June 25, 2025

Ex-US equities outperformed the MSCI All Country World Index (ACWI) by >10% from December 2024 through early April 2025. During that same period (chart below, top panel), US equities lagged ACWI by 4% outlining a clear haven rotation to ex-US shares while equities remained under pressure from trade related anxieties.

Two and a half months later, ex-US equities have retraced almost the entirety of their Q1 outperformance vs. domestic equities and EAFE shares have resumed a laggard position while EM equities are consolidating near par vs. ACWI. We’re taking a look this week to see where the ex-US action has moved and whether ex-US equities are anything more than a haven trade when volatility emerges.

Country Level

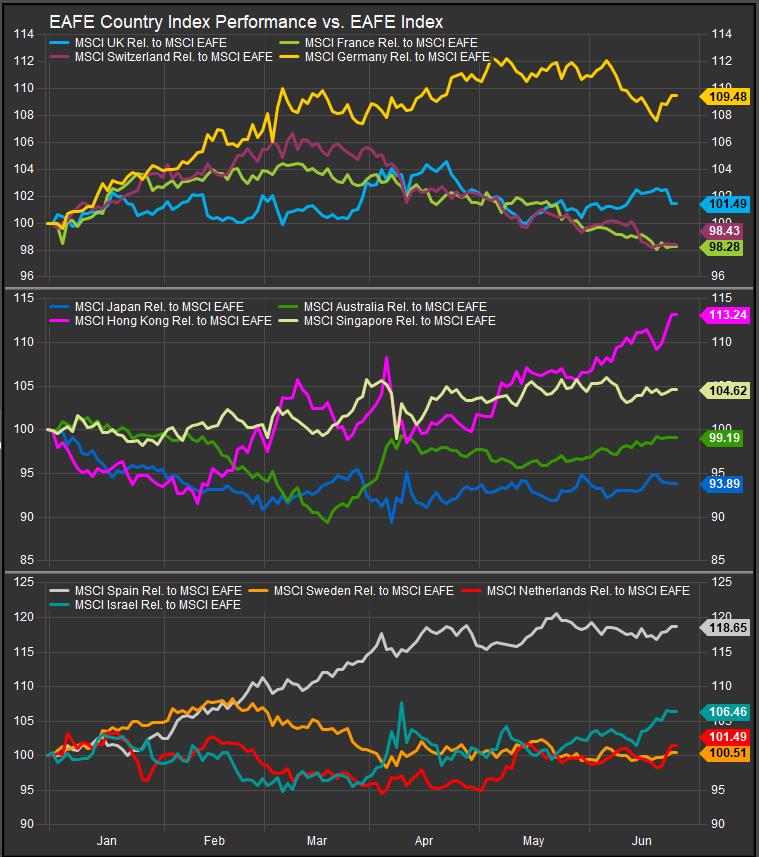

The chart below shows the relative performance of EAFE country constituents vs. the EAFE benchmark. We’ve seen core European market’s performance roll over with Germany remaining the best performing country among the group. DM Asia has inflected positively with equities as an asset class since early April led by Hong Kong shares. Spanish and Israeli shares are among the best peripheral performers YTD.

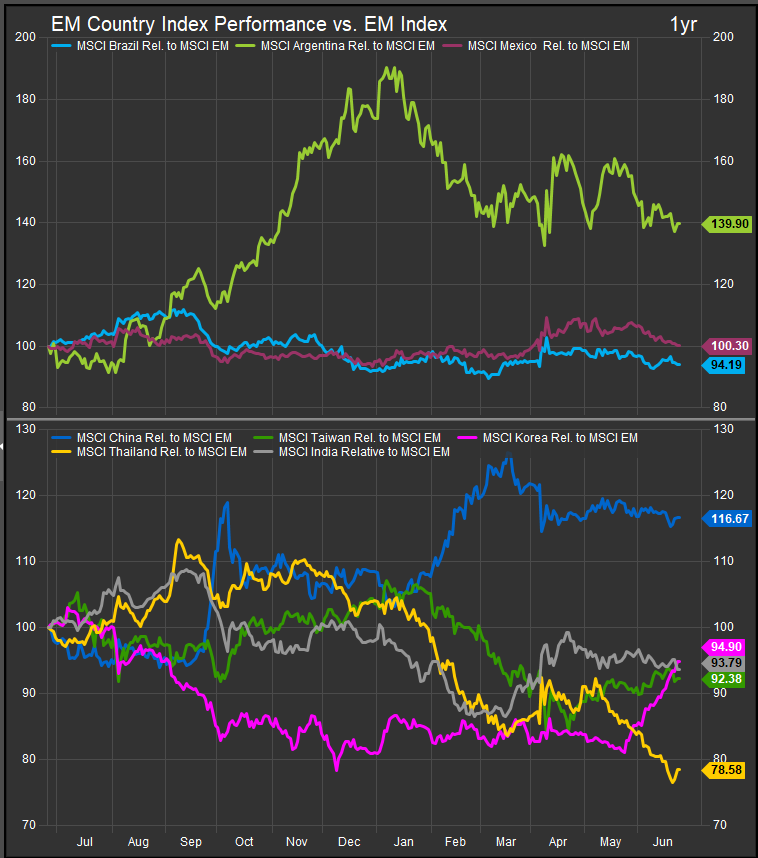

Within the EM Index, Chinese equity outperformance has paused as equities regained their footing (chart below, bottom panel). We’re seeing improvement from Korean and Taiwanese shares in the near-term while Mexican and Indian shares have shown fleeting improvement that isn’t enough to get us excited.

Stock Level

Within the EAFE space the big equity themes have revolved around the Ukraine/Russia conflict. The strongest stock level charts within EAFE are in the Financial and Industrial sectors. Major European banks have been reflating for >12 months. A stock like Barclays (chart below) is benefitting from relatively low rates and credit demand underpinned by funding for the Ukraine War.

However, it’s also a reflation play from the Global Financial Crisis even though that was news >15 years ago. The 20yr chart of Barclays (below) is very similar to many other major European banks whether in Germany, Italy, France, Spain or the US. 15 years out from the crisis, could banking finally get out of the global penalty box? Since 2005 the stock has lost 85% of its value relative to the S&P 500. This despite outperforming by 50% over the past 12-months. The bottom line for us is the charts suggest there is potential for significantly more upside here.

Funding a war boosts banks, but the real juice in the war trade is with the bullets. Rheinmetal AG has been the best performing stock in Germany over the past 12-months. The uptrend is likely on an unsustainable present trajectory, but has made a series of news highs on price and relative to equity benchmarks since the bullish pivot in March. This still looks like a trade we’d want to get into on a more significant retracement.

EM Bellwethers

We are constructive on nascent turn-arounds in Korean and Taiwanese shares, but we think the EM dog will only hunt if Chinese shares participate to the upside with equities. We have been of the opinion that BABA and TENCENT are likely leaders in any sustained outperformance trend from Chinese shares. Both stocks have been episodic rather than consistent outperformers and we expect they are nearing another move higher after 2 spending the last 3-months stalled out (charts below). If China perks up along with Korea and Taiwan, prospects would improve greatly for EM equities.

TENCENT

BABA

Conclusion

DM Banking reflation, EU Defense manufacturing and China are three areas of the ex-US equity market that look likely to sustain performance beyond a defensive rotation trade. We think Tencent and Alibaba are likely at accumulation points on their charts and we think China represents the best bet to motivate EM equity outperformance.

Data sourced from FactSet Research Systems Inc.