ETF Insights| October 1, 2024

XLP near-term outperformance paused in September with the advent of the Fed’s dovish policy stance and 50 bps rate cut. We see interest rates firming in the near-term and expect some retrenchment from defensive shares moving forward.

Price Action & Performance

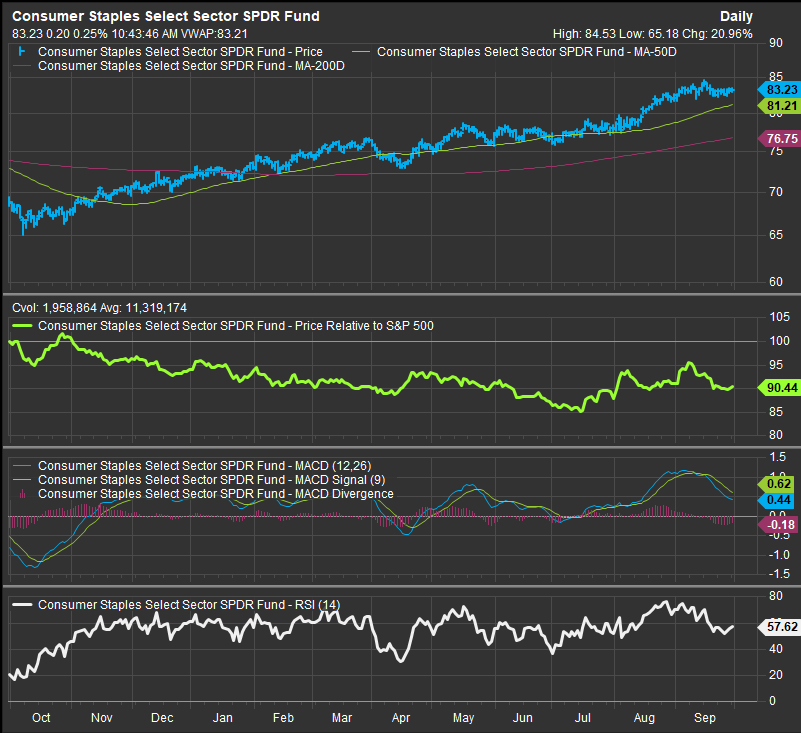

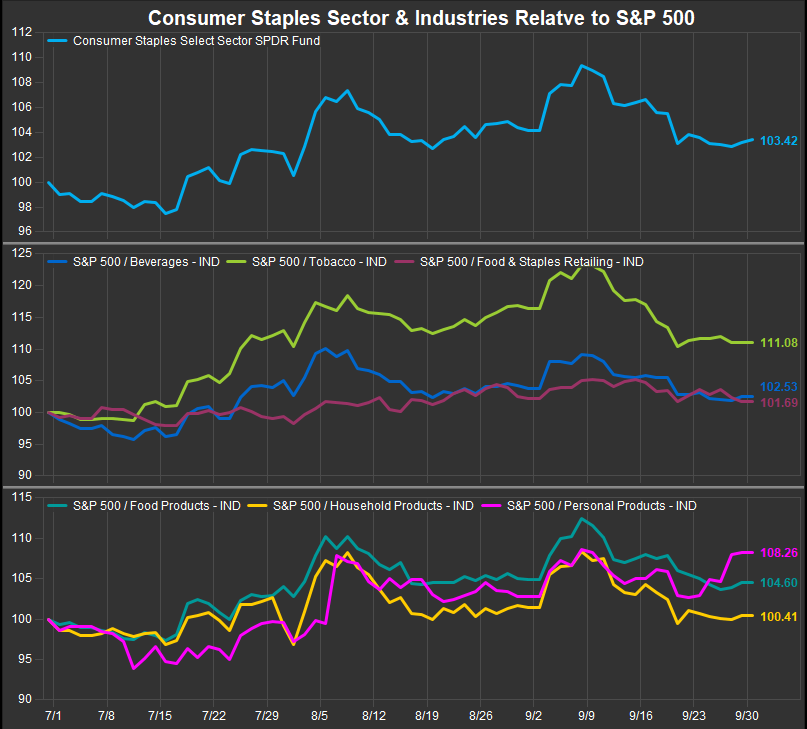

XLP price ended September right where it started despite a new multi-month relative-high vs. the S&P 500. Oscillator work has rolled over from overbought conditions and the sector remains a relative laggard over the trailing 12-month period. The sector has outperformed over the past 3-months; however, we’ve seen 5 out of 6 industries pull back since the Fed’s policy announcement and negative divergence on the RSI study.

