February 19, 2025

In mid-January, when we took our last chart-based tour around the globe, we noted that a brief reprieve for ex-US equities coincided with headwinds to US Mega Cap. Growth stocks and that international equities were acting similarly to the “average” stock in the US as proxied by the equal weight S&P 500 vs. the cap. weighted index.

As we’ve progressed further into 2025, international equities continue to gain ground at the expense of domestic equities. On the domestic front, MAG7 continues to be a headwind for US stocks though the equal weighted S&P 500 has given up some ground in the near-term vs. the cap. weighted S&P 500 (charts below).

EAFE Equities Forming Bullish Reversal, EM Getting a Near-term Bid as well

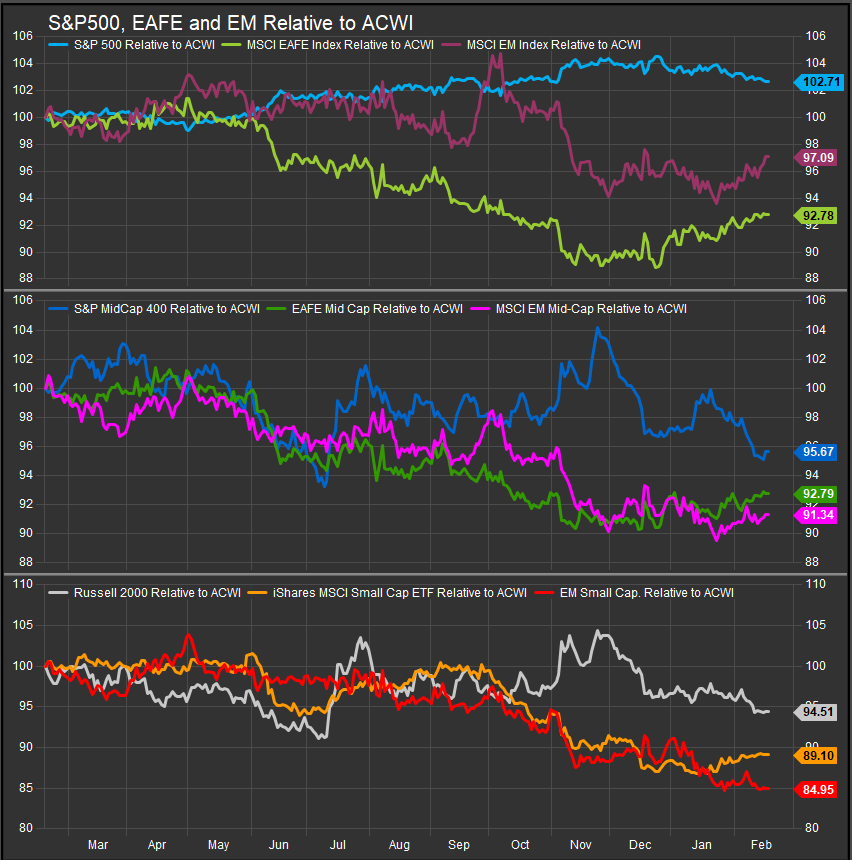

The chart below shows US, EM and DM headline indices relative to the MSCI World Index for Large, Mid and Small Cap. stocks. Within each market cap. tier, US equities, which had been pulling away to the upside entering December of ’24, have now shown bull-to-bear reversal vs. the MSCI All Country World Index (ACWI).

On the macro front, this change in performance dynamics has come as interest rates have firmed globally and commodities prices have rallied in the near-term. Investors are rotating away from the “US soft landing” scenario and, at present, seem to be contemplating the return of more inflationary dynamics as the financial news is inundated with tariff/trade war type headlines.

The Bloomberg Commodities Index (chart below) has traded up into longer-term resistance around the 107-110 level recently and Energy and Materials sectors have begun to see their performance improve vs. the broad market.

