November 19, 2025

South Korea’s equity market has been one of 2025’s strongest global performers, driven overwhelmingly by its central role in the AI hardware and semiconductor supply chain. High-bandwidth memory (HBM) has become the bottleneck in large-scale model training, and SK Hynix—whose stock has surged more than 200% from its prior-year levels—has emerged as the premier HBM supplier globally. Samsung Electronics remains Korea’s anchor, gaining from both the memory upcycle and U.S. efforts to diversify away from China for chip fabrication. The hot money has moved beyond semis into related industrials as well: LG Energy Solution and Samsung SDI continue to expand into global EV battery markets; Hyundai Motor and Kia are gaining share in hybrid and EV categories; and automation and defense names like Doosan Robotics, Hanwha Aerospace, and HD Hyundai are benefitting from global capex and reindustrialization. Together, these firms have created an unusually synchronized earnings upswing, with Korea’s export engine firing across semiconductors, autos, batteries, and heavy industry.

EWY

LG Energy

Global Trade Beneficiary

As the U.S. and China continue to reshape global supply chains through export controls, tariffs, and security-driven procurement, Korea has found itself simultaneously advantaged and exposed. U.S. restrictions on advanced GPUs have redirected some Chinese demand toward Korean memory suppliers, while American hyperscalers are increasing sourcing from Korean fabs to reduce reliance on the China tech ecosystem. Tariff exemptions under consideration in the U.S. for batteries and specialized inputs help maintain Korean price competitiveness. Yet these same dynamics introduce volatility: China’s new restrictions on gallium, germanium, and specialty graphite affect Korean chip and battery input costs; U.S. export limitations on advanced semiconductor tools could weigh on Korean firms operating fabs in China; and any escalation in U.S.–China tech conflict risks collateral damage for Korea’s position in the value chain. In short, Korea is a major beneficiary of supply-chain diversification—but it sits in the crossfire of the world’s most important economic rivalry.

Domestic Reforms

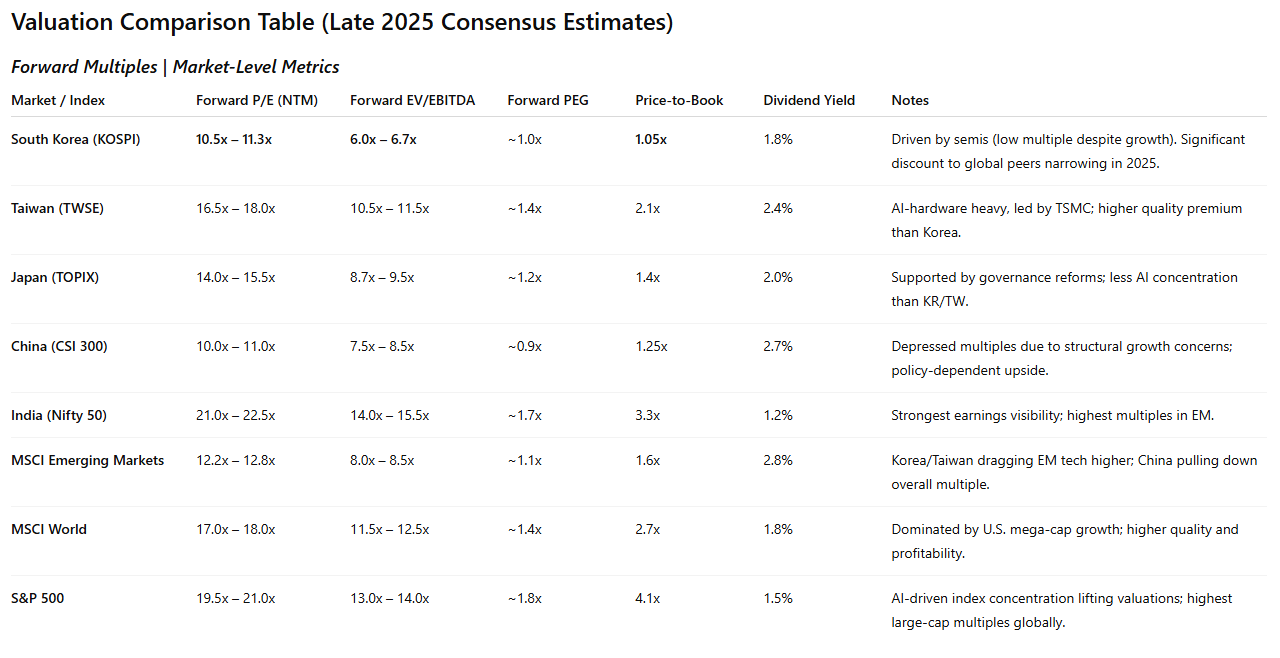

The 2025 rally cannot be understood apart from Korea’s long-awaited corporate governance and capital-market reforms. Policymakers have pushed chaebol to improve transparency, unwind circular shareholdings, and adopt global disclosure standards. Companies have responded by raising dividends, initiating buybacks, simplifying corporate structures, and divesting non-core businesses. Foreign investors—historically frustrated by low payout ratios and discount to book value—are returning in force, helping rerate the broader market. Complementary reforms to modernize capital markets, improve foreign-investor access, and stabilize flows have also deepened liquidity. As a result, the “Korea discount,” which kept KOSPI valuations depressed relative to Taiwan, Japan, and the U.S., has begun to narrow. Even after the rally, Korea still trades at approximately 10–11x forward earnings—far below global peers—suggesting the rerating may not be complete if reforms stick.

Conclusion:

South Korea’s equity surge in 2025 is the product of genuine structural advantages: world-class semiconductor and battery manufacturers, a deep bench of global industrial exporters, supportive U.S.–China supply-chain realignment, and credible domestic reforms that improve governance and capital allocation. These factors make Korea one of the most compelling equity markets in the world for investors seeking a blend of value and AI-linked growth.

But the same forces powering the rally contain embedded risks. The market remains highly concentrated in Samsung and SK Hynix; China’s slowdown poses a persistent threat to autos, materials, and consumer sectors; geopolitical tensions can shift abruptly; and the AI capex cycle—while powerful—is notoriously volatile. Korea offers real upside, but it demands an investor who understands both the structural growth drivers and the geopolitical and macro sensitivities surrounding them.

SK Hynix

In 2025, Korea is neither a simple recovery trade nor a speculative boom. It is a strategically essential, globally integrated technology economy—capable of producing world-class returns, but only for investors prepared to navigate its cyclical and geopolitical complexity.

Data sourced from

Bloomberg

Reuters

Financial Times (FT)

CNBC

Business Insider

DigiTimes

FactSet Research Systems Inc.