December 17, 2025

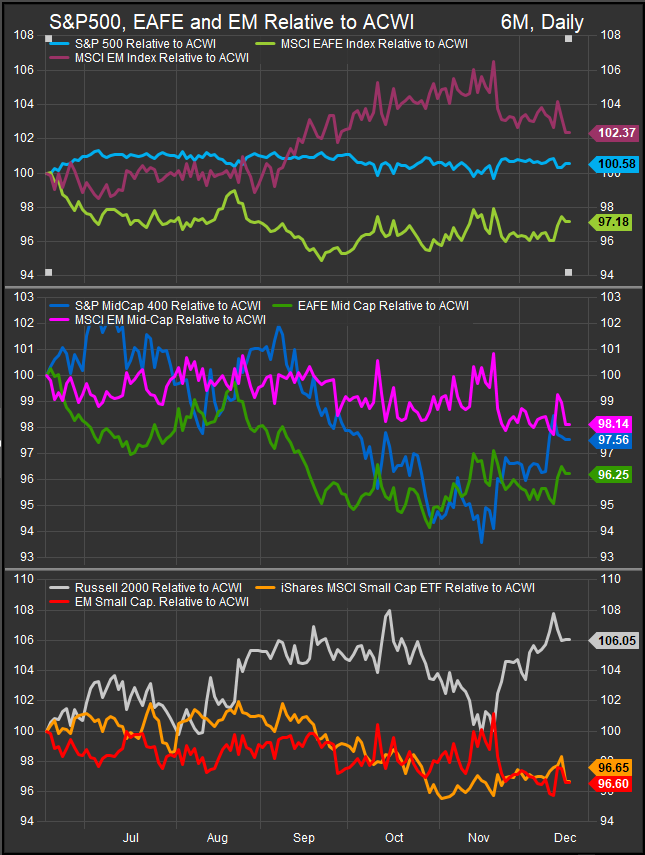

Crosscurrents have defined equity trading in November and December. Concerns about rich valuations and circular investing in the AI trade has triggered selling in domestic Mega Cap. Growth stocks while the recent Fed rate cut has supported lagging cyclical stocks and commodities prices. The upshot has been rotation away from domestic Growth exposures and longer duration fixed income assets. Beneficiaries in the near-term have been a mix of Small/Mid US stocks and Developed Market International equities (chart below).

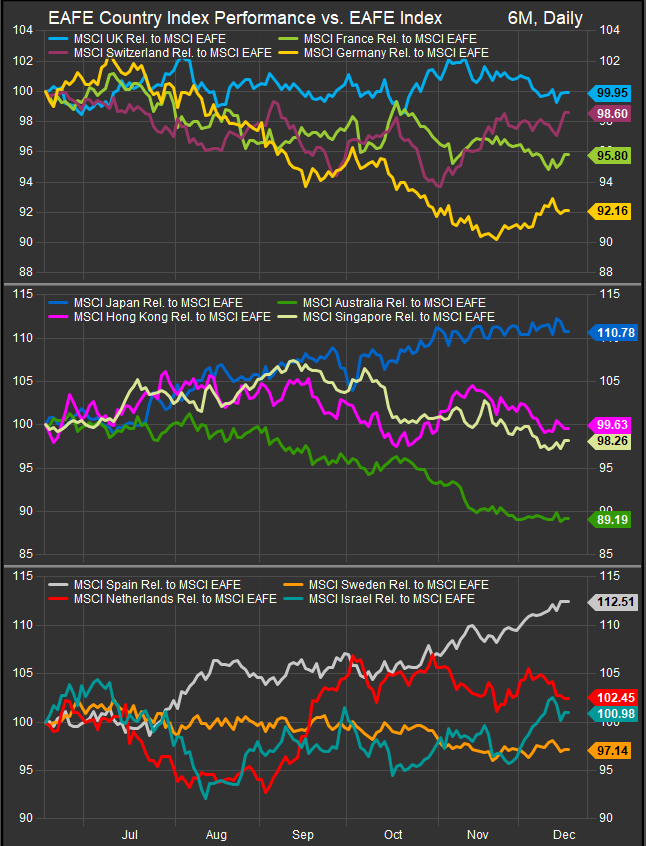

Drilling into Developed Market equity performance we can see that near-term strength is coming from core Europe as German and Swiss shares have begun to outperform over the past month (chart below). Japanese and Spanish shares have been strong over the longer-term. Swiss and German shares outperformed significantly when equities corrected in March/April of 2025, and we’d expect inflows to continue while the Growth trade remains under pressure. Out of the money conservative exposures are typically rotation beneficiaries when valuation is a concern/catalyst as it is today.

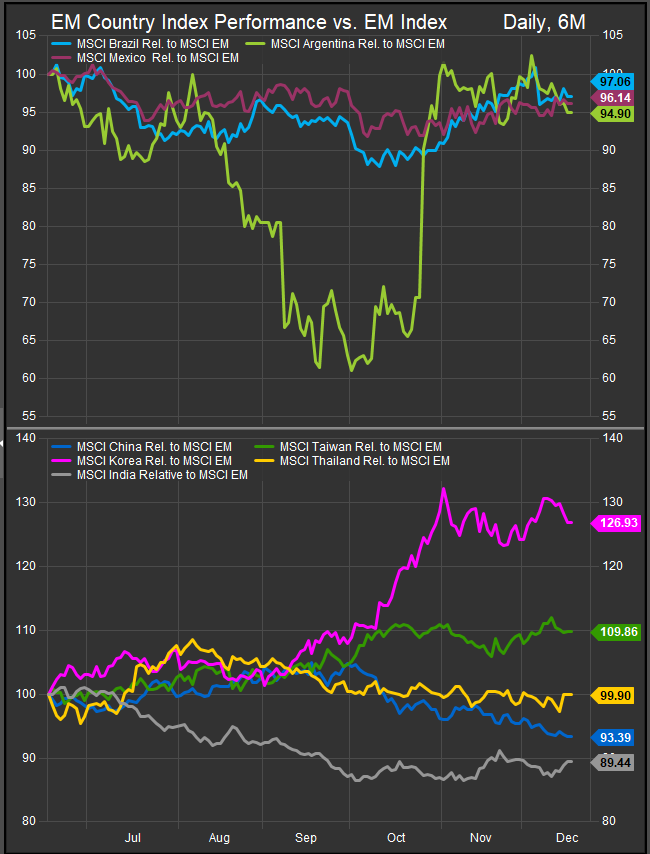

Looking at EM country level performance, we see firming in LATAM (chart, top panel) since October while Chinese shares have continued to give back gains since the end of September. Korean shares have been leadership throughout 2025 but are at a potential pivot amidst consolidation since October. Taiwanese shares remain in a stable bullish reversal. EM Asia has been the locus of the ex-US AI trade. We think those shares are likely to consolidate while there’s rotation away from the Growth/Technology trade. Longer-term, we’d expect investors to rotate back into Growth stocks if interest rates stay contained.

Looking at US 10yr yields which have been sensitive to inflation dynamics we see the series backing up into near-term resistance at the 4.2% level. A move higher implies upside to 4.45% and we’d expect higher rates to negatively impact risk appetite.

Going forward a balanced portfolio is called for while sentiment remains a headwind to the AI trade. Upwards pressure on rates would be a bearish development for risk assets, but if rates stay contained the Fed has more leeway to support continued expansion of the business cycle. In the mean-time YTD laggard themes like core European equities are likely to take inflows.

Data sourced from FactSet Research Systems Inc.