ETF Insights| November 1, 2024 | Utilities Sector

Utilities Sector November Outlook—Utilities Continue in an Intermediate-term Bullish Reversal

Price Action & Performance

Utilities have been the best performing sector over the past 6-months despite spending most of October in a corrective phase. However, with price pulling back to the 50-day moving average and the oscillator work closer to oversold than overbought, we expect Utilities are setup to succeed in November as earnings season has left some doubt in investor’s minds as it relates to big Tech. That is historically an opportunity for all the smaller sectors to benefit. The relative performance curve remains in a bullish reversal pattern. We’re sticking with it for November.

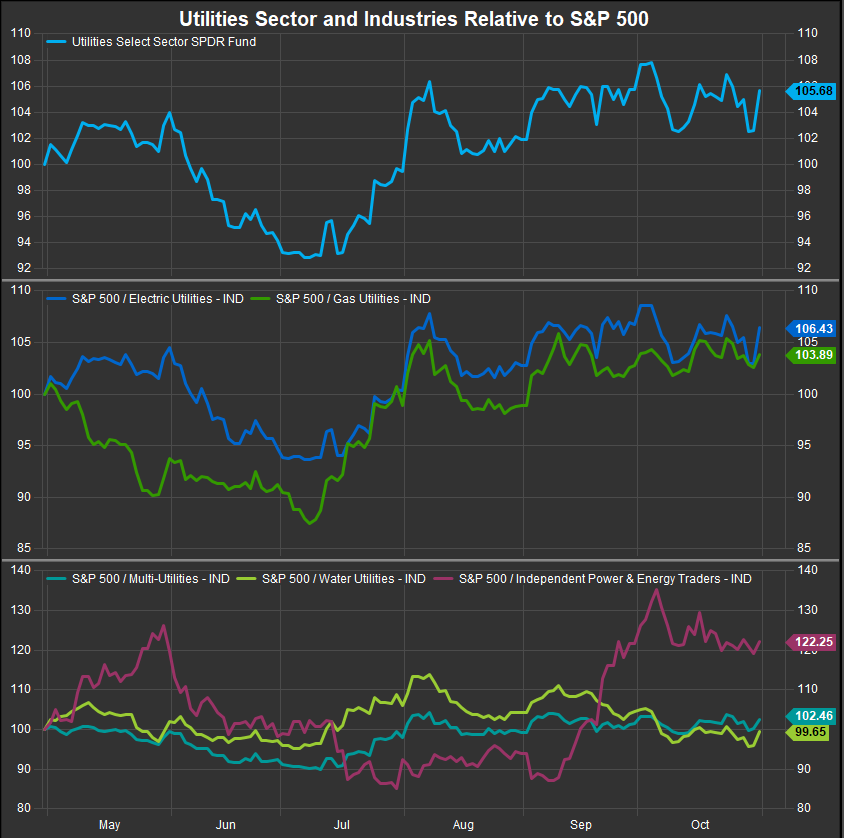

At the Industry level, 4 of the 5 industries that comprise the sector have outperformed over the past 6 months, with Independent Power & Renewables leading the way. VST has been a stock level driver of that outperformance and, along with CEG. offers a sustained momentum profile you don’t often see in a Utilities chart.

Economic and Policy Drivers

Expectations around dovish policy from the Fed have backed interest rates up into resistance with the 10yr Yield just shy of 4.3% which is a key level. Given weakness in Crude and Commodities prices over the short and intermediate terms we are betting that rates will roll over sooner rather than later and we are expressing that conviction with a long exposure in Utilities, Real Estate and Staples as well as a broad mix of sectors that benefit in bull markets.

Tax Credits for renewable energy have been a tailwind for the sector as have features of the Biden Administration’s “Build Back Better” plan. Names like CEG and VST have benefitted from more openness to nuclear power as an energy source as well as increased energy demand from AI facilities and chip fabrication plants.

We like Utilities as a hedge against potential downsides in Growth sections of the market. The bull trend has been strong, with the S&P 500 appreciating well above its long-term expected return in 2024. With the intrinsic uncertainty of Presidential Election season upon us we see Utilities as useful add to the portfolio.

In Conclusion

XLU is likely to be useful in November as increasing uncertainty around the election may cause continued rotation and/or correction in equities. Our Elev8 Sector Model continues with an OVERWEIGHT allocation to XLU of +2.24% above the benchmark S&P 500.

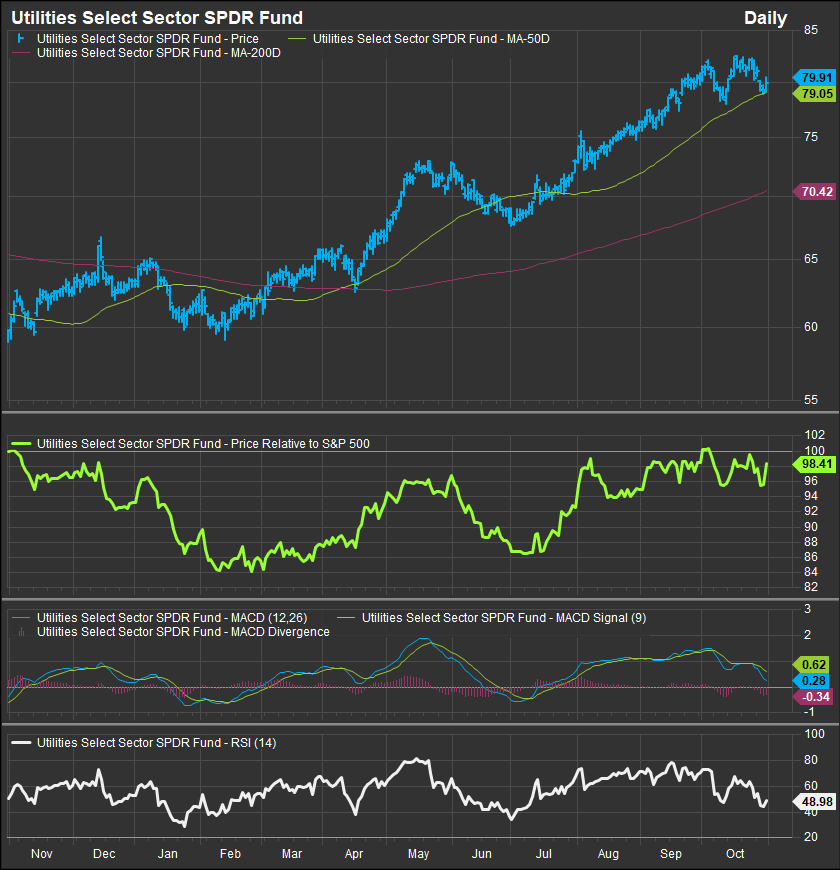

Chart | XLU Technicals

- XLU (200-day m.a. | Relative to S&P 500 | MACD | RSI)

- XLU has been tracing out an intermediate-term bullish reversal over the past 6 months after lagging materially over 3 and 5yr periods. We like this setup for the sector

XLU Relative Performance | XLU Industry Relative Performance | 3-Months

Data sourced from FactSet Research Systems Inc.