September 10, 2025

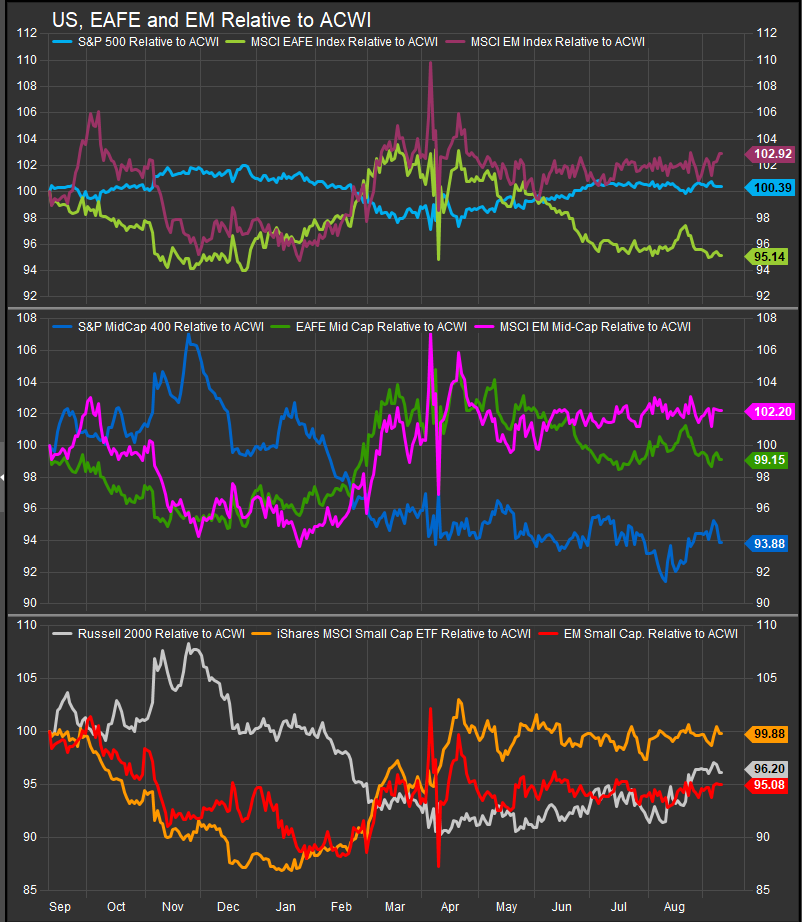

In our last Worldwide Wednesday column on August 6, we remarked that some deterioration in US stock market breadth (upside participation at the stock level) was weakening and some continued rotation into ex-US exposures was likely. That dynamic shifted rather quickly as Fed chairman Powell came out with clear dovish remarks at Jackson Hole, WY on August 20th. Expectation of policy easing in the US firmed domestic shares and halted the nascent bullish reversal in EAFE shares (chart below, top panel); however, we note EM equities continue to act well.

