December 3, 2025

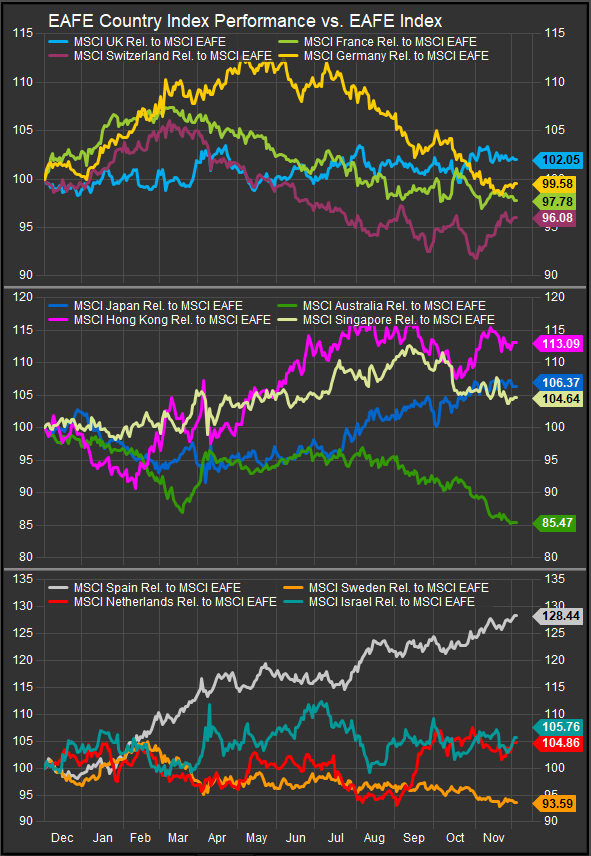

Given some signs of rotation away from domestic AI majors, we wanted to take a closer look at why German shares have been soft on performance in the near-term after they saw heavy inflows early in the year when US sentiment soured. German equities entered 2025 with unusual strength. Through the first quarter, the DAX and MDAX were among Europe’s top performers, buoyed by falling energy prices, a mild winter that eased gas-storage fears, and a powerful rebound in industrial output as global manufacturing cycles bottomed. Export demand from the US and Asia picked up simultaneously, inflation moderated faster than expected, and the ECB’s early pivot toward easing created an environment in which Germany’s rate-sensitive sectors—autos, industrials, capital goods, and chemicals—outperformed sharply. By April, analysts widely argued that the “German discount” was finally narrowing.

But as the year progressed, the drivers that once supported German shares faded, and by late 2025 the DAX had slipped into persistent underperformance relative to both the EuroStoxx 50 and the S&P 500. The story of the reversal reflects a mix of cyclical headwinds, policy frictions, and a shift in global equity leadership—one that particularly disadvantages Germany’s export- and manufacturing-heavy market structure.

The first, and most immediate, pressure point has been global industrial softness. What began as a mild slowdown in US manufacturing this summer broadened into a more synchronized cooling across Europe and Asia. German new orders decelerated sharply, especially for machinery, chemicals, and intermediate goods. China’s recovery—crucial for German industrial exporters—lost momentum again as property-market stabilization efforts plateaued and local-government financial stress limited fresh stimulus. Automotive exports, which had driven strong Q1 performance, ran into stiffer competition from Chinese EV manufacturers abroad and cooling demand across Europe as high borrowing costs persisted. The result is a textbook late-cycle squeeze: slowing orders, high fixed costs, and intense global pricing pressure, all of which disproportionately affect Germany’s flagship sectors. Industrial heavyweights like RHM (chart below) have retraced and now look technically vulnerable.

