The US Fixed-Income market showed positive performance in January 2025, with most bond sectors delivering gains.

Yields were relatively stable, with the 10-year U.S. Treasury yield ending January at 4.58%, unchanged from the end of 2024. Lower-quality credit segments outperformed, driven by favorable macroeconomic conditions and robust investor demand.

Fixed-Income funds experienced significant inflows, with more than $28.8 billion flowing into long-term taxable bond mutual and exchange-traded funds (ETFs) through January 22.

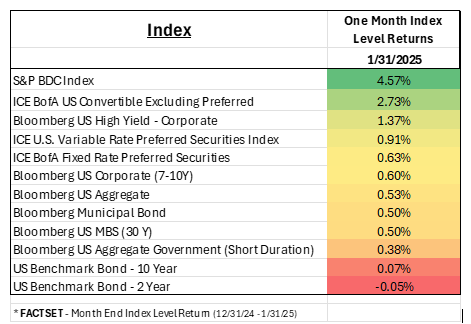

ETFsector.com looked back on a set of indices (above) picked out the top three and bottom one performing benchmarks and reviewed below what type of exposures they each represent.

- The main draw for BDCs is their high dividend yields. BDCs invest in small and midsize businesses. Some cases involve BDCs gaining equity positions in companies, but BDCs also invest in companies by lending money. These entities are similar to venture capital funds. The index consists of 41 constituents in the Financial Services Sector, with a mean market cap of $1.7 Billion.

- The ICE BofA US Convertible Excluding Preferred index is a market-capitalization weighted index that tracks the performance of US-dollar-denominated convertible securities. The index includes both investment-grade and non-investment-grade convertible securities and excludes preferred equity redemption stocks and converted securities. Convertible preferred stock included in the index must have underlying equity that is publicly listed and actively trading.

- The Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high-yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below 1. The index includes all domestic and Yankee high-yield bonds, including deferred-interest bonds.

- The US Bond Benchmark (2-Year) is a passively managed single-bond benchmark that invests in the most recently issued on-the-run- 2-year Treasury Note. The 30-day yield is approximately 4.1% and it carries an effective duration of 1.9%.

Investors seeking yield in their portfolios can access these exposures in ETF and Mutual Fund vehicles.

Overall, the outlook for bonds so far in 2025 is notably positive, with attractive starting yields offering the prospect of durable income and potential capital appreciation.