Staples reversed to the downside in June as tepid inflation and strong Tech Sector Earnings re-animated the bull market. XLP has continued to deteriorate after consolidating its May break-out which has triggered sell signals in our Elev8 Sector Rotation Model.

Price Action & Performance

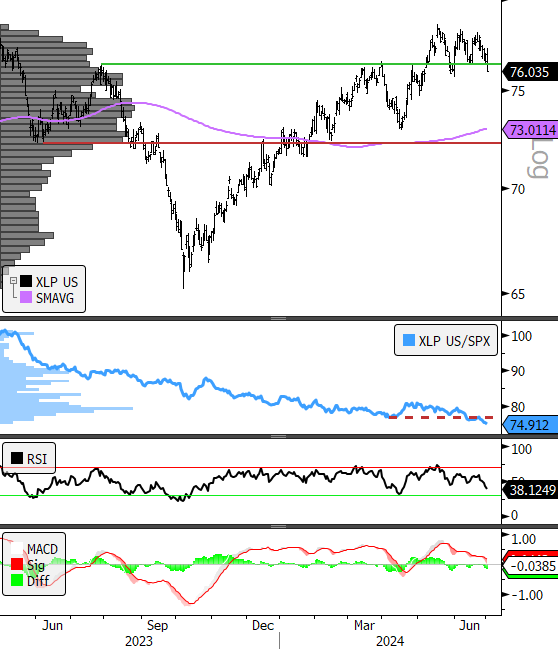

XLP price has retreated to intermediate term support on the chart. The Staples sector made a fresh 52-week relative low vs. the S&P 500 in June confirming its longer-term underperformance trend and wiping out the improvements made by a strong month of April. WMT and COST have been strong stocks, but the rest of the sector, even within the leading Staples Retailing Industry are characterized by weak charts that aren’t even showing positive momentum divergences. Given the context of the long-term bull trend playing out at the index level for large cap. US equities, and the focus on potentially accommodative interest rate policy changes moving forward we expect to see a pick-up in risk appetite that has historically been a headwind to XLP performance. We think the XLY is a better marginal bet on a rebound in US consumer spending given the macro backdrop. We also have preference for XLU and XLRE as lower volatility exposures as they as the former has shown some intermediate-term positive divergence and the latter has had some improvement in the near-term.

Economic and Policy Drivers

Cooler inflation prints in May and June have cut the legs out from under the recession trade and have given the edge to high-beta stocks at the expense of min vol. stocks for the time being. XLP is a part of both cohorts on the losing end of these developments.

Staples co.’s typically operate lower margin businesses with a broad array of essential products. The product categories are typically associated with value-oriented marketing. This has caused consumers to balk at some of the higher prices showing up on store shelves for established brand names. The present behavioral trend is exacerbated by increased competition from private label entrants into the traditional staples categories.

ESG policies also add a layer of cost that is particularly difficult for the Staples sector. Increased R&D and costs associated with recyclable and reusable packaging is a strain on lower margin businesses that market low price points.

How Can XLP Help?

XLP has several characteristics that make it attractive to investors when there is expectation of equity price correction, volatility, or economic decline into late cycle or recession. It is comprised exclusively of Large Cap. US stocks which generally offer a lower volatility profile to the broad market. It has one of the highest dividend yields among the 11 GICS sectors, which offers income and stability when markets are falling on price. That isn’t the environment we appear to be in at present, but if we get negative surprises on inflation or exogenous shocks that challenge the bull trend, XLP offers a quick way to add defensive characteristics to an equity portfolio.

In Conclusion

Weaker inflation and a fairly bullish earning season from the Tech. Sector have put the XLP in the back seat. Several o our model inputs have deteriorated for the sector since May and it now scores as a zero-weight sector for July in our work. Our Elev8 Sector Rotation Model Portfolio has sold out of XLP for July and starts the month short the sector -5.77% vs. the benchmark S&P 500

Chart | XLP Technicals

- XLP 12-month, daily price (200-day m.a. | Relative to S&P 500)

- A strong June for the S&P 500 has seen XLP re-establish its underperformance trend with investors preferring the Discretionary Sector as a play on dovish expectations for interest rate policy

Data sourced from Bloomberg