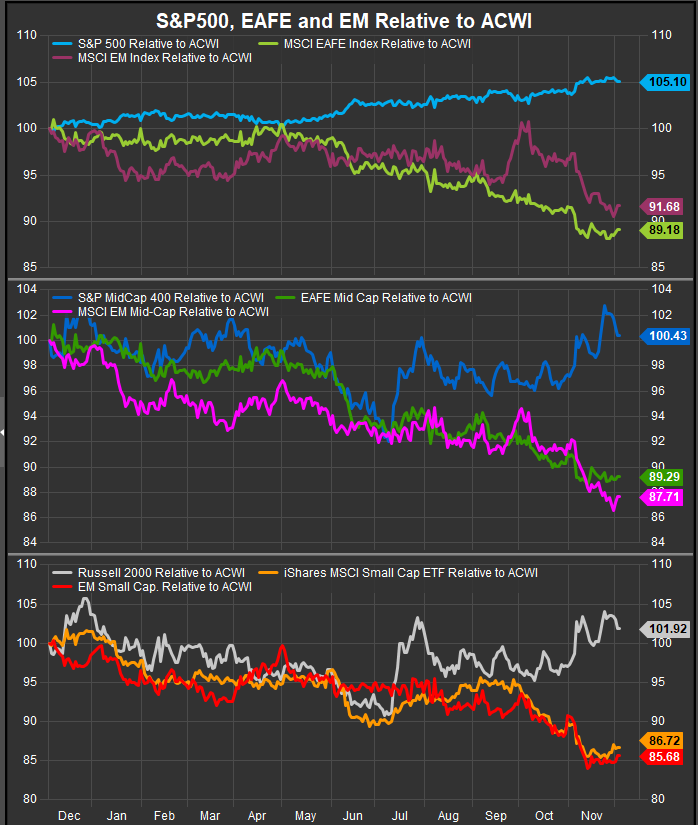

US Large Cap. Still in the Driver’s Seat (now joined by US Small & MidCap Stocks)

That time in early October when we had a reason to be excited about a potential turn in China and EM equities is getting further in the rearview mirror without any sign of bullish follow-through. As the chart below shows, domestic US shares have taken a decisive leadership role in Large, Mid and Small-Cap tiers with EM and DM counterparts trading to 52-wk relative lows in November.

The notable change since we last ran this report has been new upside assertiveness from US Mid and SmallCap. Stocks. They have been reinvigorated by Fed rate cuts and the election of Donald Trump and his promises of a broad deregulatory bent to his Presidency.

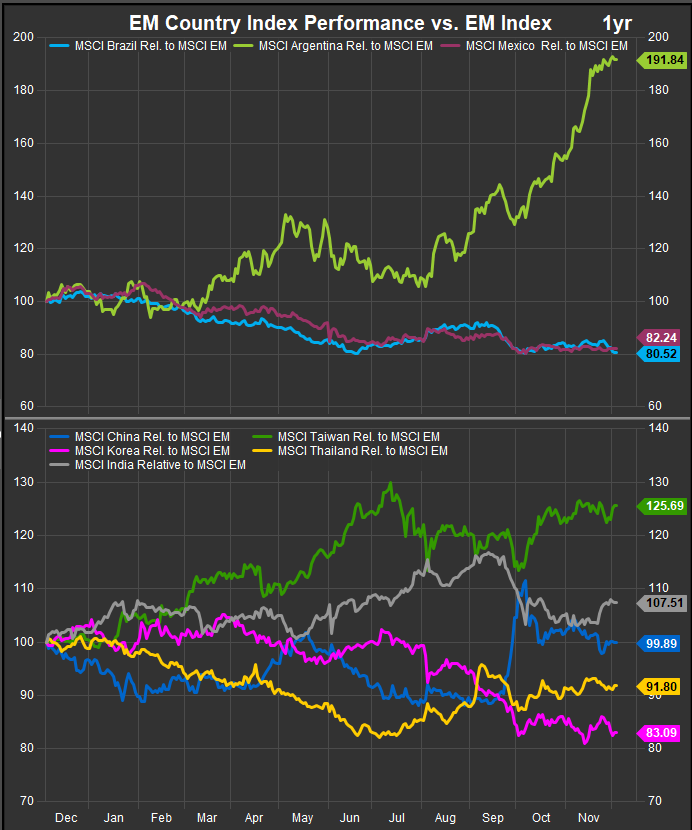

EM Country Performance

Taiwanese and Argentine shares continue to be the top performers in the near-term and over the past 12 months (chart below). The run up in Argentine shares has been nothing short of impressive and everytime we pull up the chart it seems they’ve made significant new gains. The MSCI Argentina Index has outperformed the MSCI EM index by 91% over the past 12-months outpacing regional counterparts.

Among Asia/Pacific countries in the EM space, China continues to retrace its October gains lower, and with the relative curve now moving below the May relative high, its potential bullish reversal from October is called into question. Among Asian country indices, Taiwan is the strongest performer followed by India.

DM Equities Are Starting to Differentiate by Country Performance

DM equities in aggregate have lagged the MSCI World benchmark by 11% over the past 12 months. But we are starting to see clear winners and losers among country constituents.

In core Europe, German shares have separated themselves positively from those of France, Switzerland and the UK (chart below, top panel). Asia/Pacific countries in the EAFE universe have firmed with strong performance from Singapore to go along with Australian and Japanese outperformance (chart below, middle panel). Israeli shares have accelerated higher relative to the EAFE benchmark and represent the best performing EAFE country index (chart, bottom panel).

Conclusion

Ex-US equities continue to lag at the aggregate level, but there are clear pockets of strength in some international geographies. Argentina, Israel and Singapore are showing outperformance trends worth getting excited about. China has faded, but Germany is starting to gain some positive momentm and Japan and Australia have been steady outperformers vs. the EAFE benchmark.

From a macro perspective we would expect US equity leadership to continue over ex-US as long as interest rates/inflation stay contained. This should help the US power through inflationary headwinds to the business cycle while Europe continues its interminable flirtation with recession. Rising rates in the US could change the calculus and put the Fed in an awkward position regarding its continued plans to ease the policy rate, but with the US 10yr Treasury Yield rolling over to the downside in the near-term, that potential complication is back on the sideline for now.

Data sourced from FactSet Research Systems Inc.