February 4, 2026

International Equities: A New Era of Diversified Leadership

For much of the past decade, global equity performance was dominated by the United States, driven by outsized technology sector leadership and steady earnings growth. However, as we move deeper into 2026, a significant shift in leadership dynamics is becoming unmistakable. Two themes stand out with conviction: Emerging Market equities have been leadership over the past 6-months, and European financial stocks are outperforming their historical stereotypes. Both trends are asserting themselves not as fleeting market anomalies, but as reflections of fundamental drivers that could shape asset allocation for years to come.

Emerging Market Equity Leadership: Fundamentals and Flows Align

Emerging Market (EM) equities have begun to outperform developed markets in both absolute and relative terms, propelled by several reinforcing dynamics. In 2025, broad EM equity benchmarks delivered compelling relative returns, with the FTSE Emerging Index returning approximately 26.5% versus roughly 22.8% for developed markets. Dollar-based investors benefited particularly from a softer U.S. dollar, which amplified foreign returns in USD terms.

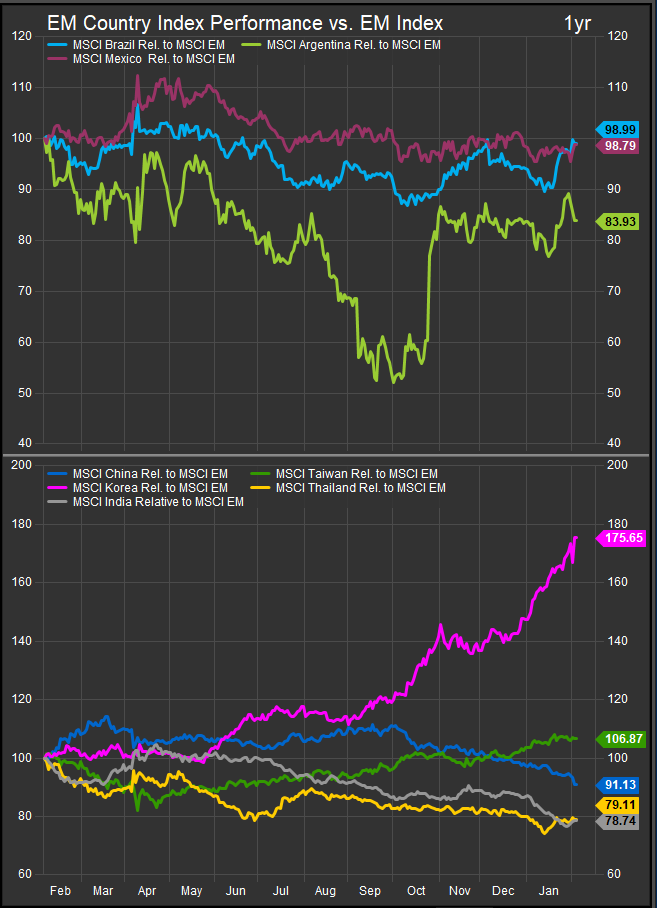

Investor flows into EM equity funds have surged. Notably, emerging market equities accrued over $39 billion in inflows in January 2026, one of the strongest monthly starts in over two decades, buoyed by moderating inflation in EM economies and dollar weakness that reduces financing costs and supports domestic demand. Latin American and select Asian markets such as South Korea posted dramatic early-year gains (e.g., a ~24% January rally by the KOSPI), underscoring the role of country-specific macro and tech-oriented growth drivers.

Why does this matter beyond raw performance? For long-term investors, EM’s structural tailwinds extend beyond cyclical catch-up. Valuations remain materially more attractive than developed peers, often trading below historical norms, while demographic trends and lower debt burdens set the stage for sustained consumer and investment-led expansion. Even asset managers who had previously underweighted EMs are reconsidering allocations as growth prospects and diversification arguments strengthen.