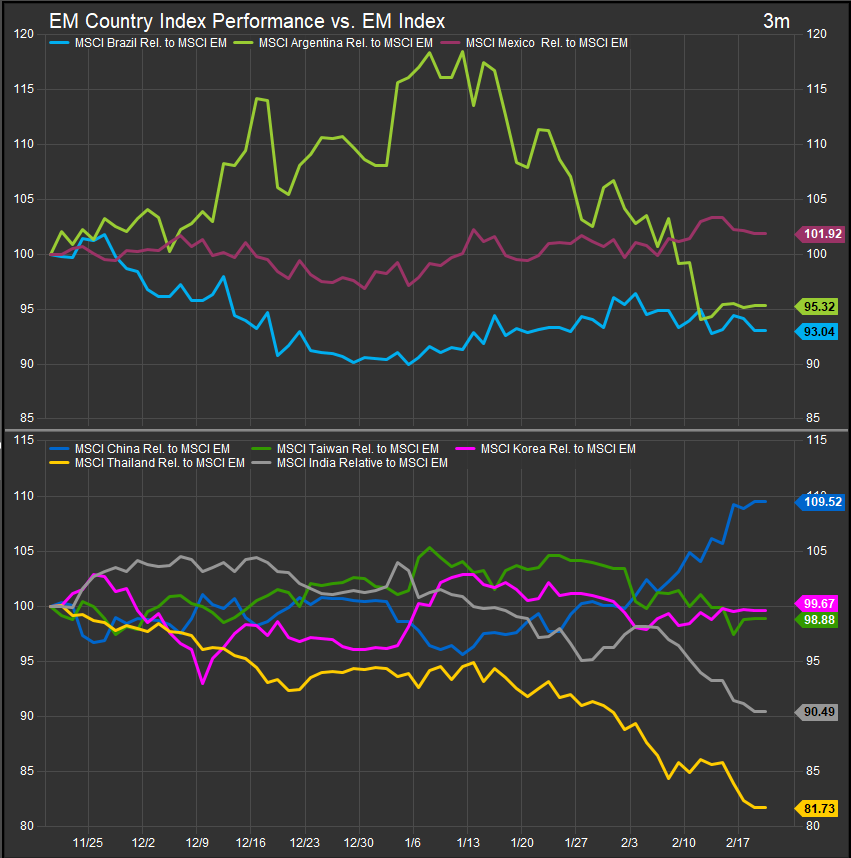

EM Country Performance

Looking at the countries with larger weights in the EM Index, we see that Chinese shares have led over the past 3-months while previous outperformers Taiwan and Argentina have retraced their gains over that time (chart below).

