August 6, 2025

With August getting under way and US equities starting the month with some corrective price action, we’re looking abroad to see if investors are starting to rotate to any of the havens they sought in our previous correction from February through early April. That correction, which was basis points short of a 20% decline (the standard minimum threshold for a bear market), saw investors move to ex-US and low vol. exposures and away from Growth stock leaders. After 3+ months of reflation and firming risk appetite, equities are set up for some mean-reversion.

Setup for Rotation?

The indicators for a potential rotation are a wide spread between high-beta and low vol. securities, deteriorating S&P 500 internal strength and the spread between Growth and Value factors back at cycle highs. We think this sets equities up for a seasonal pause in the AI-led uptrend.

Since April, only Industrials, Technology and Utilities Sectors have outperformed the S&P 500. Typical bull market exposures like Financials and Discretionary stocks lagged while commodities sectors and low vol. sectors were also neglected. As a result, S&P 500 internal trends are weakening (chart below).

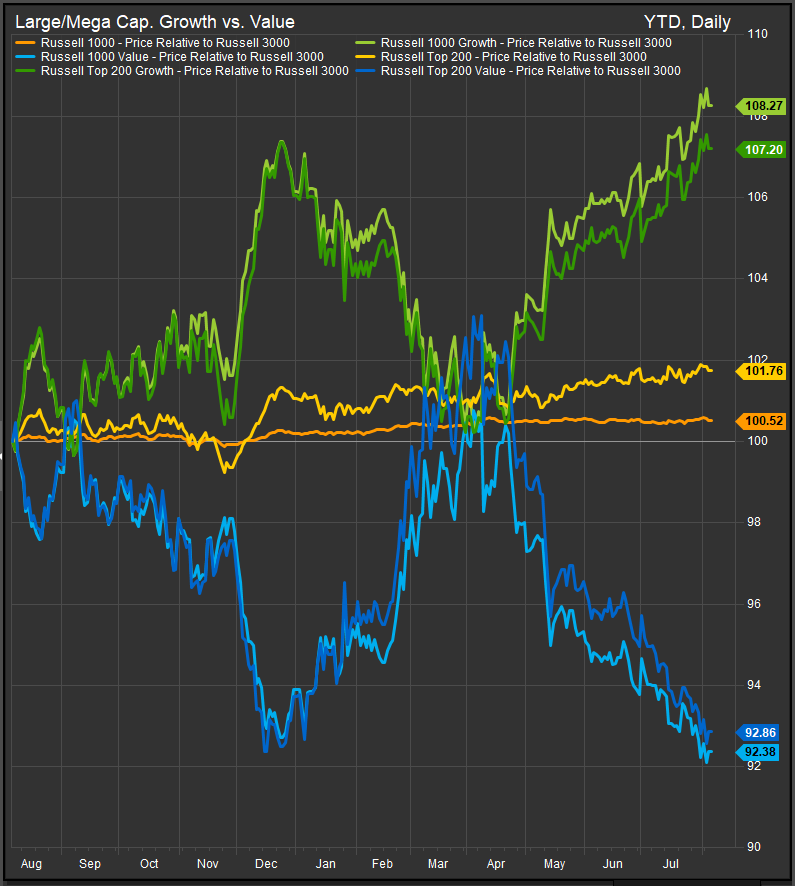

Further, domestic Growth stocks have traded to relative highs vs. Value (chart below) and we would expect some retracement in the near-term.

Finally, looking at high beta vs. low vol. securities, it’s been a one-way trade since April (chart below) and the spread has reached levels where reversion has occurred in the past.

EM (not DM) Equities are Perking up in the Near-term

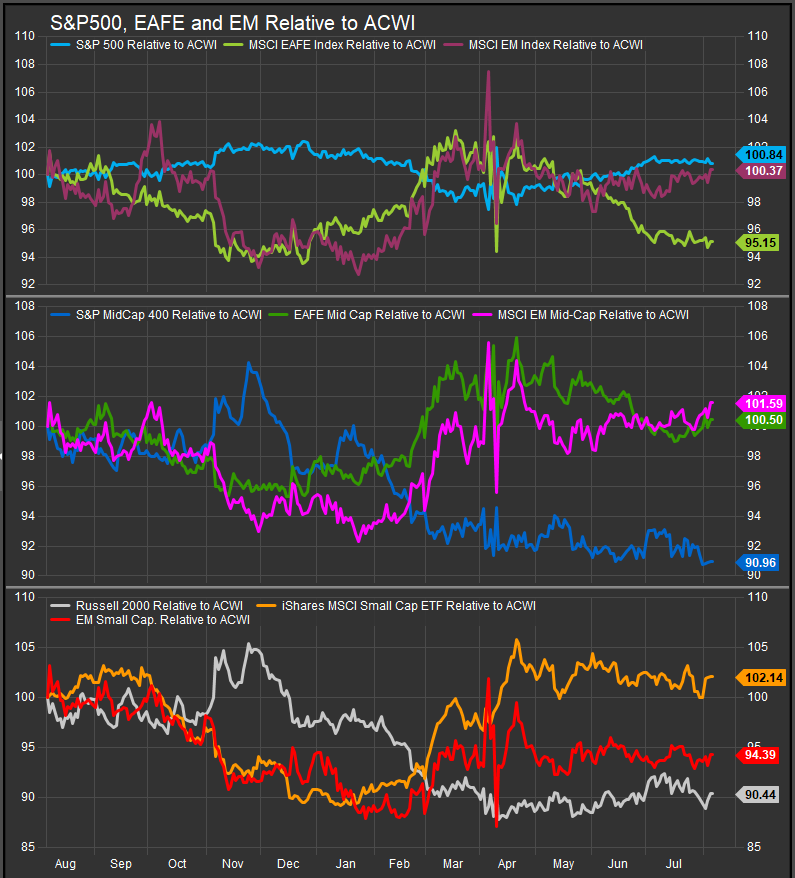

What catches our eye on the international performance charts is the developing bullish reversal in EM Large and MidCap. Shares (chart below, top 2 panels). EAFE stocks were the big beneficiaries of ex-US rotation in March, but we are seeing a preference for EM stocks at present.