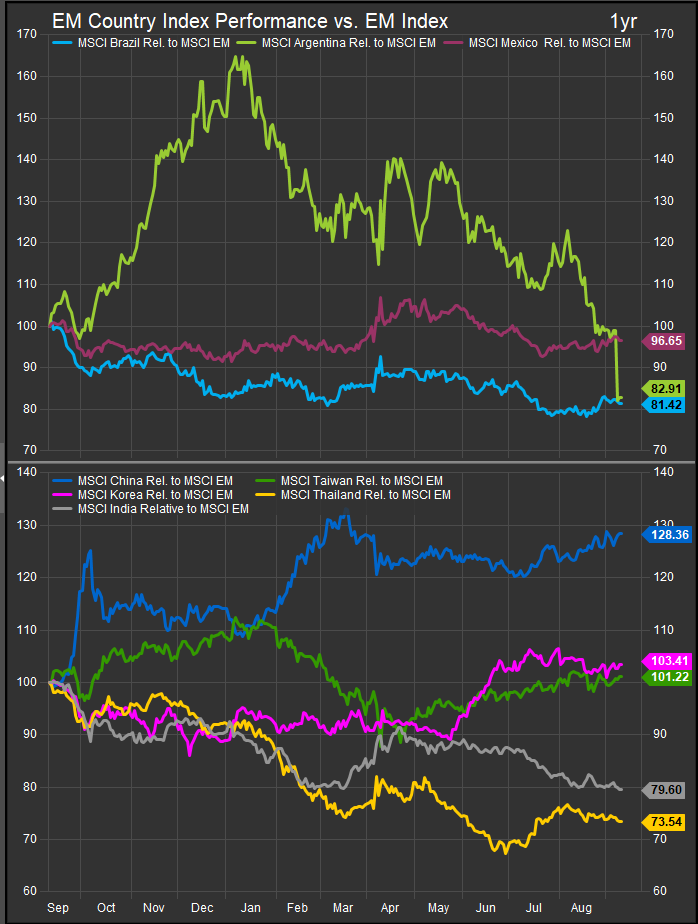

EM Tech, particularly in Asian geographies has been a standout theme as disaggregation of the global supply chain has created growth opportunities for a larger set of companies both within and outside the US political sphere of influence. Long dominated by stocks like Tencent, Alibaba and TSMC, there are a new wave of high momentum tech stocks benefitting from continued AI enthusiasm. When looking at country level performance of EM majors, China, Taiwan and South Korea continue to be leadership (chart below).

At the stock level, the intermediate-term momentum in established and emerging Tech names has been impressive. Both Taiwan Semi and Foxconn (China) Industrial Internet (6011138-SHG) have taken off, with the former breaking out decisively to new highs from an intermediate-term bullish reversal and the latter on a momentum surge from early June (charts below). In addition, stocks like Wiwynn Corp. (6669-TAI), a Taiwanese hyperscaler, have emerged in strong long-term trends. Hyperscalers are the cloud, datacenter and IT infrastructure companies that enable large scale AI implementation (think MSFT, Amazon AWS, Google, META in the US).

TSM

Foxconn (China)

