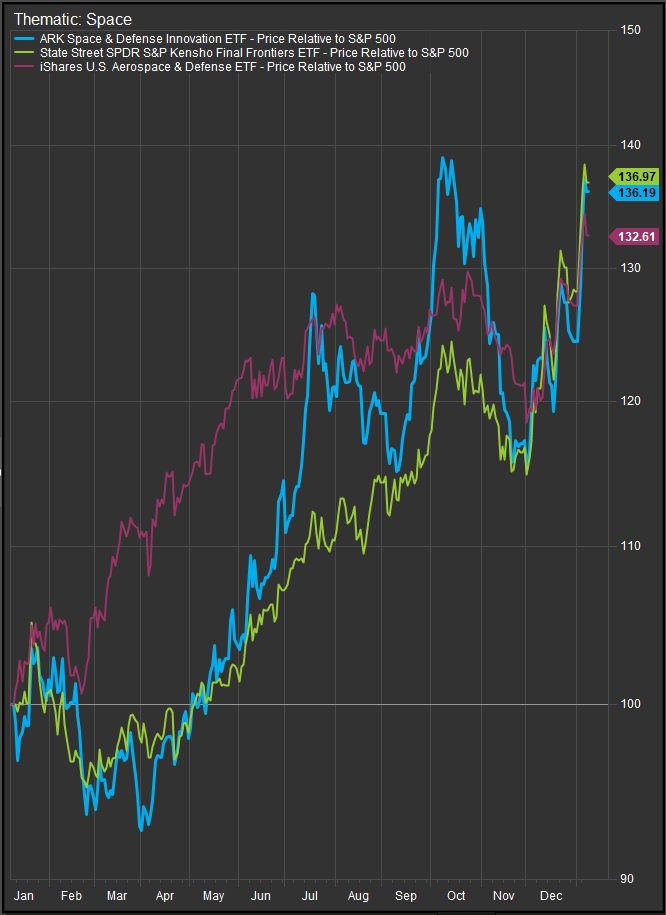

Space and aerospace innovation continue to evolve from speculative exploration toward strategic infrastructure. Satellite networks, defense-linked space assets, and launch services are increasingly framed as national security and communications priorities, not optional growth bets. While the theme remains volatile and capital-intensive, the growing overlap between space, defense, and communications has improved its durability relative to earlier cycles.

Satellite stocks have been strong. GSAT (below) has been among those leading the Comm. Services Sector higher.

Across all themes, a common thread is emerging: the market is rewarding physical scarcity, capital intensity, and long-duration investment visibility, while penalizing ideas that rely on rapid adoption curves or cheap financing. Thematic investing in early 2026 is less about chasing the next story and more about positioning within established structural trends at the right layer of the stack.

The implication for investors is clear. Thematic exposure still plays a critical role in portfolios, but success increasingly depends on precision, patience, and an understanding of where earnings and cash flows will materialize. As themes mature, they behave less like narratives and more like industries—bringing both opportunity and the need for discipline.

Charts and additional data sourced from Factset Research Systems Inc.