S&P futures are up 0.3% in Wednesday morning trading after US equities closed mostly higher on Tuesday. Gains were led by small caps, banks, commodity equities, capital goods, builders, and airlines, while big tech and healthcare continued to lag. Treasuries are firmer across the curve, the dollar index is down 0.2%, gold is up 1%, Bitcoin futures are up 0.5%, and WTI crude is up 0.5%.

Investors are focused on the December CPI report, expected to show a 0.3% m/m increase in headline inflation (y/y to +2.9%) and a 0.2% m/m rise in core inflation (y/y at +3.3%). Market expectations for rate easing remain muted, with only about 25 bp priced in for 2025. Bank earnings are also in focus as the market looks for signs of a 2025 rebound in capital markets and loan growth. Uncertainty around Trump 2.0 policies and global developments like cooler UK inflation data and hawkish BoJ commentary add to the backdrop.

Key Economic Events:

- CPI, Empire manufacturing, and house prices will be reported today.

- Fed’s Beige Book and remarks from Barkin, Kashkari, Williams, and Goolsbee are expected later.

- Retail sales, import/export prices, and homebuilder sentiment data are due Thursday, with industrial production and housing starts closing the week on Friday.

Corporate Updates:

- JPM: Beat estimates with strong trading performance.

- WFC: EPS beat, supported by NII and NIM upside despite slightly weaker revenue.

- BLK: Earnings beat on inflows and accelerating client activity.

- PEP: Reportedly in talks to take a minority stake in Haldiram Snacks.

- DE: FTC preparing a lawsuit over competition concerns in agricultural equipment repair practices.

- APD: Preannounced slightly better-than-expected fiscal Q1 results.

- BIIB: CEO stated no immediate need for acquisitions.

- DLO: CEO confirmed the company was approached for a buyout last year but declined due to a lack of interest in selling.

- APLD: Reported an earnings beat but provided no updates on lease timing.

US equities ended mostly higher on Tuesday, with the Dow up 0.52%, S&P 500 gaining 0.11%, Nasdaq down 0.23%, and Russell 2000 rising 1.13%. The S&P 500 slightly extended Monday’s gains, while the Nasdaq continued to lag. Breadth was positive, supported by strength in cyclicals and value stocks. Outperformers included airlines, autos, homebuilders, machinery, banks, oil services, and diversified chemicals, while big tech, semiconductors, pharma, and biotech underperformed. Treasuries were mixed with some curve steepening, and the 30-year yield briefly surpassed 5%. The dollar fell 0.7%, gold edged up 0.1%, Bitcoin futures rose 3.3%, and WTI crude declined 1.2% following a recent rally.

Market sentiment was shaped by cooler-than-expected core PPI data, easing inflation concerns. Reports of a gradual implementation of Trump tariffs and improved small business optimism further boosted value and cyclical stocks. However, uncertainty around Trump 2.0 legislation, stretched valuations, and weak guidance from key healthcare players weighed on some sectors.

Company-Specific News by GICS Sector:

Energy:

- SLB (-1.2%): Reportedly under pressure from US lawmakers to withdraw from Russia amid new sanctions.

Materials:

- OLN (+3.2%): Noted strong FCF yield and insulation from trade policy risks. Upgraded to buy at BofA, citing strong free cash flow and limited exposure to potential trade policy risks.

Industrials:

- URI (+5.9%): Announced the acquisition of HEES (+105.5%) for $3.4B in cash, a deal expected to be accretive to EPS and FCF within the first year.

- PCAR (+1.9%): Upgraded to buy at BofA, citing stabilization in truck markets and improving customer demand.

Consumer Discretionary:

- KBH (+4.8%): Q4 EPS beat expectations; FY25 guidance flagged buyer hesitancy but noted better-than-expected margins.

- SIG (-21.7%): Lowered Q4 revenue and comps guidance, citing weaker peak holiday sales.

- LVS (-4.0%): Downgraded to equal weight at Morgan Stanley, reflecting concerns over China’s economic outlook and Singapore growth trends.

Consumer Staples:

- ADM (-1.8%): Downgraded to underperform at BofA due to trade policy risks and biofuel uncertainty.

Healthcare:

- LLY (-6.6%): Lowered Q4 revenue guidance due to slower GLP-1 market acceleration and inventory issues.

- CRL (-6.3%): Provided weak FY25 revenue guidance, citing constrained spending by global biopharma clients.

- TGTX (+7.5%): Reported stronger-than-expected product revenue driven by Briumvi’s performance.

Technology:

- FTNT (-1.4%): Downgraded to market perform at Raymond James, citing valuation concerns and potential slowdown in network security growth.

Utilities:

- BCE (-2.9%): Downgraded to underperform at BofA due to high leverage and dividend sustainability concerns.

Eco Data Releases | Wednesday January 15, 2025

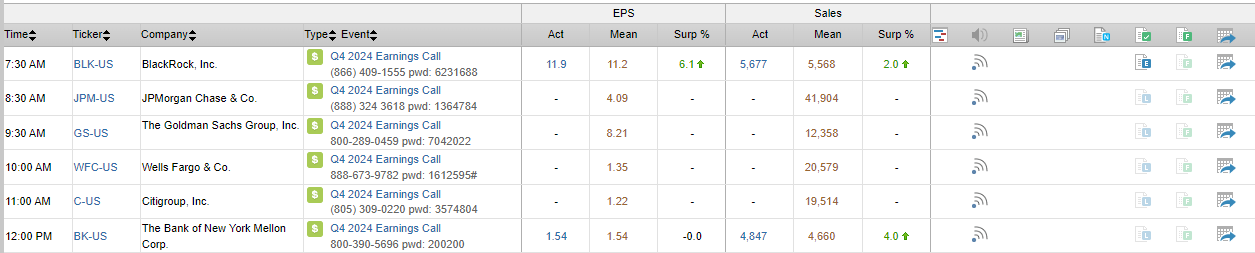

S&P 500 Constituent Earnings Announcements | Wednesday January 15, 2025

Data sourced from FactSet Research Systems Inc.