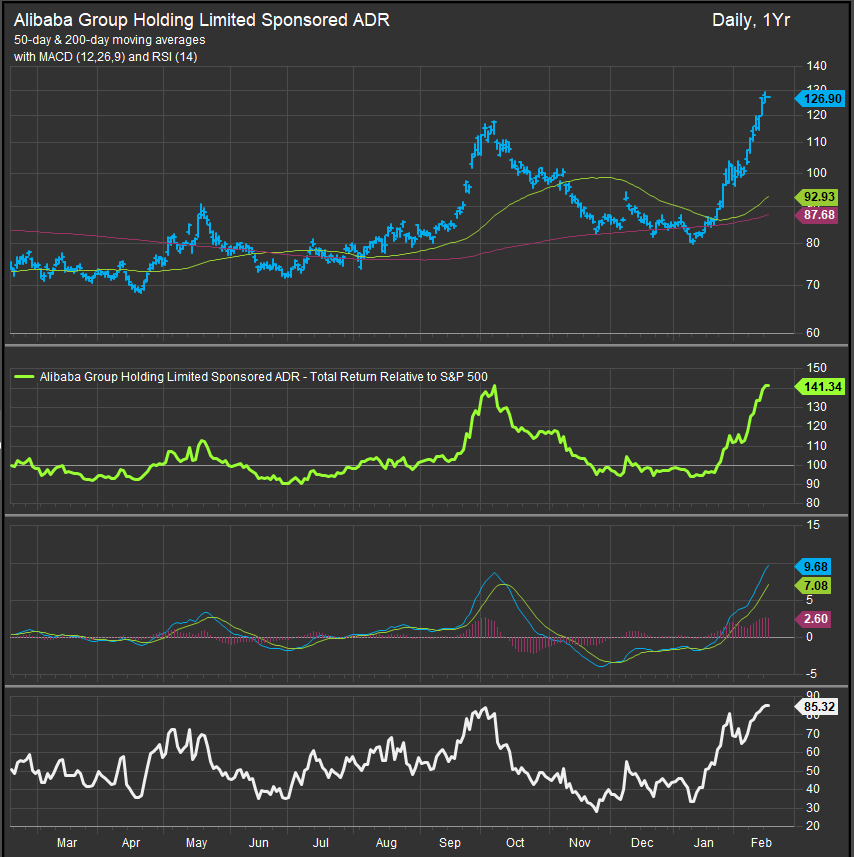

It’s interesting that while Mag7 stocks have retraced performance, China’s big Growth co.’s are ripping. The BABA ADR (chart below) is at fresh 52-wk highs on price and and 52-wk relative highs vs. the S&P 500.

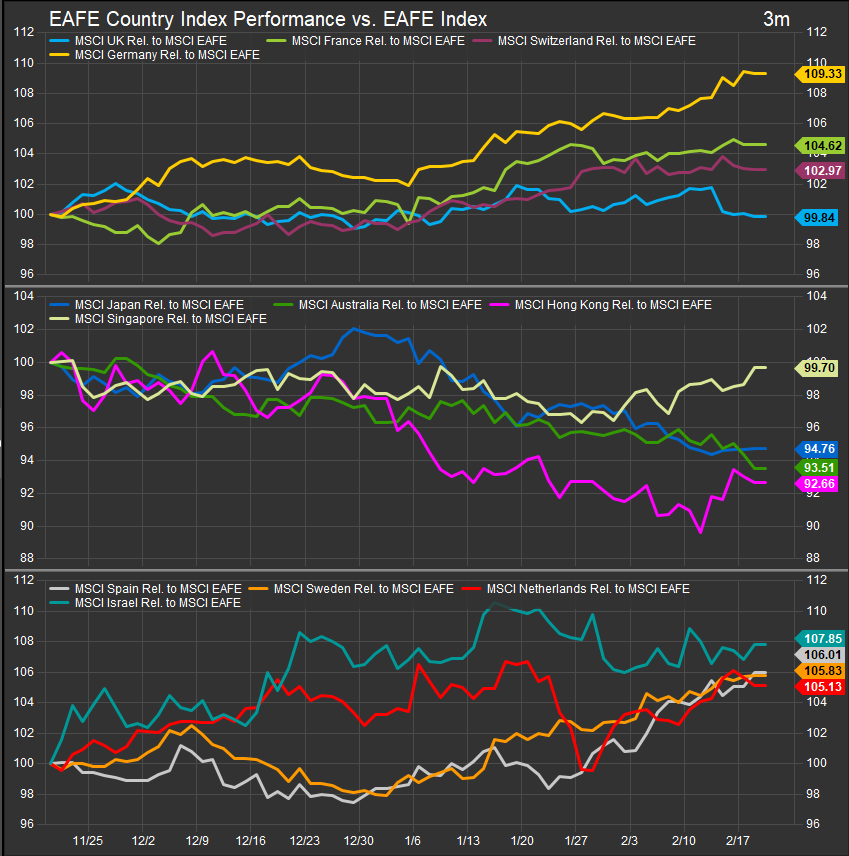

DM Equities Are Starting to Differentiate by Country Performance

Performance of core European countries Germany and France has driven the 3-month turnaround for the MSCI EAFE Large Cap. index. As the chart below shows, upside participation is broadening out for DM equities where Financials have been strong, and Industrials and Energy stocks have acted better than US counterparts.

Conclusion

Growth leadership has been winnowed down in the US as Mag7 performance is now a headwind to domestic equities. The AI theme has been resilient in February, but the US Consumer is under some pressure. While mega-cap. growth is viewed with skepticism, that should be a tailwind for ex-US equities and tariff/trade war dynamics offer enough potential and headline fodder to keep the pressure on for the time being.

Data sourced from FactSet Research Systems Inc.