At the industry level, Tobacco stocks have lagged by 10% vs. the S&P 500 since the Fed made its dovish policy announcement. Every industry is lower except for Personal Products which have gotten a boost from Chinese stimulus and the EM break-out. If you haven’t looked at it before, check out the correlation between make-up stocks like EL and the MSCI EM Index. EM affluence is a key driver of makeup sales!

At the stock level we like WMT, COST and CL and we note that these two stocks are the only material drivers of outperformance for the Sector as they account for >30% of the Sector market cap. If there are any missteps between the big two, we worry what that would mean for the sector. As we mentioned earlier, EL and KVUE are showing bullish reversal. Not much else looks appealing to us.

Economic and Policy Drivers

Consensus has firmed around dovish policy expectations for the 2nd half of 2024 and the Fed spiked the narrative with an initial 50bp cut. Rates have responded by moving lower with 2yr and 10yr Yields below 4% in August. Staples stocks historically benefit from falling interest rates, but that typically occurs when equity prices are also falling. This cycle has seen a positive correlation between bond and stock returns. That could be changing as dovish policy has sparked an upwards move in Commodities prices. If rates firm on optimism that could complicate interest rate policy objectives.

Staples co.’s typically operate lower margin businesses with a broad array of essential products. The product categories are typically associated with value-oriented marketing. This has caused consumers to balk at some of the higher prices showing up on store shelves for established brand names. As we’ve heard from the Financial commentariat class, one of the reasons inflation is cooling is because Consumers have begun refusing higher prices. The present behavioral trend is exacerbated by increased competition from private label entrants into the traditional staples categories. The big reach for margin that was sparked by pandemic shortages is now getting pushback from the consumer who is still under pressure despite promises of lower rates ahead.

ESG policies also add a layer of cost that is particularly difficult for the Staples sector. Increased R&D and costs associated with recyclable and reusable packaging is a strain on lower margin businesses that market low price points.

While expectations of dovish interest rate policy animate a near-term bid into laggards, we don’t see a clear catalyst for long-term outperformance in the XLP at present. Rather, the dynamics outlined above remain in force.

In Conclusion

Weaker inflation and a bullish earnings season from the Tech. Sector have put the XLP in the back seat on performance. Overbought conditions from September have alleviated somewhat, but optimism around Fed policy has started to show in our macro gages. Our Elev8 Sector Rotation Model Portfolio is out of XLP for October and starts the month short the sector -5.96% vs. the benchmark S&P 500

Chart | XLP Technicals

- XLP 12-month, daily price (200-day m.a. | Relative to S&P 500 | MACD |RSI)

XLP Relative Performance | Industry Level Relative Performance | Trailing 3-months

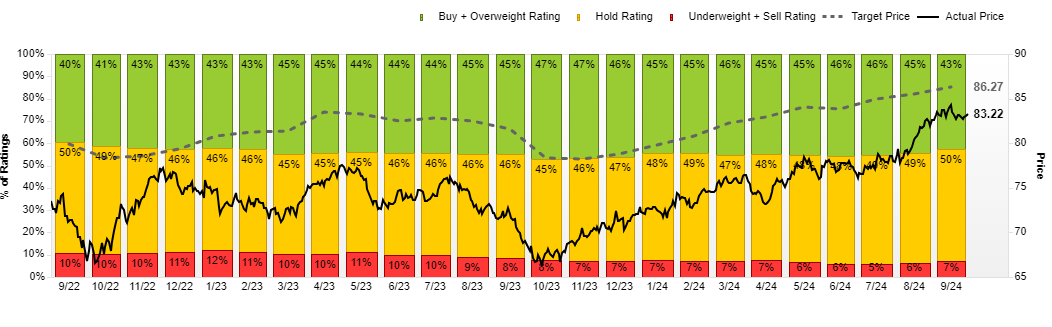

XLP Street Analyst Ratings and Price Targets:

Data sourced from FactSet