As Mega Cap. names have consolidated other industries have seen performance improve. We start September Overweight XLC.

Price Action & Performance

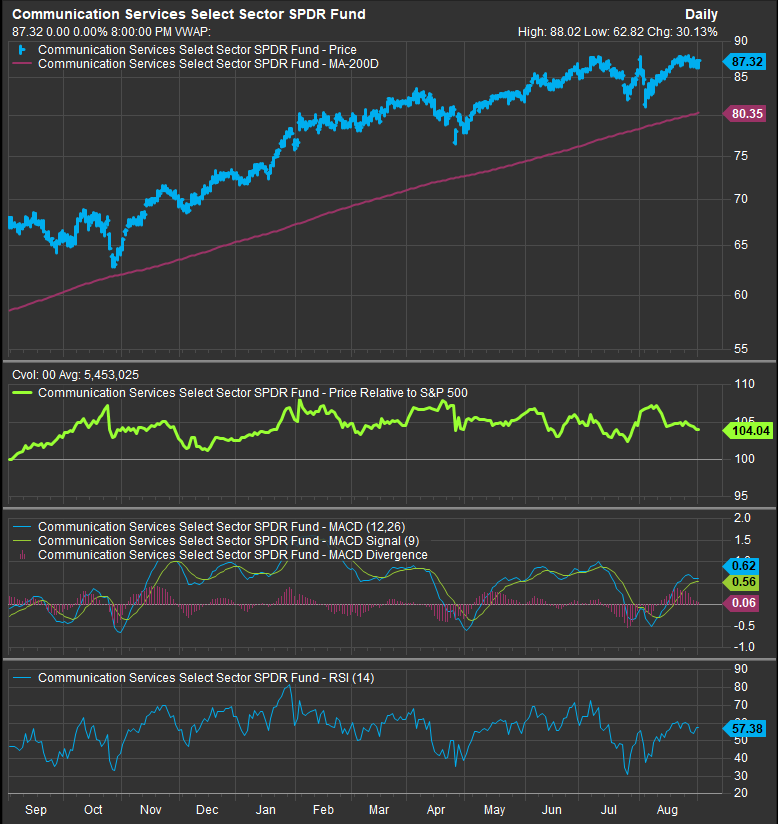

XLC corrected in August but remains among the leadership cohort at the sector level in 2024. Price is consolidating just below resistance at the $88 level. Oscillator work is showing some negative momentum divergence over the longer term, so we remain sensitive to potential sell signal triggers. The $80 level is important support for XLC.

That said, we are in a bull market trend and XLC has been a leader throughout. It has seen its 2023 outperformance trend consolidate sideways into 2024, but this has been a fairly narrow market, and many sectors show similar concerns paired with weaker performance.

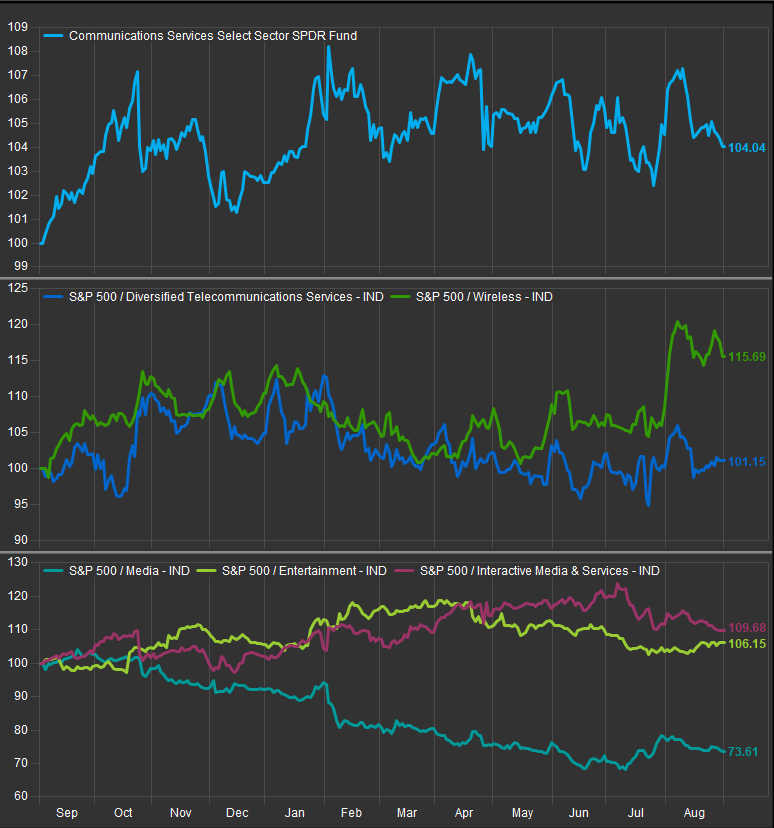

At the Industry level Interactive Media, Entertainment and Wireless have outperformed over the past 12 months while Diversified Telecom has also edged the S&P 500 over that time frame. Performance has cooled slightly in the past 3 months with laggard sectors rallying on hopes of interest rate policy relief, but we expect a sustained bid for XLC as other sectors start the month at more overbought levels.

At the stock level our favorite names are TMUS, NFLX, GOOG and META. There’s been improvement in Video game makers TTWO and EA as well. T has actually been an outperformer this year.

Economic and Policy Drivers

It’s interesting that in the month the flipped the debate on Fed. interest rate policy, the sectors that had the most to lose by way of persistent high inflation were punished for their success over the course of the longer-term bull market. Now expectations are that the Fed will pivot to a dovish policy as soon as September. We think an economic soft landing is the perfect environment for Mega Cap. Growth outperformance to continue given the centrality of cloud computing, internet media connectivity and AI, the Growth engines of the sector should continue to benefit throughout the bull cycle.

The election cycle will be interesting to monitor as policy rhetoric heats up. One of the favorite bugaboos for the XLC is the talk of anti-trust actions against GOOG, META and NFLX. If we see either candidate seek to leverage that as a populist issue to appeal to voters, we could see some volatility.

Beyond the glitz of META, GOOG and NFLX, the Comm. Services sector at its core is about media and advertising as well as the two big legacy Telecom’s T and VZ. Those are basically dividend companies at present and give the Sector some downside capture characteristics.

In Conclusion

Investors have rotated away from Mega Cap. Growth over the past 3 months, but now leave many of the bull cycle’s favorite names in buyable positions. The Elev8 Sector Rotation Model recommends an OVERWEIGHT position in XLC of +2.57% vs. the benchmark S&P 500 for September 2024.

Chart | XLC Technicals

- XLC 12-month, daily price (200-day m.a. | Relative to SPX | MACD | RSI )

- XLC has persistently rebounded from weakness, and we remain constructive on the sector

XLC Relative Performance | XLC Industry Relative Performance | 1yr

Data sourced from FactSet