February 18, 2026

In a world where U.S. large-cap indices have dominated headlines, both South Korean and Japanese equities have quietly posted remarkable relative returns over the past 6–12 months. Country-specific structural catalysts, corporate governance improvements, currency dynamics, and long-term thematic positioning have combined to make markets like Korea and Japan compelling alternatives for international equity exposure—especially through U.S.-listed ETFs such as iShares MSCI Japan ETF (EWJ) and iShares MSCI South Korea ETF (EWY).

South Korea: Tech Leadership and Structural Reform

South Korea’s equity market has been one of the standout performers in emerging markets. In 2025, the Korean benchmark generated among the highest returns globally, driven by a combination of cyclical rebounds and structural shifts. A core reason is the country’s leadership in semiconductor memory and AI-relevant components. Korean firms like Samsung Electronics and SK Hynix dominate the High Bandwidth Memory (HBM) segment of the semiconductor supply chain, which is crucial for AI and high-performance computing applications. This has translated into outsized revenue growth and market share gains as global AI data-center demand accelerates. The rapid adoption of HBM4 and similar products has allowed these companies to secure long-term contracts, increase pricing power, and expand margins relative to peers.

Beyond tech, Korea’s diversified industrial base—including shipbuilding, defense manufacturing, and power equipment—positions the economy to benefit from secular global trends like infrastructure modernization and energy transition. Reforms aimed at reducing the historic “Korean discount”—the market’s structural valuation lag caused by conglomerate (chaebol) cross-holdings and weak minority shareholder protections—are also gaining traction. Initiatives such as improved corporate governance guidelines and legislative changes to expand directors’ fiduciary duties are fostering confidence among foreign investors and enhancing multiples.

Additionally, passive flows have helped reinforce momentum. Korea’s rising weight in the MSCI Emerging Markets Index has driven incremental allocation from benchmark-tracking funds and ETFs, including EWY, further supporting valuations and liquidity as global investors re-appraise the country’s growth prospects.

Japan: Reform, Buybacks, and Currency Tailwinds

Japanese equities were long dismissed as a value trap, but that narrative has shifted. The market’s performance acceleration reflects a combination of corporate governance improvements, rising shareholder distributions, and a favorable external backdrop. Many Japanese companies have adopted more shareholder-friendly policies, including increased dividends and share buybacks, partially due to pressure from activist investors and a broader recognition that capital returns enhance valuations. This shift has narrowed the discount Japan historically traded relative to global peers.

Currency dynamics have also played a material role. The Japanese yen’s prolonged weakness versus the U.S. dollar has enhanced the dollar-denominated returns for international investors—even before considering earnings growth. This has been particularly beneficial for exporters, which make up a large portion of Japan’s equity indices. A weak yen not only boosts reported revenue for these firms but also attracts foreign capital into vehicles such as EWJ.

Importantly, performance leadership in Japan is not solely a function of valuation relativity or macro positioning; it aligns with real earnings momentum. Japan’s export and industrial sectors have found traction as global demand stabilizes and supply chains diversify away from China-centric models. Combined with steady buyback programs and dividends, this creates a fundamental foundation to support equity returns that go beyond temporary currency effects and short-term flows.

ETFs as Access Points & Regional Comparisons

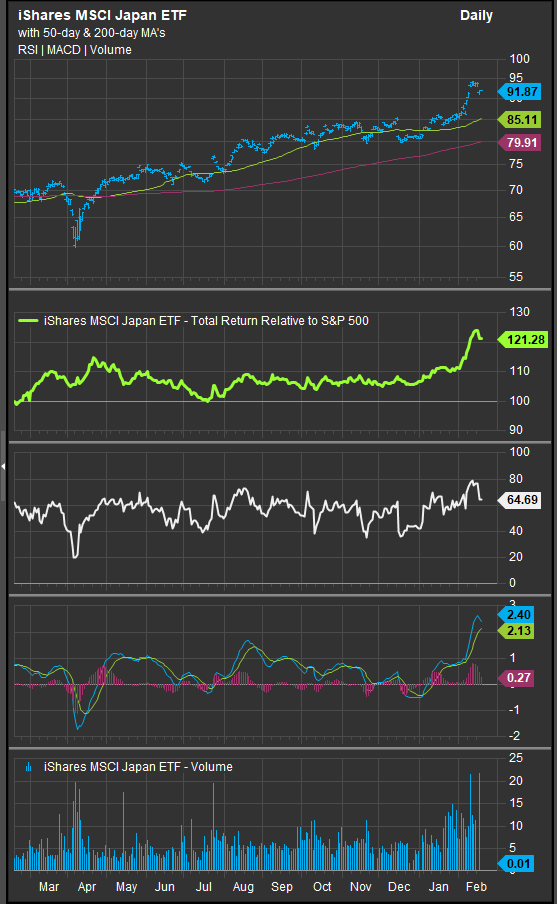

For international investors seeking exposure to these outperforming markets, ETFs provide a cost-efficient and liquid avenue. EWJ remains the flagship U.S. vehicle for Japanese equities, offering broad exposure to large and mid-cap Japanese companies and benefiting from both structural governance improvements and currency effects. Over the past year, EWJ has returned meaningfully more than the S&P 500—a performance gap that reflects both fundamentals and sentiment recalibration toward Japan.

Similarly, EWY offers investors broad access to the South Korean large-cap universe, capturing the disproportionate impact of semiconductor-linked gains and industrial strength. Korea’s return to leadership within emerging markets in 2025 highlights how thematic strengths, particularly in tech and export industries, can drive concentrated equity outperformance.

Drivers Behind the Outperformance

Three themes stand out:

- Structural competitive advantages: Korea’s dominance in semiconductor memory and Japan’s export-oriented industrial base anchor both markets in long-term global trends.

- Corporate and market reforms: Improved governance and capital allocation have reduced historical valuation discounts, particularly in Japan.

- Flows and index effects: Rising index representation and passive inflows have reinforced price momentum in both markets.

These factors converge to create a compelling narrative: markets previously pigeonholed as “emerging” or “stagnant” are now beneficiaries of secular forces—tech leadership, governance evolution, and macro signals—that resonate with global allocators.

Sources

- Matthews Asia. What’s Driving South Korea? (2025) — Korean equities’ performance drivers, AI memory leadership, and reforms.

- ETF Trends. South Korea ETFs: Tailwinds Carry Over From 2025 (Jan 2026) — ETF flow insight and Korea weighting dynamics.

- WisdomTree. Japan’s Equities Are Seeing a Performance Acceleration (Dec 2025) — Corporate reforms, buybacks, currency impact on EWJ and Japanese stocks.

- Yahoo Finance. MSCI Japan ETF’s strong run (Jan 2026) — EWJ performance data vs U.S. equities.

- KED Global. Korean ETFs see inflows (Feb 2026) — Index weight impacts on Korea passive flows.

Additional charts and data sourced from FactSet Research Systems Inc.