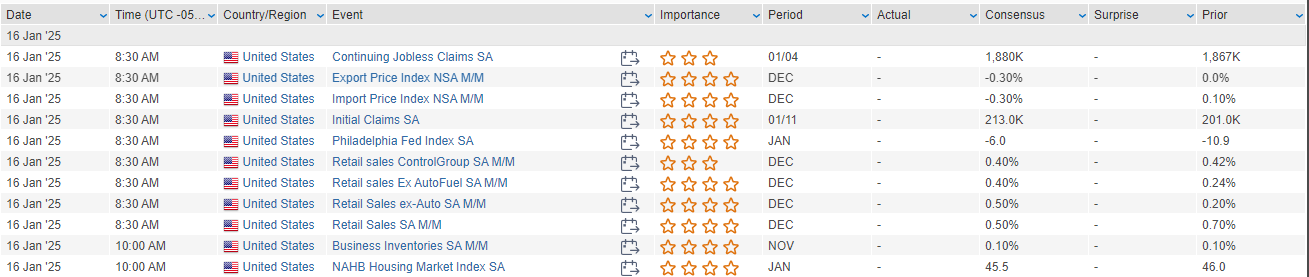

S&P futures up 0.3% Thursday morning after a strong rally Wednesday, with the S&P, Nasdaq, and R2K posting their best sessions since November 2016. Big tech, banks, builders, semis, and software led gains, supported by cooler inflation data and strong bank earnings. Asian and European markets traded higher overnight, with notable strength in Taiwan, Australia, and South Korea. Treasuries mostly weaker with curve flattening. Dollar index steady; yen firmer on BoJ rate hike speculation. Gold rose 0.8%. Bitcoin futures down 0.4%. WTI crude flat. Improved risk sentiment driven by inflation data, easing rate concerns, and positive NII guidance from banks. Focus on retail sales and Bessent confirmation hearing for updates on Trump 2.0 policies, especially tariffs. Retail sales, Philly Fed manufacturing, initial claims, and homebuilder sentiment reports expected today. December retail sales seen up 0.6% m/m; core control group expected to rise 0.4%. Treasury Secretary nominee Bessent emphasized tax cuts and maintaining dollar reserve status in prepared testimony. Trump reportedly considering an executive order to delay TikTok restrictions.

Notable Corporate Updates:

- TSM: Q4 profit beat expectations; Q1 and capex guidance ahead with strong AI commentary.

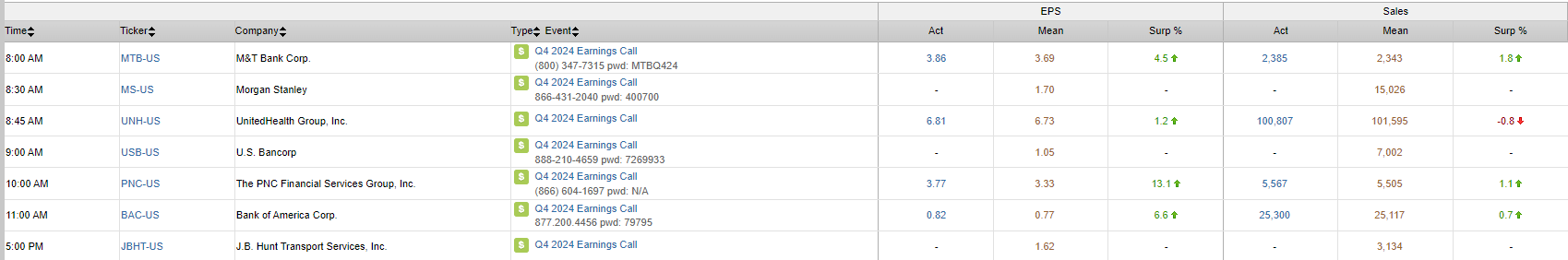

- UNH: EPS beat; revenue and MCR missed, but 2025 outlook reaffirmed.

- TGT: Raised Q4 comp guidance.

- DD: Accelerating Electronics business separation; Water business separation canceled.

- FUL: Q4 missed; FY25 midpoint EPS guidance below expectations.

- SEZL: Raised FY24 revenue and EPS guidance on strong holiday demand.

- CNXC: Q4 beat; FY25 guidance light.

US equities closed sharply higher on Wednesday, with the Dow up 1.65%, the S&P 500 rising 1.83%, the Nasdaq gaining 2.45%, and the Russell 2000 climbing 1.99%. Major indices logged their best sessions since the day after Trump’s 2016 election, buoyed by a broad rally driven by improved inflation sentiment. Big tech led gains, while small caps and commodity equities also outperformed. Treasuries rallied across the curve, pushing yields lower, with the 30-year experiencing its largest daily yield drop in two months. The dollar index fell 0.2%, gold rose 1.3%, Bitcoin futures increased 3.1% to approach $100K, and WTI crude gained 3.1%, nearly erasing Tuesday’s losses.

The rally was supported by a softer-than-expected December core CPI reading, which eased inflation concerns and led to a pullback in Treasury yields and dollar strength. Bank earnings provided another boost, with several financial institutions delivering positive 2025 NII guidance. However, lingering uncertainties around Trump 2.0 policies, including potential tariffs and fiscal policies, remain a concern for market participants.

Economic Data:

- CPI: December headline CPI rose 0.4% m/m, slightly above consensus, while core CPI increased 0.2% m/m, a touch below expectations. The y/y core inflation rate remained at +3.3%.

- NY Empire Manufacturing: Missed expectations, with significant declines in new orders and shipments, though optimism improved.

- Fed Beige Book: Highlighted slight to modest economic growth, with more businesses optimistic about 2025.

- Fedspeak: Richmond Fed’s Barkin expressed confidence in inflation moving toward the 2% target, while Kashkari noted potential tariff impacts on inflation.

Company-Specific News:

Financials:

- JPM: Beat expectations with standout trading results; guided 2025 NII above consensus.

- WFC: EPS beat with stronger-than-expected NIM, NII, and 2025 guidance for modest NII growth.

- GS: Reported solid Q4 earnings with FICC, equities, and asset/wealth management exceeding expectations.

- C: Q4 EPS and revenue beat; announced a $20B stock repurchase program; investment banking revenue rose 35% y/y.

- BLK: Q4 earnings and revenue beat; strong inflows and improved flow momentum cited as positives.

Health Care:

- ISRG: Guided Q4 revenue above estimates, citing strong procedure volumes and customer trends.

- VCEL: Lowered Q4 revenue guidance and cut FY24 revenue expectations but expressed optimism about growth in 2025.

Information Technology:

- QBTS: Rallied 22.4% following Microsoft’s blog highlighting increased focus on quantum computing development.

- PI: Reaffirmed Q4 guidance, with revenue in line but adjusted EBITDA slightly below estimates.

Comm. Services:

- PARA: Fell 2.2% on reports of potential CFIUS scrutiny over its merger with Skydance Media due to Tencent’s involvement.

Materials:

- CVGW: Q4 revenue exceeded expectations, but EPS missed due to higher incentive compensation and fruit input costs.

- APD: Preannounced slightly better-than-expected fiscal Q1 results

Industrials:

- BECN: Acquisition proposal boosted shares by 7.7%. Received an $11B acquisition proposal from QXO, representing a 37% premium to its 90-day VWAP.

Eco Data Releases | Thursday January 16, 2025

S&P 500 Constituent Earnings Announcements | Thursday January 16, 2025

Data sourced from FactSet Research Systems Inc.