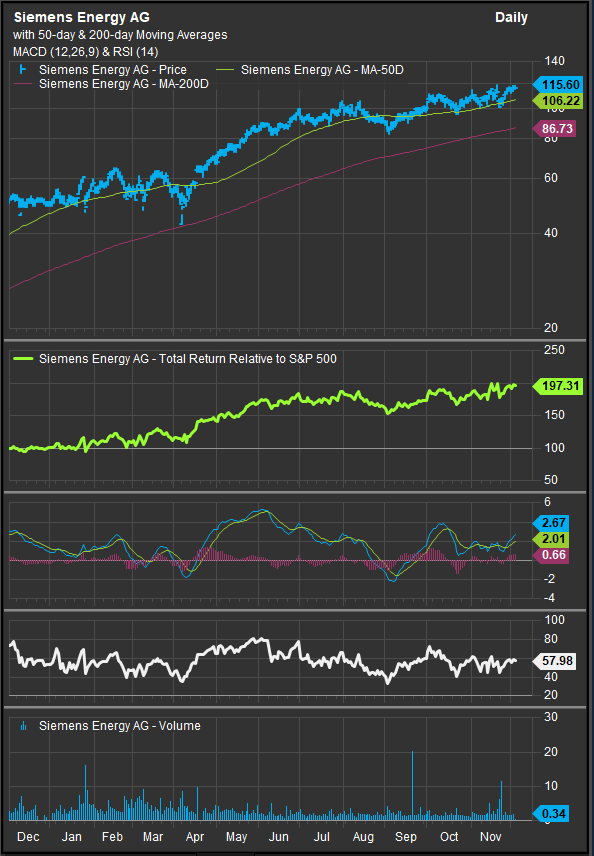

Second, Germany’s energy-cost advantage disappeared. In Q1, falling natural gas and electricity prices were a tailwind for German manufacturing margins. But by midyear, power prices rebounded as data-center demand, weather variability, and geopolitical tensions in Eastern Europe lifted energy markets again. While not a full-blown crisis, the reversal was enough to pressure margins for energy-intensive industries such as chemicals, metals, and autos. Germany’s long-term transition away from nuclear and coal continues to raise structural power-cost concerns, which foreign investors increasingly cite as a competitive disadvantage relative to France, the US, and parts of Asia. Siemens Energy (chart below) remains one of the strongest stocks in Germany.

Third, the ECB’s path changed. Germany benefited early in the year from a clearer ECB pivot toward easing. But by late summer, persistent services inflation and stronger wage growth across the eurozone forced the central bank to slow the pace of rate cuts. Real rates stayed higher for longer, tightening financial conditions precisely as German growth momentum weakened. While France and southern Europe have more consumer- and tourism-driven equity markets, Germany’s cyclical and capital-intensive profile makes it much more sensitive to a pause in the easing cycle. Equities that outperformed on the promise of cheaper financing—autos, industrials, property developers—were among the first to lose steam.

Fourth, the global equity leadership rotated away from Europe. In early 2025, German stocks benefited from a “manufacturing renaissance” narrative that briefly rivaled the US AI boom in performance. But as the year went on, the AI-driven rally in US megacap technology, semiconductors, cloud infrastructure, and automation reasserted dominance. For global asset allocators, the opportunity cost of holding Europe increased. Fund flows turned decisively toward US large-cap tech, Japanese equities with structural reform tailwinds, and selective EM Asia exposure tied directly to AI hardware supply chains. Germany, lacking a deep bench of high-growth, high-multiple tech champions, became a relative funding source for the higher-beta, higher-earnings momentum trade elsewhere.

Finally, domestic political and fiscal uncertainty weighed on sentiment. Germany entered H2 2025 with renewed disputes over fiscal rules, rising pressure to increase defense spending, and contentious debates over industrial subsidies and green-transition financing. Combined with slow approval processes for infrastructure and energy projects, investors grew more concerned about Germany’s long-term competitiveness. While not a crisis, these frictions added to the underperformance at a time when global capital was seeking clarity, growth acceleration, and structural earnings stories—traits Germany could not consistently supply.

So what has changed since Q1 2025? In early 2025, the global cycle was turning up, energy costs were falling, the ECB was easing, and China’s early-year stabilization briefly lifted German exports. Today, the cycle has flattened, energy costs are rising again, the ECB has slowed its rate-cutting trajectory, and global equity leadership is firmly centered on US technology rather than European cyclicals. Germany’s export engine went from being perfectly aligned with macro tailwinds to being tightly exposed to the year’s biggest headwinds.

Where does that leave investors now? The underperformance is understandable, but not necessarily permanent. For a durable rebound, German equities need three conditions to fall into place: a clearer global industrial bottoming, a resumption of the ECB’s easing cycle in 2026, and a stabilization in China’s demand for machinery, autos, and intermediate goods. If energy costs remain contained and global manufacturing finds a floor, Germany could again be a high-beta beneficiary of a cyclical upswing. But without those conditions, the market’s structural sector bias toward old-economy exporters will remain a drag relative to more growth-oriented global markets.

Germany’s story this year is not about crisis—it is about misalignment with the global drivers of equity performance in 2025. Until the cycle turns back toward global manufacturing rather than digital infrastructure, German equities may continue to lag the world’s new growth engines. While digital transformation and AI plays dominate, Japanese and EM Asian shares particularly in Korea and Taiwan have had tailwinds.

Data sourced from FactSet Research Systems Inc.