Price Action & Performance

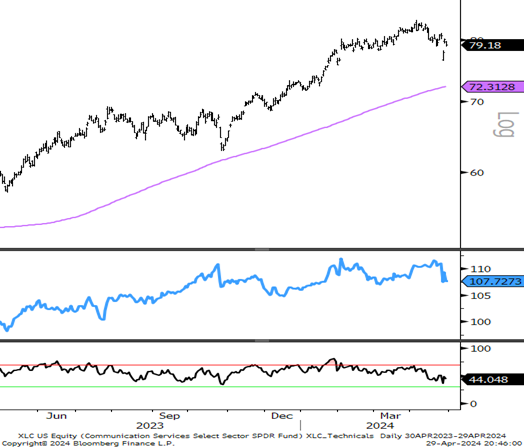

XLC has been a leading sector on performance over the past 12+ months since the market put in a trough in Q4 of 2022. Since then XLC price has come close to its all-time high from late 2021 and is now pulling back towards its 200-day moving average. The relative uptrend vs. the S&P 500 remains intact, but there has been some negative momentum divergence since February as has been seen in other long-term leaders.

Economic and Policy Drivers

Alphabet Corp. (GOOG/L) and META are the two heavyweights in the sector. They are threatened somewhat by the prospect of rising rates, but more so by inflation manifesting high enough to raise recession probability which likely would cause correction as it historically coincides with major reductions in ad spending. A marginally higher CPI could be taken in stride, but anything more than a few tenths of a percent above the previous print could lead to investors heading for the exits in more force. I don’t see commodities prices acting strongly enough to predict a very high inflation print, but it bears watching.

How Can XLC Help?

The Communication Services Sector is a collection of somewhat odd bed-fellows as GOOG and META and a few other internet technology companies were merged with legacy Telco’s, print media and television concerns as well as various other entertainment properties and DIS. XLC provides an easy one-click way to manage exposure to all those various business lines. GOOG remains one of the strongest charts in the S&P 500 and NFLX looks great too. META is at a potential pivot which will likely be resolved when they report earnings. There are several potential pivots this month for the Economy and the mega cap. stocks that dominate the sector.

In Conclusion

The XLC has improved steadily since the advent of the bull market in early 2023. Upside participation has narrowed, and I’m a bit concerned that a crack in GOOG/L will accelerate deterioration in the sector despite it holding up well YTD. I would recommend a Market Weight position in XLC for May of 2024.

Chart | XLC Technicals

- XLC remains in an intact relative uptrend, but only 2 stocks in the sector (NFLX and GOOG/L) are compelling at present.