March 26, 2025

Rotation out of US equities has been a boon for ex-US stocks in 2025. However, the last 2-weeks have seen a pull-back as investors kick the tires on discounted US shares and take profits from some parabolic moves in European and Chinese equities. As we’ve mentioned in several of our recent columns, we think there’s likely another leg down for US equities. Given the YTD rotation away from Growth and into everything else, we would expect any further downside correction in US shares to continue reflecting that dynamic.

The chart below shows US, EM and DM benchmarks vs. the MSCI All Country World Index for Large, Mid and Small-Cap. stocks. Performance spreads favor EAFE and EM across all cap. tiers, with EM strength notable in the Small-Cap. tier. Among Large Cap. stocks, EAFE and EM indices are both outperforming YTD by > 600 bps vs. the S&P 500.

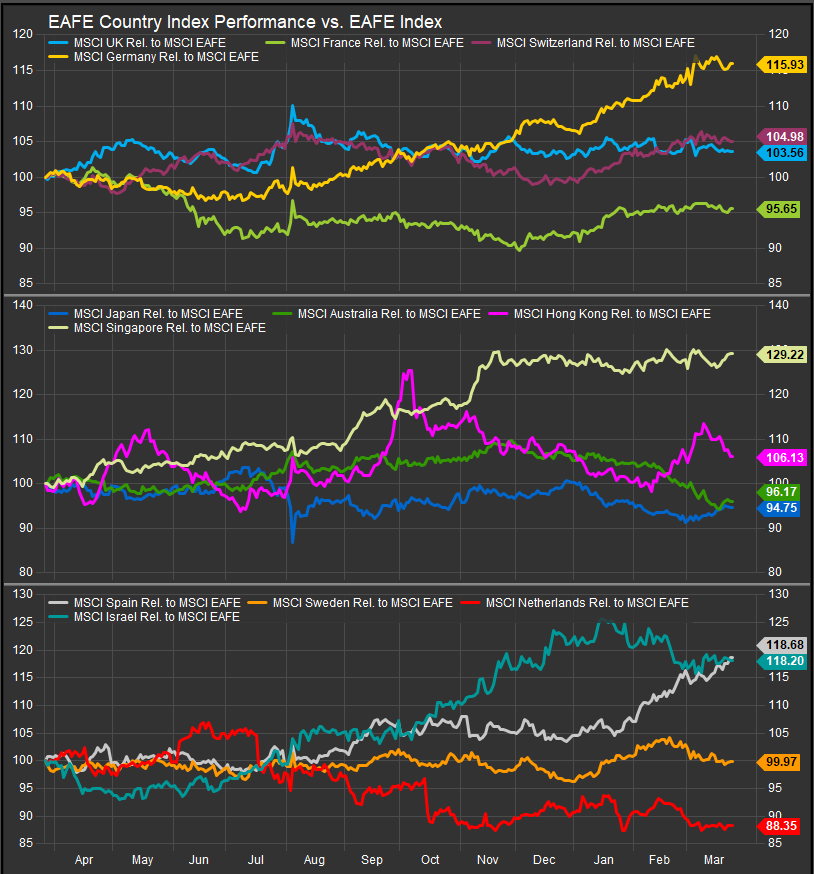

EAFE Country Performance: German and Spanish Shares Leading in 2025

Reviewing the MSCI country index performance within EAFE shows improving relative trends within core Europe. German shares have continued to improve in 2025 while Swiss and French shares have also ticked higher vs. the ACWI benchmark. Singapore’s shares are holding onto 2024 gains despite rotation out of many other areas that had previously been outperforming. Australian and Japanese shares have been weaker in 2025.

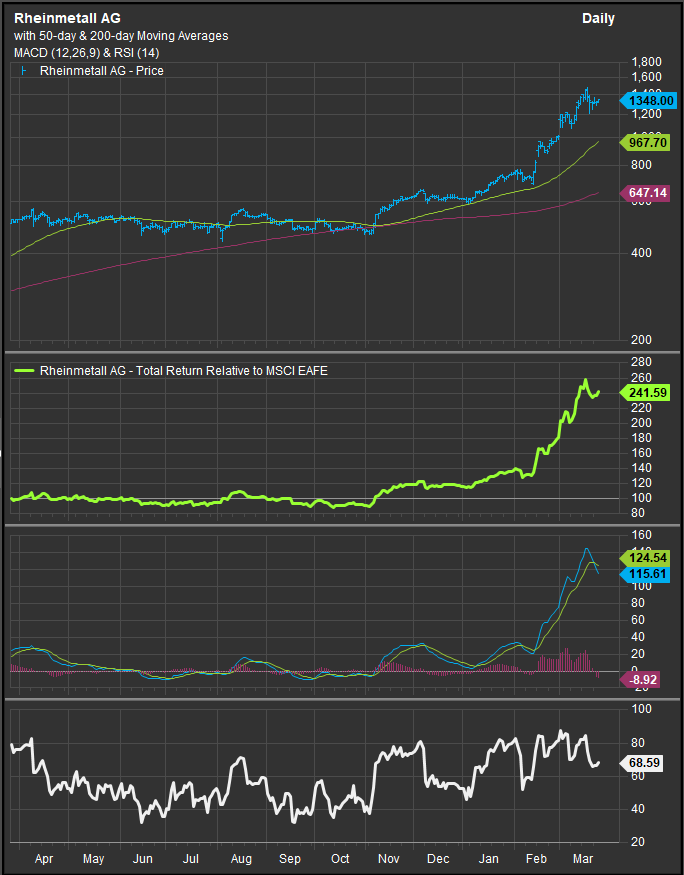

We are seeing some extended stocks in the near-term as ex-US Financials, Defense and Low Vol. exposures have been bid as havens from US turbulence and potentially as new beneficiaries from ongoing tariff policy roll-outs. Rheinmetall AG is an example of an extended chart in the near-term. We’d expect some profit taking in the very near-term, but we’d be interested in the stock on a pullback to the 50-day moving average at the 967 Euro level.

EM Country Performance: All about China

EM equities have shown clear rotation into China YTD and generally away from other country level exposures. In the very near-term we’ve seen Indian and Argentine shares perk-up after significant retracements of previous outperformance. Korean shares are potentially basing out and we are watching closely for signs of bullish reversal there. Chinese shares (chart below, bottom panel) look like they’re setting up for an accumulation opportunity after the higher relative-high in March confirmed the longer-term bullish reversal there.

Chinese equities have been driven higher by outperformance in big Growth names like BABA and Tencent, but the financial sector also looks very strong there. Industrial and Commercial Bank of China (1398-HK) has been an example of the strong trend (chart below). Longer-term trends in China suggest this may be where the rally ends, so the resolution of the current consolidation will be important to monitor.

Conclusion

Ex-US equities have been bid in 2025 corresponding to correction in domestic shares. There’s been a pause in the near-term, but we’re looking at key belwethers in the banking sector for some signal on the next leg of the trend. Historically Chinese equities have had trouble carrying momentum from the intermediate term to the long-term, but the technical setup in the US remains chanllenged and we expect at least one more leg higher for ex-US shares.

Data sourced from FactSet Research Systems Inc.