October 8, 2025

Emerging markets (charts below), particularly across Asia, have been the bright spot in global equities this year. The rally reflects a combination of macroeconomic tailwinds, strong earnings from leading technology exporters, and renewed investor confidence in the region’s long-term growth story. Companies such as Taiwan Semiconductor Manufacturing (TSMC), Wiwynn, Alibaba, and Tencent have led this charge, benefiting from the powerful expansion of artificial intelligence (AI) infrastructure and improving financial conditions worldwide.

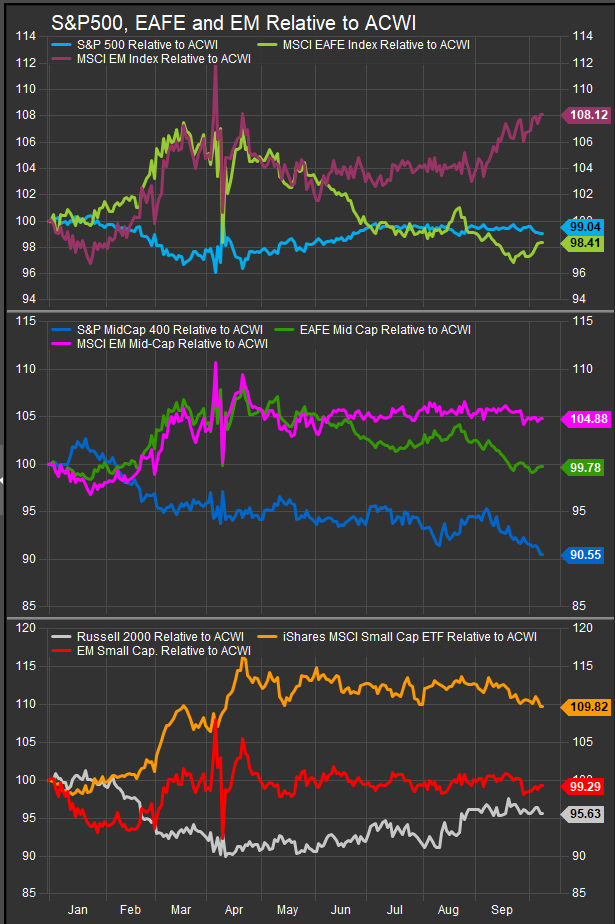

US/EM/DM vs. ACWI

EM Major Country Performance

Why Emerging Markets Are Outperforming

Several key factors are driving emerging market strength. First, a weaker U.S. dollar and easier global monetary policy have made emerging market assets more attractive. When the dollar declines, local currencies strengthen and capital tends to flow back into developing economies. The dollar has fallen roughly 11% since the start of the year, while expectations of future interest rate cuts by the Federal Reserve have fueled optimism for risk assets globally.

Second, earnings growth in Asian technology companies has far outpaced global averages. The rapid build-out of AI infrastructure—ranging from data centers and semiconductors to power systems and cooling equipment—has created a new wave of demand across the Asian supply chain. Taiwan, South Korea, and parts of Southeast Asia dominate this manufacturing ecosystem. As a result, the region’s stock indices, which are heavily weighted toward technology, have outperformed broader emerging market benchmarks.

Finally, improving corporate governance and capital return policies have restored confidence in several major Asian markets. Companies in China, Taiwan, and South Korea are showing a greater willingness to return cash to shareholders through buybacks and dividends, signaling maturity and financial discipline that long-term investors have been waiting for.

Company-Level Leadership

At the company level, the outperformance is being led by a handful of large and strategically positioned firms.

TSMC, the world’s leading semiconductor manufacturer, has reported record profits as demand for high-performance chips used in AI servers and data centers continues to surge. In the most recent quarter, TSMC’s revenue rose nearly 39% from a year earlier, while profits jumped over 60%. The company is expanding its advanced packaging capacity, which remains in short supply globally, and has strong visibility into 2026 orders.

Wiwynn, a key supplier of servers for hyperscale data centers, has seen even faster growth. Its second-quarter revenue soared 185% from the previous year, driven by strong orders for AI-optimized systems. Profitability has held steady even as production volumes have multiplied, highlighting operational efficiency and pricing power within a booming segment of the tech supply chain.

Alibaba and Tencent, two of China’s largest technology platforms, have also regained investor favor after a period of regulatory uncertainty. Alibaba’s cloud computing division—once a drag on performance—has returned to double-digit growth, expanding 26% year-over-year as AI-related workloads surge. The company’s renewed focus on profitability and consistent share buybacks have helped restore market confidence.

Tencent, meanwhile, has delivered steady profit growth across its gaming, advertising, and financial services businesses. The firm reported net income of roughly ¥55.6 billion last quarter, ahead of analyst expectations. Tencent has also launched one of the largest share repurchase programs in Asia, underscoring management’s commitment to shareholder value.

Will the Leadership Continue?

The outlook for Asian and emerging market equities remains constructive, though not without risks. The underlying AI investment cycle appears durable, with global technology firms planning multi-year increases in spending on chips, servers, and related infrastructure. Given Asia’s central role in this ecosystem—from semiconductor fabrication in Taiwan to component assembly in China and Southeast Asia—regional companies are positioned to benefit for years to come.

Monetary conditions also remain supportive. If the Federal Reserve follows through on expected rate cuts, the dollar is likely to stay weak, which would continue to favor emerging market performance. At the same time, improving fiscal and market reforms in countries such as Vietnam and India are drawing more foreign capital into Asia.

However, several risks could interrupt the current leadership. Export controls and geopolitical frictions remain a constant overhang for the semiconductor supply chain. Any renewed trade restrictions between the U.S. and China could create short-term disruptions in shipments and profitability. Likewise, if the global economy slows sharply or if AI-related spending proves more cyclical than expected, demand could temporarily soften.

Conclusion

Emerging market and Asian equities are leading global performance because they sit at the intersection of two powerful trends: easier financial conditions and a generational technology investment cycle. Companies like TSMC and Wiwynn are providing the hardware that powers artificial intelligence, while Alibaba and Tencent are integrating AI capabilities into software, advertising, and cloud computing platforms.

While volatility will remain a feature of investing in emerging markets, the region’s leadership in the global technology supply chain suggests this outperformance has structural underpinnings—not just a cyclical burst. Barring a sharp rebound in the dollar or renewed policy shocks, Asia’s technology-driven markets are likely to remain at the forefront of global equity leadership in the coming year.

Data sourced from FactSet Research Systems Inc.