May 22, 2025

Global trade dynamics have impacted almost every aspect of the global equity market in 2025. Investors have concerns about aggregate economic impact on growth, inflation concerns due to rising trade barriers, infrastructure and supply chain sourcing and the availability of labor. One way that has manifested across investment themes is by bifurcating themes along geographical lines.

Ex-US vs. US is a clear factor in YTD performance across a broad swath of thematic investments. The current alignment is setup where US exposures have an advantage when global equity prices are rising while ex-US has been preferred by investors when prices are falling. Given that we are at a corrective point for the equity bullish reversal that began in early April. The behavior of the US vs. ex-US dynamic will help us get a sense for risk appetite.

Whose Internet do we Want?

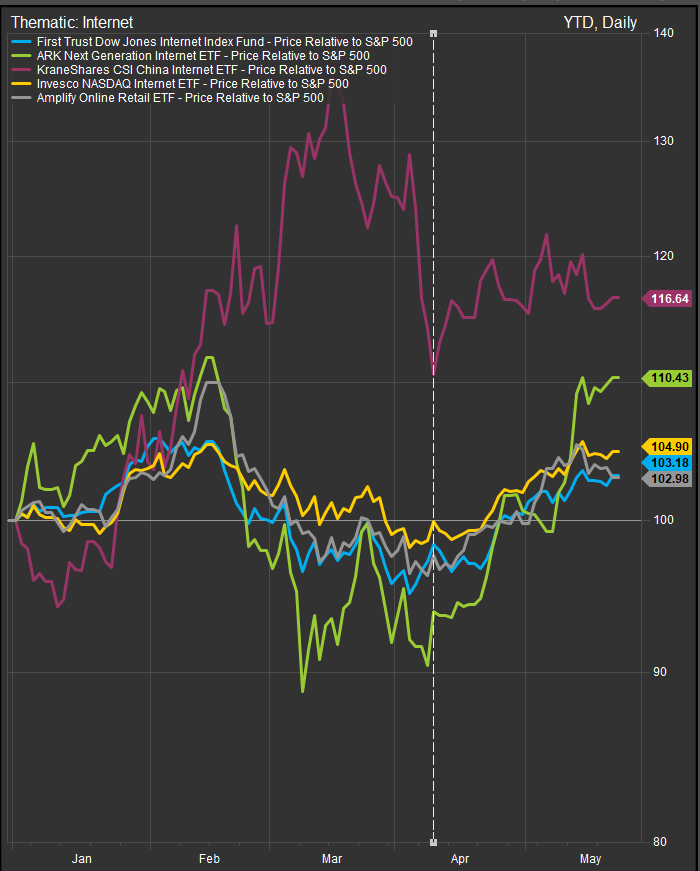

The chart below shows the dynamic we’re describing in comparing US internet ETFs vs. the KWEB ETF on ytd performance vs. the S&P 500 index. We can see the clear pivot in March where Chinese internet shares corrected while US internet rebounded with the broad equity market. April saw some positive correlation in performance and that is now diverging again in May in favor of US shares. We think a sign of constructive stabilization would occur if/when both begin trading in the same direction again as they had in January when the US bull trend was still psychologically intact.

If US equities fall out of their bullish reversal structure (we like the 5504 level on the index as support for the current bullish reversal), the move is to shift assets to ex-US based on the year-to-date performance trends we’ve observed.

Conclusion

While investors need to continue considering traditional measures of risk-on/risk-off exposure like volatility, valuation and earnings risks, the US vs. ex-US dynamic has become a driver of performance in 2025 with clear dynamics for bull market leadership (US) or safe haven exposure (ex-US). We are using this relationship to inform our tactical positioning. Global trade dynamics are a potential pivot point, and a re-alignment is likely more of an opportunity for ex-US shares broadly considering US stocks have enjoyed the upper hand within the previous status quo for most of the last two decades.

Data sourced from FactSet Research Systems Inc.