COMMENTARY:

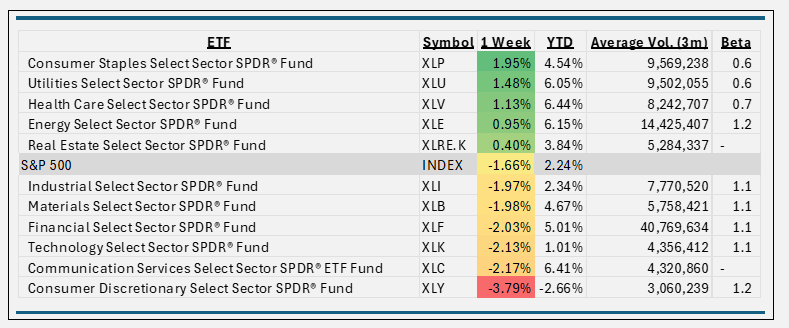

- The S&P500 index fell 1.7% this week but remains in positive territory year to date, holding at 2.2%. The S&P 500 notched two new record highs but also logged its worst day of the year—all in the same week. Stocks tumbled on Friday after weaker-than-expected economic reports suggested President Trump’s policies could impact U.S. business activity, while consumer sentiment dropped to a 15-month low.

- Consumer Discretionary was the worst-performing sector, down 3.8%. Several Cruise ship lines dropped after a U.S. official said the cruise industry avoids U.S. taxes, and there could be a crackdown on unpaid taxes. Carnival (-11.5%) and Royal Caribbean (-11.1%) fell the most within the sector.

- Communication Services, Technology, and Financials all tool over a 2% hit this week.

- The best-performing sector was Consumer Staples, gaining almost 2%. Food stocks were the best performers there. Hershey Foods (+9.5%), Constellation Brands (+8.0%) and J.M. Smucker (+7.8%) had the highest returns for the week.

- Sector returns overall this week were mixed with five outperforming the broader S&P500 index and six underperforming. The only sector in the red, year to date, is Consumer Discretionary, all other sector returns are up at least 2% or greater.

ETF TIDBITS:

Hashdex Asset Management released the Hashdex Nasdaq Crypto Index US ETF (NCIQ). According to Hashdex, NCIQ is the first multi-asset spot crypto ETF to be made available to U.S. traders.

Thrivent expanded its offerings with the launch of two new actively managed ETFs. The Thrivent Core Plus Bond ETF (TCPB) aims to provide current income. Also, the Thrivent Ultra Short Bond ETF (TUSB) looks to generate strong income while preserving capital.

A few Large ETF providers take a second look at ESG Strategy Amid Tougher SEC Disclosure Rules. New SEC guidance redefines investor activism boundaries, forcing Vanguard and BlackRock to pause company engagements while assessing compliance risks.