Wiwynn Corporation

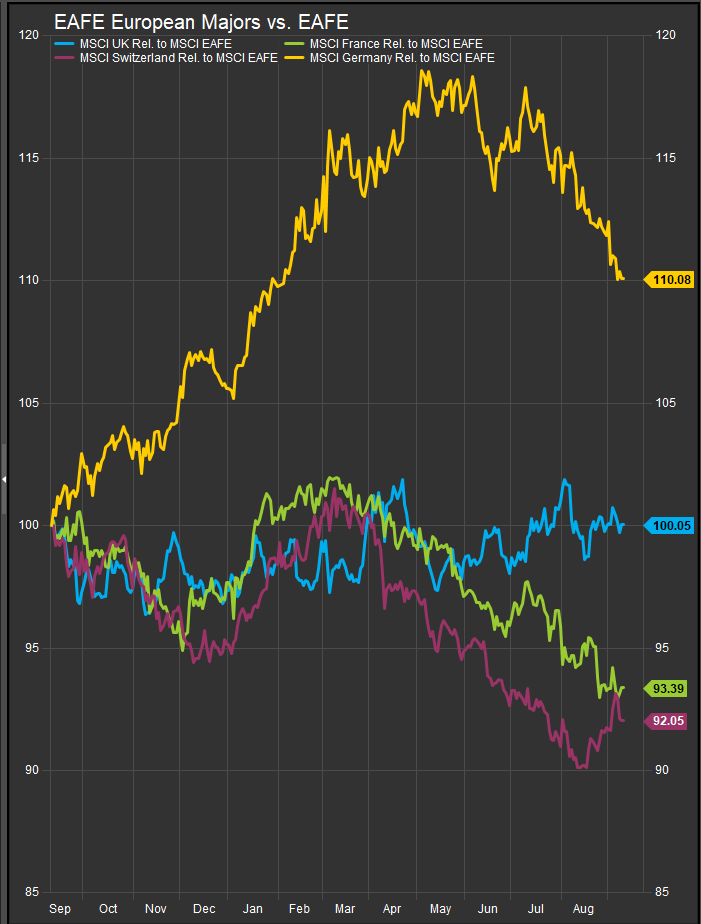

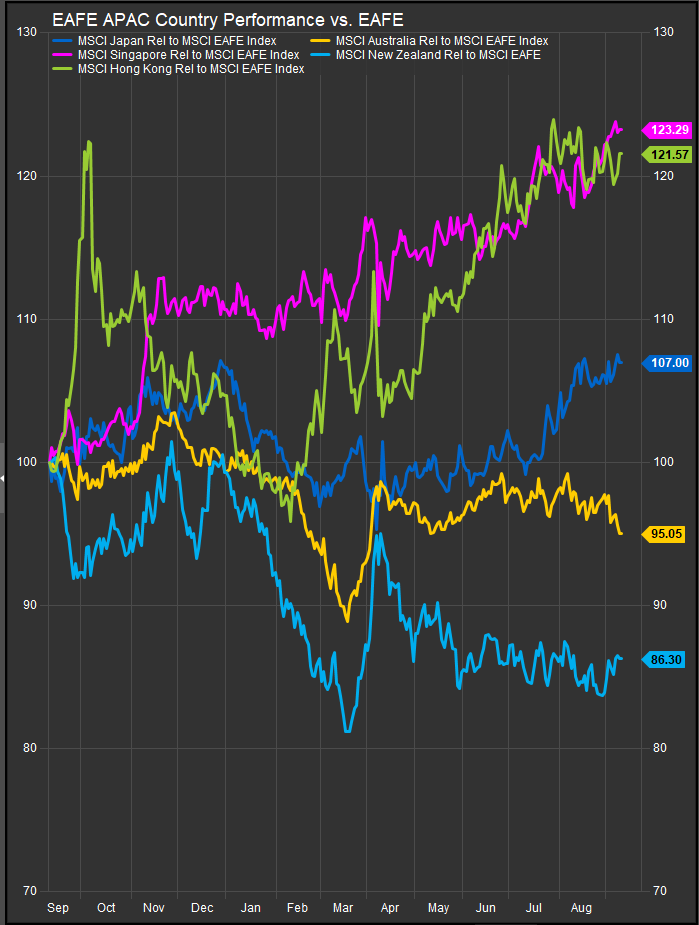

Developed market equities have persistently had trouble keeping pace when AI stocks lead as the European Tech Sector is notably small relative to its US and EM counterparts. We can see the results of this in country level performance. Leadership has shifted dramatically away from core Europe, particularly out of German equities, and towards DM Asian geographies. Japan, Hong Kong and Singapore have been leadership (charts below).

EAFE Core

EAFE Asia/Pacific

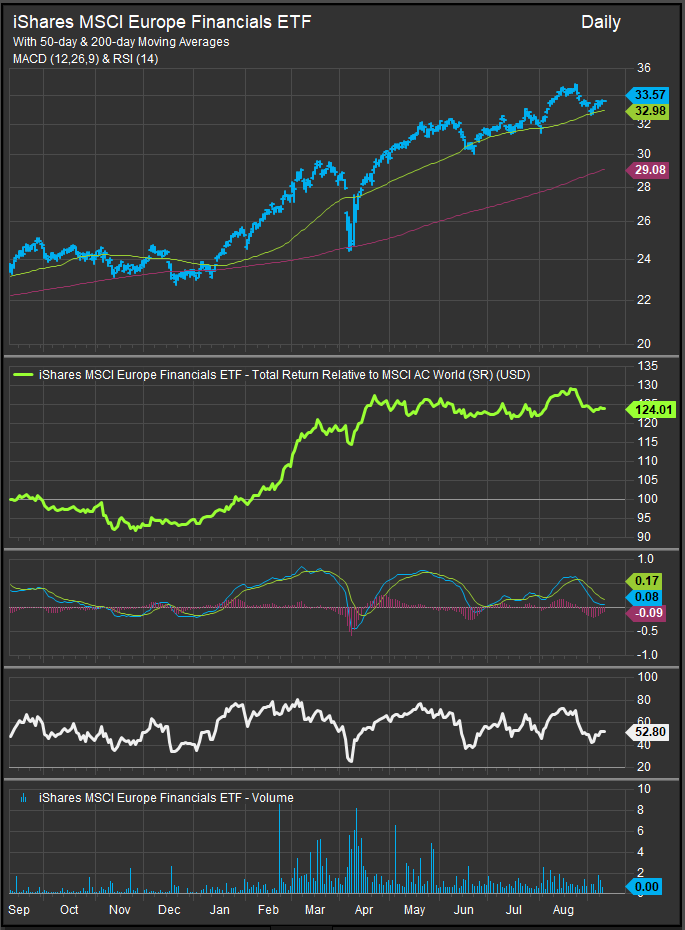

Central themes that had boosted European equities revolve around the rubric “Banks & Tanks”, and that theme has slowed in the near-term. Leading defense manufacturer Rheinmetall AG (RHM-ETR) has consolidated sideways. The biggest banks remain strong, though other financials which had been riding high with the banking trade are in retracement. We highlight Deutsche Boerse AG (DB1-ETR) as a prominent example. The result has been that EU financials have leveled off, and while we’re still constructive on the trade over the longer-term, EAFE equities are likely to lag without strong tailwinds from these sectors (charts below).

RHM

DB1

EUFN (ETF)

Conclusion

With AI the clear motive force behind the current global bull trend, investors should expect leadership to swing on the trade. Currently the long AI trade is on and EAFE is likely to continue to lag in aggregate while that is the case. Strength in EM Asian technology shares highlights an interesting dynamic around global trade. Tariffs may make global supply chains less efficient as they are likely to add a layer of cost. However, parallel Tech supply chains catering to a bifurcating world, create opportunity and invite speculation in the early phases of global disaggregation. We think this explains the continued bid for AI despite some signs of economic weakness in the near-term.

Data sourced from FactSet Research Systems Inc.