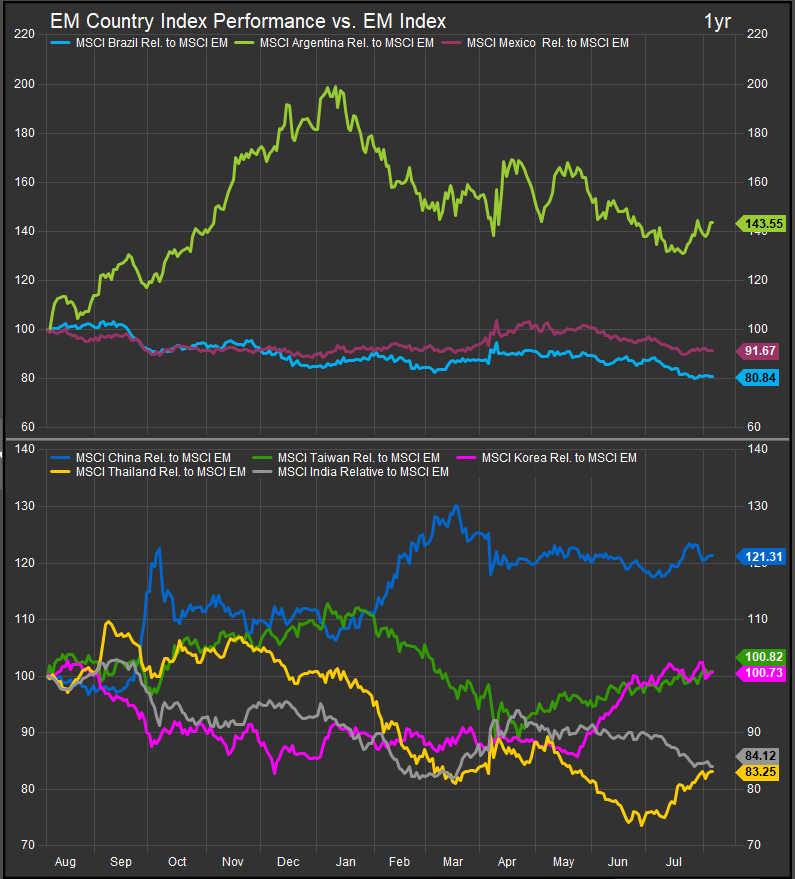

Within EM, Asian shares, particularly Korea, Taiwan and China are showing strength in the near-term. Those are geographies that underpin the ex-US Growth trade and may benefit from fragmenting global trade networks.

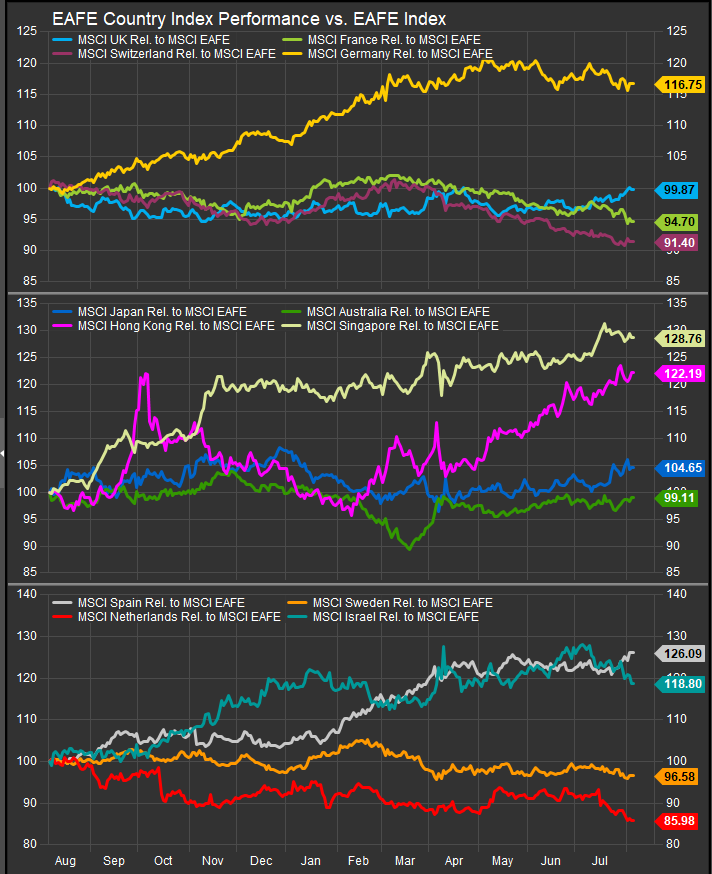

Within the EAFE universe (chart below), Asian geographies are leading as well with Japan, Hong Kong and Singapore improving in the near-term. We’ve seen some improvement in Spanish and UK shares as well, but German stocks have not made headway. This is a change from the last time around.

Conclusion

With US equities overbought and economic data softening in conjunction with weaker seasonals, we see potential for some near-term rotation. We see investors preferring EM over DM in the near-term and we want to keep tabs on that situation as it is different than the dynamics we saw in the spring. We think some allocation to low vol., Value and ex-US is appropriate for investors with shorter-term trading strategies.

Data sourced from FactSet Research Systems Inc.