March 27, 2025

S&P futures down 0.1% in early Thursday trading, following a broad market decline Wednesday where the S&P, Nasdaq, and Russell 2000 all fell over 1%. Mag 7 stocks pulled back after a recent run, while cyclicals, AI data center names, and high short interest stocks also underperformed. Defensive sectors held up better, and equal-weight S&P outperformed the cap-weighted index by ~90 bp.

Treasuries sold off, with the curve steepening and yields up 1–4 bp. Dollar index slightly lower, while gold gained 1.3%, Bitcoin futures rose 0.8%, and WTI crude dipped 0.3%.

Trade tensions remain front and center, especially for autos. Trump announced a 25% tariff on all non-U.S.-made cars and parts, effective April 3, and warned of further hikes in retaliation scenarios. However, he also described the upcoming April 2 reciprocal tariffs as potentially “lenient”, providing some offsetting sentiment. Still, concerns linger about the broader Trump 2.0 policy uncertainty, which has driven much of the recent ~10% market drawdown.

Washington dynamics are looking more constructive, with Senate Republicans accelerating reconciliation efforts. With month- and quarter-end near, desks continue to highlight rebalancing tailwinds for equities.

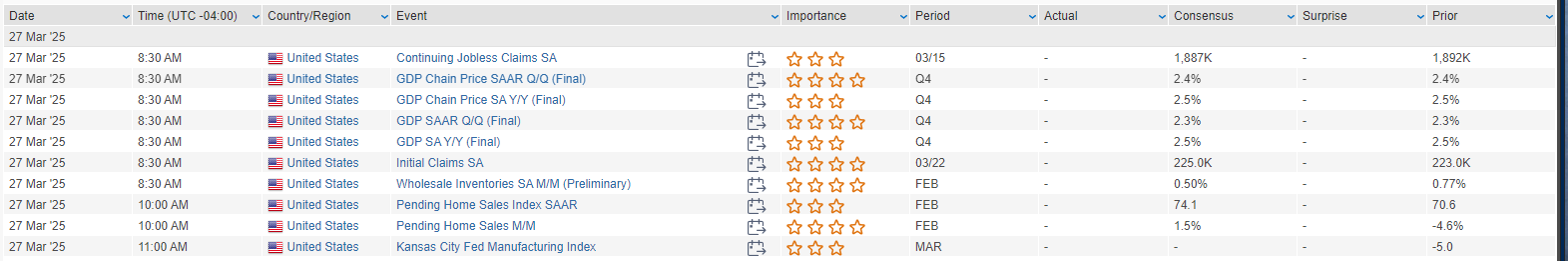

Today’s Economic Calendar

- Q4 GDP (third estimate)

- Weekly jobless claims

- February pending home sales

- $44B 7-year Treasury auction

- Fed’s Barkin speaks after the close

Looking ahead: Friday brings personal income/spending, core PCE inflation, and consumer sentiment, plus comments from Fed’s Bostic

U.S. equities fell sharply Wednesday, with tech and growth names leading the decline. The S&P 500 and Nasdaq posted their worst single-day performance in weeks, as Mag 7 stocks came under pressure following a recent rebound. Equal-weight S&P outperformed by ~90 bp as rotation into cyclicals and defensives continued. Treasuries weakened, with yields up 1–4 bp across the curve. The dollar index rose 0.4%, while gold fell 0.1%, and Bitcoin futures dropped 2.2%. WTI crude settled up 0.9%.

Markets remained focused on escalating trade tensions, ahead of the April 2 reciprocal tariff announcement. The White House confirmed President Trump will announce new auto tariffs Wednesday afternoon, while the U.S. expanded its tech export blacklist to China. These developments follow recent reports of narrower tariff implementation, but momentum has since shifted toward more aggressive action.

Durable goods orders surprised to the upside in the headline figure (+0.9% vs -1.0% expected), while core capital goods orders fell unexpectedly (-0.3%), raising concerns about business investment. Comments from Fed officials leaned cautious. St. Louis Fed President Musalem warned of persistent inflation risks stemming from tariffs, while Minneapolis Fed’s Kashkari called for an extended pause in rate changes due to policy uncertainty.

