Price Action & Performance

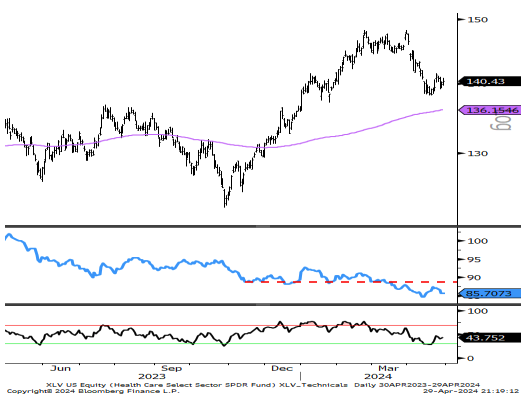

XLV has continued its steady march lower from 2023 into 2024. Price action in absolute terms has been stable, and there is have been some significant rallies in the sector in 2022 and in 2022, but the technical picture is extremely weak with every industry within the XLV underperforming the S&P 500 by double digits over the past 12 months.

Economic and Policy Drivers

The emergence of GLP1 drugs has had a profound impact on the Healthcare sector. While the chart of Eli Lily (LLY) is still one of the strongest in S&P 500, success of that product has potentially cannibalized several other prominent healthcare business lines. As investors bet on a reduction in the number of various surgeries required, cases of diabetes, traditional weight loss, and many other areas associated with a broad reduction in obesity and related illness, many other stocks in the sector have seen their prospects deteriorate. The emergence of inflation in 2022 helped the sector by arresting the advance of the broad market and allowing some of the more stable business lines in the sector like managed care (UNH, ELV, MOH) and Pharmaceuticals to add value to investor portfolios.

How Can XLV Help?

XLV can help by offering the ability to pivot quickly if inflation morphs from a somewhat concern to a full-blown problem like we had in 2022. That year the HC sector outperformed in 11 out of 12 months. I’m not expecting that to happen at this point, but it shows that things can change quickly and the low cost, highly liquid XLV is a great way to put a placeholder in a portfolio if/when trends change. As is, MRK, LLY, BSX, and ISRG represent some of the best charts in the sector.

In Conclusion

The XLV has continued to deteriorate and has been a large underweight in my process since the bull market started in early 2023. Emergence of inflation could cause rotation, but so far there are no signs. I would recommend an underweight position in XLV for May of 2024.

Chart | XLV Technicals

- Price chart looks copasetic, but the relative curve tells the story of a sector in persistent decline