Contrary to our expectations entering August, the XLY broke down hard at the beginning of the month and then whip-sawed higher after triggering our sell signals. We continue to dislike the Sector from a technical and fundamental standpoint. However, we note that Fed. policy is directly targeting the consumer and keeping employment strong. We don’t want to make too big a bet against that reality. We are taking a cautious approach to XLY in September.

Price Action & Performance

In our technical process, the $188 level is very important for the XLY. August saw the ETF break to a YTD price low undercutting April, but drawdown progressed into a bullish island reversal on the chart. XLY now sits just below where it started in August at $187.12. Oscillators are tepid with the MACD giving a weak buy signal.

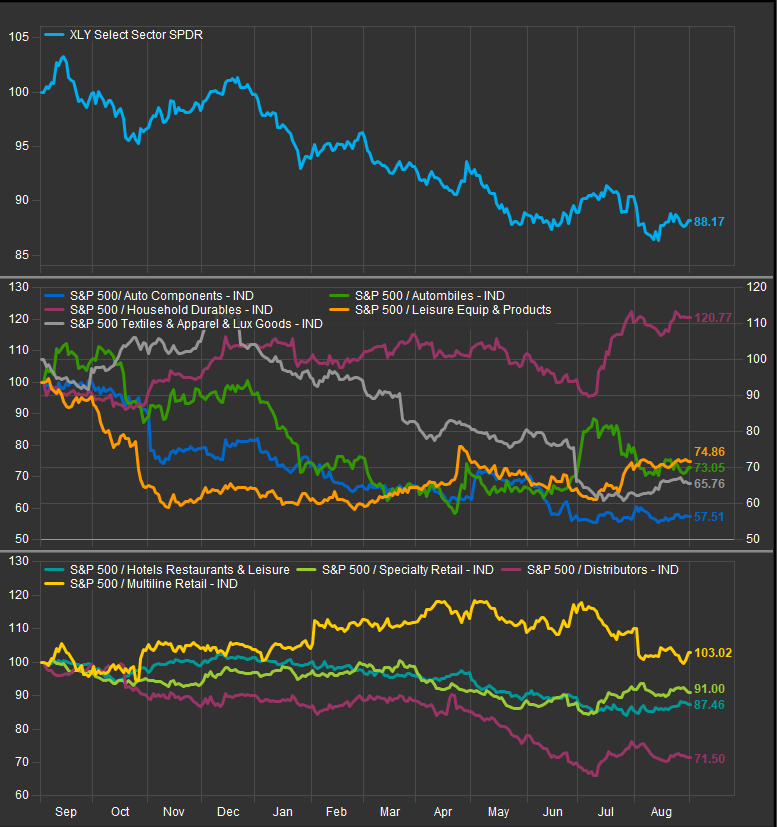

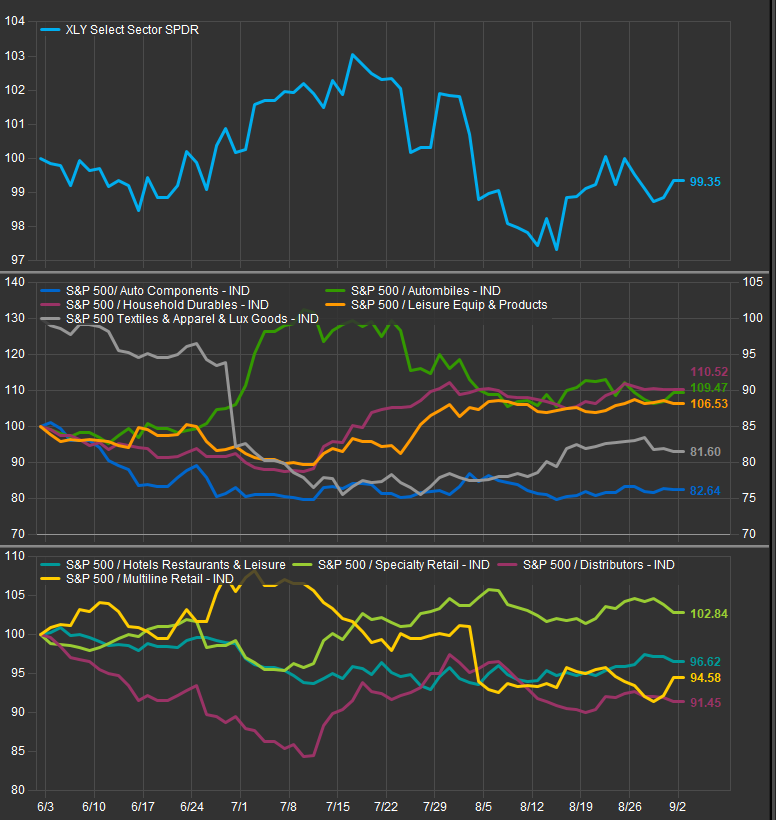

At the Industry level, only 2 of 9 within the sector are outperforming YTD. The clear leadership resides with Homebuilders and the Household Durables Industry. The AMZN powered Multiline Retail Industry is the only other outpacing the S&P 500 YTD. Auto Components, Auto’s, Textiles & Lux Goods, and Leisure Products have all lagged by double digits. Specialty Retail, Hotel & Restaurants, and Distributors are all off > 9% as well. In the past 3 months, performance has firmed somewhat, with Leisure Products and Automobile Industries outperforming since dovish policy began coming into focus.

At the stock level we still find breadth is poor and the average stock is an underperformer. Our favorites, though few and far between are DHI, NVR, PHM, BKNG, RCL, AZO, TJX. We are constructive on big names AMZN and SBUX. We have an unfavorable view on TSLA, LOW and HD.

Economic and Policy Drivers

Interest rate policy expectations have pivoted to the benefit of the Consumer. Upwards pressure has come input costs from lower commodities prices in 2024. Yields have re-rated lower on dovish expectations for the remainder of 2024. The base case is two quarter point cuts by year end. Yields on the 2yr and 10yr now sit below 4% and have found support at the 3.8-3.9% range in the near term. Is the current modest move lower in rates enough relief? A clear upside surprise would be a more aggressive move by the Fed in the near-term, but regardless of the direction of interest rates from here will likely be a big factor in the Sector’s performance.

We are entering peak election season with our two candidates staking out vague, but different ideas for the coming administration. It’s important to note that despite the rhetoric, Former President Trump’s policies led to some inflationary outcomes though they clearly benefitted commodity’s adjacent sectors. On the other hand, Vice President Harris has discussed affordability which hints at potential changes in regulation and oversight. So far, she has outlined expanding the Child tax credit as a policy tentpole.

At present, tax credits for EV’s and energy efficient home improvements remain in place which offer the potential to lower energy costs over the longer term.

In Conclusion

XLY has potential to benefit from the change in Fed policy outlook. It has shown some technical improvement over the previous 3-months as well. However, the stock level picture is showing a tough environment for the average stock at present. We start September with an UNDERWEIGHT position of -2.09% vs. the S&P 500 weight in our Elev8 Sector Rotation Model.

Chart | XLY Technicals

- XLY 12-month, daily price (200-day m.a. | Relative to S&P 500 |MACD|RSI)

- The price pattern in absolute terms would resolve bullishly on a break-out above resistance, but the underperformance trend remains with out a clear positive divergence in momentuem.

XLY Relative Performance | Industry Level Relative Performance | 1yr

XLY Relative Performance | Industry Level Relative Performance | 3m

Data sourced from FactSet