Meanwhile, Washington showed signs of progress on a reconciliation bill combining tax relief and a debt ceiling increase, though some Senate GOP opposition remains. Next up on the calendar: Thursday’s Q4 GDP revision and jobless claims, with core PCE inflation and consumer sentiment on deck for Friday.

GICS Sector Highlights

Information Technology (S&P 500: -2.46%)

- NVIDIA (NVDA -6.0%): Fell after FT reported potential $17B annual risk if China enforces stricter energy rules on advanced chips.

- Vertiv Holdings (VRT -10.9%): Dropped on negative TD Cowen data center channel checks, suggesting slower H1 orders.

- Cintas (CTAS +5.8%): Q3 beat on revenue, margins, and EPS; raised FY25 EPS guidance.

- Cloudflare (NET +2.9%): Continued strength after a prior day upgrade citing AI infrastructure leadership.

Consumer Discretionary (S&P 500: -1.66%)

- GameStop (GME +11.7%): Rallied post-earnings after adding Bitcoin to its treasury reserve.

- Dollar Tree (DLTR +3.1%): Beat on Q4 comps and EPS; announced sale of Family Dollar for $1.007B; margins positive but tariff risk flagged.

- CarMax (KMX +1.1%): Upgraded to Overweight at Stephens; valuation and tariff insulation cited.

- KB Home (KBH -5.2% prev day): Continued weakness after Q1 miss and guidance cut due to macro and affordability concerns.

Communication Services (S&P 500: -2.04%)

- Grab Holdings (GRAB +5.3%): Reportedly seeking $2B loan to acquire Indonesia’s GoTo.

- Meta, Alphabet, and Netflix also traded lower as broad tech weakness spilled over.

Consumer Staples (S&P 500: +1.42%)

- McCormick (MKC): Recent miss blamed on weaker consumer segment and dye removal strategy.

Industrials (S&P 500: -0.65%)

- Worthington Enterprises (WOR +23.8%): Q3 results beat across the board; strong execution cited amid tariff uncertainty.

- UPS (UPS -5.1%): Still under pressure following guidance and tariff-related demand concerns.

- Boeing (BA): Headline risk as 737 Max fraud trial set for June 23.

- Lyft (LYFT +2.2%): Continued momentum after activist stake reported by Engine Capital.

Financials (S&P 500: -0.24%)

- Paychex (PAYX +4.2%): Helped sector performance after inline results and stable guidance.

- Investment banks broadly lower on weak deal outlook and recession concerns.

Energy (S&P 500: +0.60%)

- Crude up 0.9% on falling U.S. inventories and rising refinery utilization (EIA).

- ExxonMobil in focus after announcing UK job cuts amid consolidation efforts.

Health Care (S&P 500: -0.37%)

- Biotech and Pharma weak as sector underperforms despite few headlines.

- Humana and other managed care names dragged on by macro policy concerns.

Real Estate (S&P 500: +0.52%)

- REITs firmed, possibly helped by rate stabilization.

- Crown Castle (CCI -3.7% prev day): Still digesting CEO termination news and strategic review.

Utilities (S&P 500: +0.70%)

- Defensive bid supported utility names in a risk-off tape.

Materials (S&P 500: +0.18%)

- Perimeter Solutions (PRM +10%): Upgraded to Buy at UBS; noted wildfire experience as growth catalyst.

- Copper producers mixed ahead of expected tariff announcements; concerns around input costs linger.

Eco Data Releases | Thursday March 27th, 2025

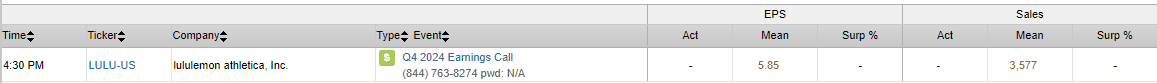

S&P 500 Constituent Earnings Announcements | Thursday March 27th, 2025

Data sourced from FactSet Research Systems Inc.