We are offsides in our Elev8 Sector Rotation Portfolio for August. The Consumer Discretionary Sector has flipped to negative trend signals on the back of AMZN’s earnings miss after market on August 1st. Further, S&P 500 price correction on weak economic data, particularly deeper contractionary readings on the ISM surveys was met with a negative reception, a first in 2024 for soft economic data.

We started the month giving the benefit of the doubt to higher beta cyclicals based on the long-term bull trend in US equities and a near-term oversold conditions from a top-line correction in July, but it looks like that corrective action is going to bleed over into August as we’ve seen a series of technical breakdowns in higher beta sectors that are typically strong bull market exposures and a change in how investors are interpreting soft economic data releases.

Portfolio Rebalance: Sell out XLY XLB and XLE, go Short XLK to Fund Long XLV, XLRE and XLP

XLE was a tactical long for August based on extended downside weakness in Commodities prices. We expected mean reversion. If we are going to get more top line corrective action from US equities, we are doubtful that transpires with a meaningful rally in Crude. We also view XLK shares as deeply oversold and don’t want to be short the entire sector.

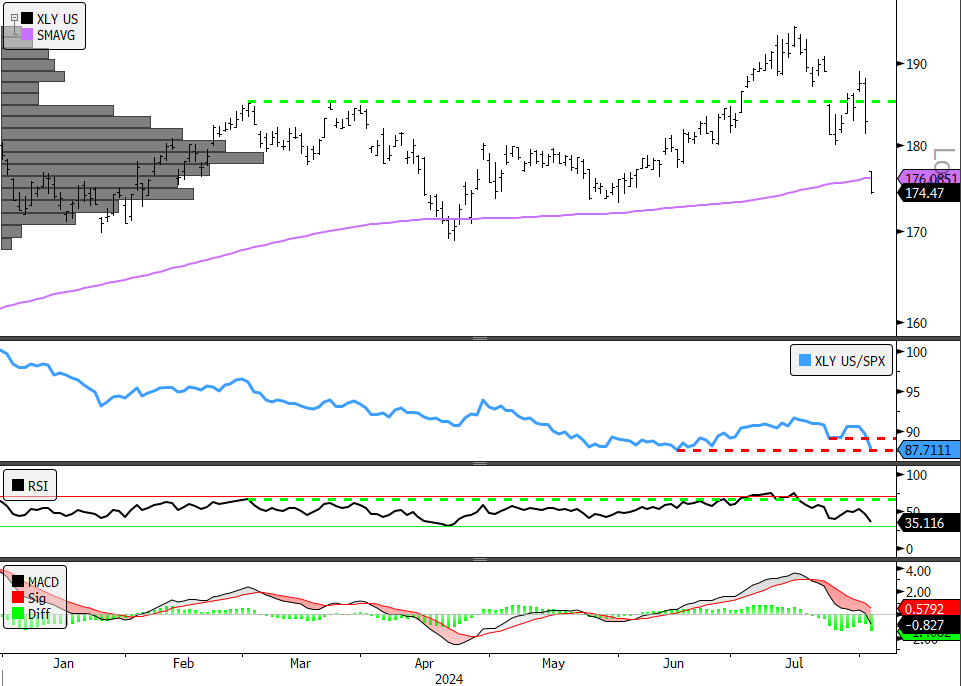

Selling Out of XLY:

- XLY daily, YTD (Relative to S&P 500 | RSI | 12, 26, 9 MACD)

- A break-out in June was promising, but August’s sharp break-down calls into question the bullish reversal pattern and creates a unambiguous tactical sell signal in our process

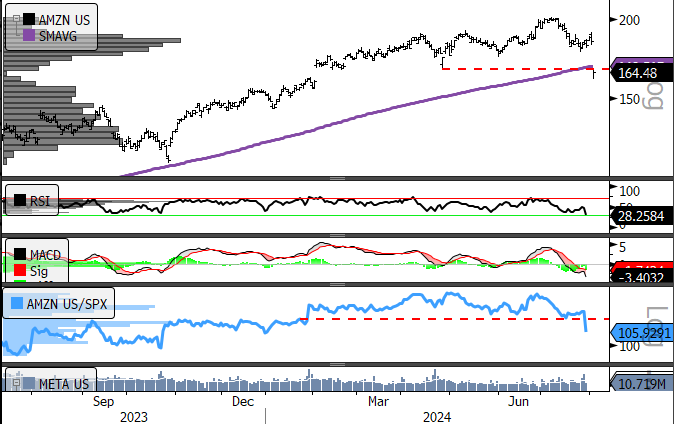

- AMZN daily, 1yr (Relative to S&P 500 | RSI | 12, 26, 9 MACD)

- AMZN has broken price and relative uptrends in 2024. This is a clear tactical sell signal in our work

New Positioning for August

It is not ideal to restate outlook 1 day into a monthly rotation exercise, but this is the first instance in 2024 where negative economic data has been processed as such by investors and we need be cognizant that selling could persist with less eyes on the market in August. At present, there are no obvious upside catalysts now that dovish policy has been recognized and the cadence of economic data releases is tilting further into negative territory.

Here is our updated positioning for August. As we noted in our monthly sector insights, we had been skeptical of the bullish reversal in low vol. and embracing the same for cyclical and commodity sectors. We now have some conclusive evidence that low vol. is in the stronger position. We continue to believe that the longer-term bull trend will persist, but we expect equities are poised to re-rate lower in the near-term and we will look to go long at a more opportune time.

Update Elev8 Sector Model Positioning for August 2nd, 2024:

Previous Positioning, August 1st, 2024:

Data sourced from Bloomberg