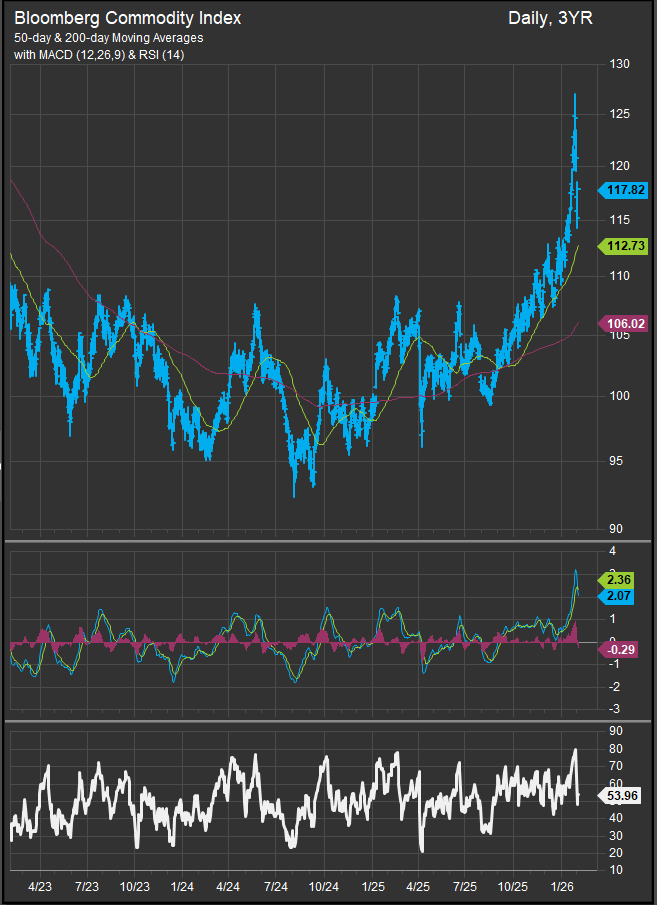

Another key driver for EM has been the recent surge in Commodities prices (chart below) and a sharper focus on accumulating input production. Brazil has often experienced bullish tailwinds when interest in commodities prices waxes and several other EM economies profile similarly.

The EM rebound also reflects growing heterogeneity within the asset class, with select economies benefiting from prudent monetary policy, energy market positioning, and digital infrastructure growth that feeds into higher productive capacity. This sophistication of drivers suggests EM leadership is more than a transient valuation rebound; it is a regime shift toward broader global participation beyond U.S.-centric returns.

European Financial Outperformance: From Value Trap to Structural Opportunity

Concurrently, European equities—long overshadowed by U.S. benchmarks—are staking a compelling claim as a distinctive segment of global leadership. At a headline level, indices such as the STOXX Europe 600 have outpaced the S&P 500 year-to-date, driven disproportionately by gains in the financial and healthcare sectors.

Within this rotate-to-value narrative, European banks have posted record performance, with banking stocks rallying to levels not seen since early last decade. This rebound reflects higher interest rate environments that expand net interest margins, improving loan portfolio performance, and renewed investor confidence amid stronger economic data. Historic valuations—European banks were long discounted versus U.S. counterparts—have caught up as yield curves steepened and profitability prospects improved, challenging the narrative that European financials are structurally inferior.

Importantly, these developments are not purely cyclical. Structural reforms, easing regulatory constraints, and an uptick in merger and acquisition activity are enhancing capital markets depth across the continent—suggesting that European financials may be undergoing a durable transformation rather than a short-lived valuation recovery.

Moreover, data on asset flows reinforce this conviction. In late 2025, European equity strategies attracted meaningful inflows even as global sentiments tilted toward risk aversion. In contrast to broader outflows from global funds, European funds saw net positive investor allocation, signaling confidence in the region’s earnings prospects and relative valuation appeal.

Trend Drivers

What makes these trends—from EM leadership to European financial outperformance—convincing enough to influence strategic asset allocation?

- Valuation and Relative Opportunity: EM equities often trade at meaningful discounts compared to developed markets, while European banks, after years of underperformance, now present compelling earnings yields relative to risk.

- Macro Regime and Policy Dynamics: A softer U.S. dollar, coupled with supportive monetary stances in EM regions and a stabilizing European policy backdrop, reduces traditional headwinds that once hindered international equity performance.

- Capital Flows and Diversification Behavior: Capital is demonstrably rotating toward EMs and Europe, driven by yield search, diversification mandates, and relative valuation reconsiderations, rather than mere risk appetite.

- Structural Growth Themes: From younger demographics in EM to financial modernization in Europe, fundamental growth drivers suggest persistent rather than transitory performance asymmetries.

The Long View: Conviction With a Cautious Bias

No bullish narrative is complete without sober caveats. Emerging markets remain exposed to external demand cycles and commodity price volatility, while European financials are sensitive to credit cycles and geopolitical uncertainty. Yet the current evidence supports the argument that international equities are not merely catching up but leading part of the next phase of global equity returns.

For global investors, the recalibration away from a U.S-centric portfolio toward meaningful EM and European financial exposure is not just tactical—it is strategic. When valuation, flows, and fundamental earnings trends align across broad regions, history suggests that leadership is rarely short-lived.

Bibliography / Sources

- Catherine Yoshimoto, “Non-US and emerging equity markets took leadership baton in 2025,” LSEG FTSE Russell (2026).

- Reuters News, “Emerging market stocks rally appears intact after buoyant January inflows” (Feb 2, 2026).

- Reuters News, “Global equity funds attract inflows for third week in a row” (Jan 30, 2026).

- Reuters News, “Banks drive European stocks to record high…” (Feb 2, 2026).

- FT.com, “European bank shares hit highest levels since 2008” (2025).

- Morgan Stanley Insights, “What’s Driving European Stocks in 2026” (2026).

- Allianz Global Investors, European Equities Outlook Q4 2025 (Nov 2025).

- ClearBridge, Under the Radar: Why Now is the Time for Emerging Markets (2025).

Additional charts and data sourced from FactSet Research Systems Inc.