President-Elect Donald Trump’s campaign platform centered on policies promoting domestic production, tax reduction, deregulation, and a generally more business-friendly environment. The implementation and efficacy of these policies remain to be seen.

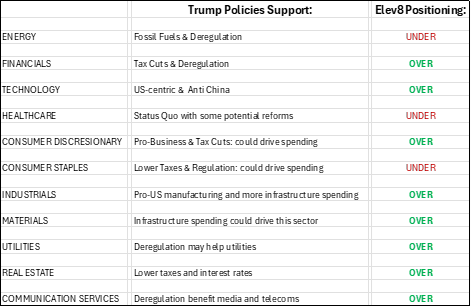

Investors may consider adjusting their asset allocations based on the potential impact of Trump’s proposed policies on individual sectors. The chart below summarizes the potential effects of Trump’s policies on each of the eleven sectors tracked by ETFsector.com. Our Elev8 sector rotation model incorporates up to fourteen technical and macroeconomic factors. Based on the trends observed in these factors, the model recommends overweighting or underweighting specific sectors.

As the new administration takes office, investors should remain vigilant and adaptable. While Trump’s proposed policies suggest potential benefits for certain sectors, it’s crucial to remember that campaign promises don’t always translate directly into policy.

Investors should continue to monitor economic indicators, policy developments, and market trends and consult a licensed investment professional to make informed investment decisions.