Price Action & Performance

XLRE underperformed in nominal terms in August by a small margin, but a bullish reversal pattern has emerged at the stock, industry and sector level over the past 3-months as interest policy expectations have turned dovish. Similar to XLF and XLU recent strength comes against a backdrop of sustained weakness as Office REITs and residential REITS were tanked in the pandemic cycle and rising rates became a persistent headwind for the sector thereafter.

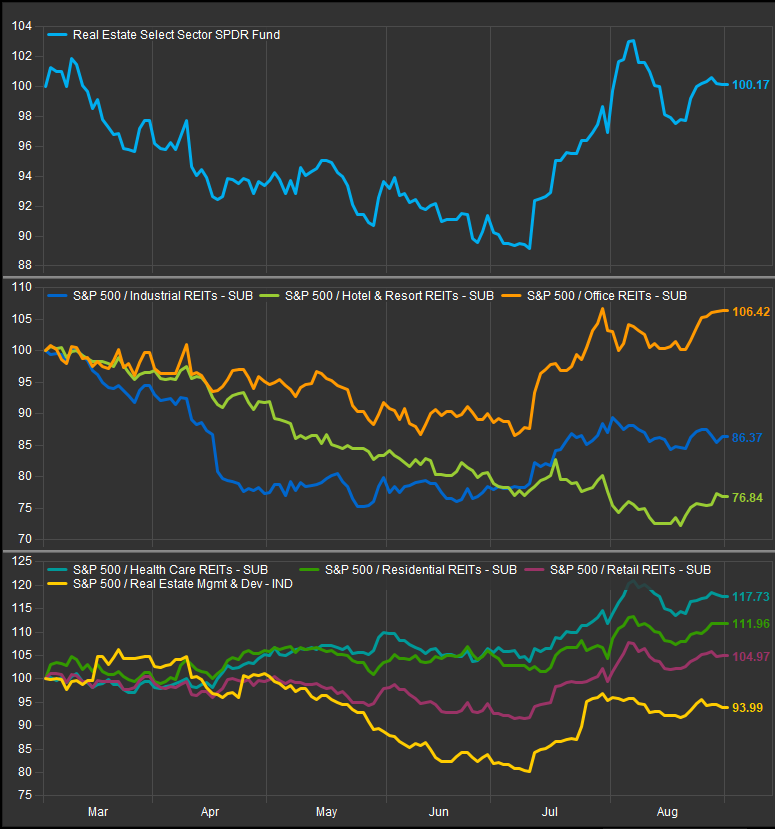

At the industry and sub-Industry level we’ve seen breadth and performance steadily improve over the past 3 months. We think there is potential for this to continue given long-term underperformance in the preceding 3yr and 5yr periods. However it’s also important to note that Healthcare REITs and Residential REITs were showing some improvement before policy conviction solidified.

At the stock level we are seeing broad improvement with a fairly high correlation. Standout stocks are few and far between, but we see clear bullish reversals in residential real estate names, Healthcare REITs and Retail REITs. Our favorite stocks in the sector are IRM, EXR, KIM and WELL.

Economic and Policy Drivers

This has been a period of renewed rotation as expectations for interest rate policy in the second half of the year come into focus. Rate cuts are expected as soon as this month and the XLRE has re-rated higher.

Beyond the Fed, we are seeing some give back in post-pandemic behavior patterns as more co.’s start looking to get employees back into offices. With lower interest rates forecasted, we may also see some investment come back into the REIT space. It is, after all, somewhat ironic that a structural housing shortage in the US has coincided with weak prices for Real Estate equities. An overbuild of office capacity into the pandemic is an overhang on the sector, but much bad news is priced in the Office REITs lagging the S&P 500 by almost 50% over the past 5 years. If rates continue lower, some office-to-residential conversion may become feasible.

In Conclusion

XLRE consolidated in August, but its intermediate term bullish reversal looks primed to continue in September. We are long XLRE for September with a +1.57% allocation vs. the S&P 500 Index.

Chart | XLRE Technicals

- XLRE 12-month, daily price (200-day m.a. | Relative to S&P 500 |MACD | RSI)

- We’ve seen enough over the intermediate term to get more constructive on the sector

XLRE Relative Performance | XLRE Industry Relative Performance | 6m

- 4 out of 7 REIT Sub-Industries have outperformed over the past 6 months and all of them have over the past 3-months. Broad based improvement is a good thing!

Data sourced from FactSet