ETF Insights| October 1, 2024

Legacy industries have seen performance improve while heavyweight Alphabet has traded down to oversold levels.

Price Action & Performance

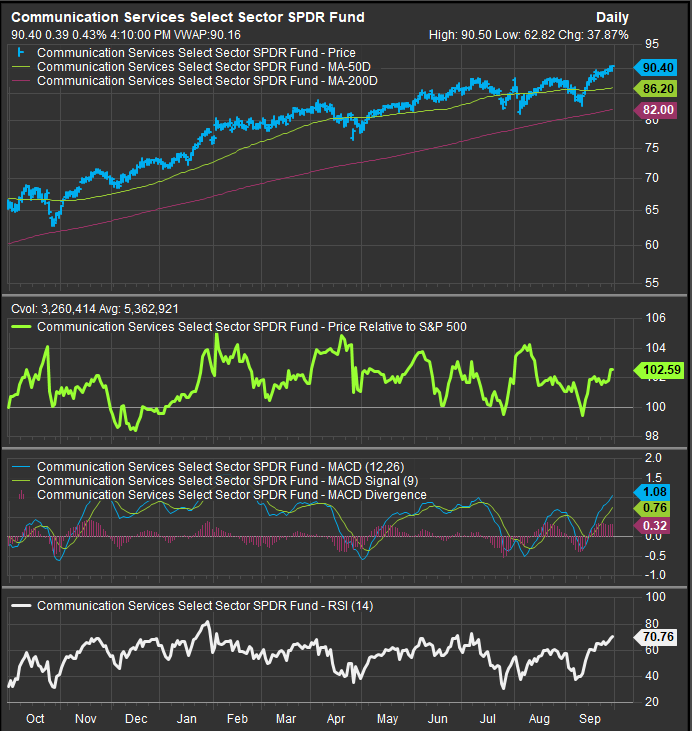

XLC broke out to fresh all-time highs in September and the sector projects significant upside based on the technical break-out patterns upside objective. Classic pattern analysis implies 50% upside over the next 2 years to a price target of $135 for XLC.

Oscillator work is overbought on the daily RSI, but the MACD gage is on a buy signal for XLC, and significant upside breakouts typically coincide with sustained overbought readings. In short, we interpret the condition as a bullish signpost and confirmation of the longer-term uptrend.

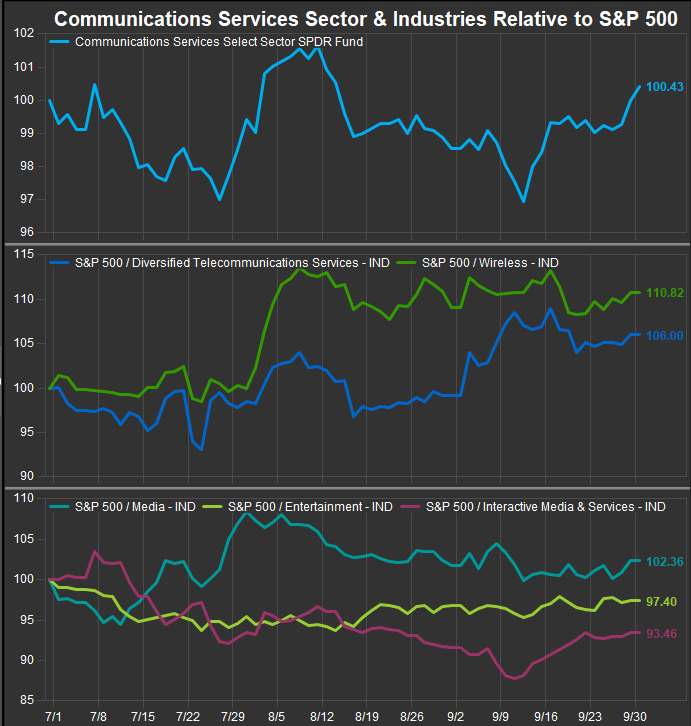

At the industry level, legacy Telecom names T and VZ have outperformed over the past 3 months, their big dividends becoming more attractive to investors as rates move lower. The Wireless and Media industries have also improved while previous leadership in the Entertainment and Interactive Media industries has corrected in the near-term.

At the stock level our favorite names are NFLX and META. We are also constructive on Alphabet as a bullish accumulation opportunity and TMUS, T and VZ are also buys in our work. There’s been improvement in Video game makers TTWO and EA as well.

Economic and Policy Drivers

Election years typically spike media buying, but soft eco data was a cross current against that trend this year. As we noted in the previous section, T and VZ have become attractive as high dividend payers with the Fed coming in aggressively with a 50bp cut to the target Fed Funds Rate. The election cycle will be interesting to monitor as policy rhetoric heats up. One of the favorite bugaboos for the XLC is the talk of anti-trust actions against GOOG, META and NFLX. If we see either candidate seek to leverage that as a populist issue to appeal to voters, we could see some volatility.

Beyond the glitz of META, GOOG and NFLX, the Comm. Services sector at its core is about media and advertising as well as the two big legacy Telecom’s T and VZ. The former are economically sensitive and likely to get a near-term boost from stimulative interest rate policy while the latter are basically dividend companies at present and give the Sector some downside capture characteristics if the Fed can’t perk up the economy and rates continue lower.

In Conclusion

We like the technical setup for XLC heading into October. The Elev8 Sector Rotation Model recommends an OVERWEIGHT position in XLC of +3.74% vs. the benchmark S&P 500 for October 2024.

Chart | XLC Technicals

- XLC 12-month, daily price (200-day m.a. | Relative to SPX | MACD | RSI )

- XLC has persistently rebounded from weakness and we remain constructive on the sector

XLC Relative Performance | XLC Industry Relative Performance | 3-Months

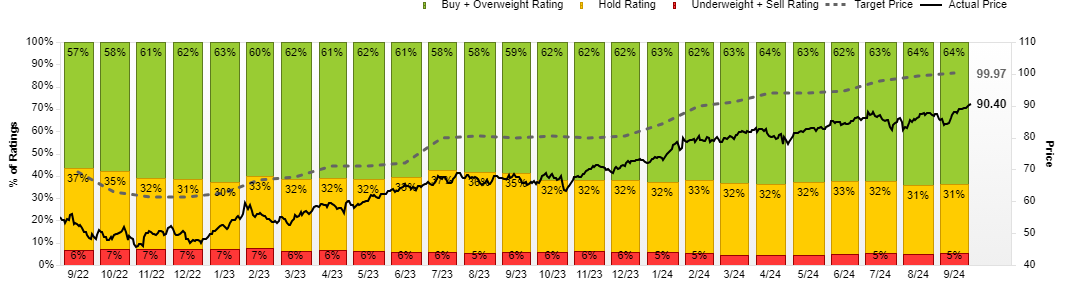

XLC Street Analyst Ratings and Price Targets:

Similar to XLK, street analysts have gotten persistently more bullish on XLC over the past 12-months

Data sourced from FactSet