February 14, 2025

S&P futures are down 0.2% after a strong Thursday session, with European markets mixed and Asian markets mostly higher. Treasuries are mixed with a steeper yield curve, while the dollar index is down 0.3%, marking its fourth weekly decline in five weeks. Gold is up 0.3%, Bitcoin futures are up 0.6%, and WTI crude has gained 0.7%, on track for a modest weekly rise.

Markets remain focused on Trump’s tariff plans, with optimism around delayed implementation and potential negotiations (as India’s Modi announced he would engage in). Analysts see limited impact from firmer January CPI and PPI categories on core PCE. Rate-cut expectations have been pushed to the second half of the year, but Powell’s testimony did not unsettle markets. Other bullish themes include Ukraine ceasefire hopes, GOP legislative progress, strong earnings, and retail dip buying.

Today’s key economic data includes January retail sales (expected to show a slight decline after December’s strong reading), import/export prices, and industrial production. Dallas Fed’s Logan is set to speak this afternoon. The Munich Security Conference may provide insights into Ukraine peace talks, though Russia is not attending

U.S. equities closed higher on Thursday, with the Dow Jones up 0.77%, S&P 500 up 1.04%, Nasdaq climbing 1.50%, and the Russell 2000 advancing 1.17%. Stocks rebounded from Wednesday’s losses, with the S&P 500 and Nasdaq on track for solid weekly gains. Treasuries firmed as the yield curve flattened, following a sharp increase in rates earlier in the week. The dollar index declined by 0.8%, while gold gained 0.6%. Bitcoin futures dropped 1.1%, and WTI crude settled just 0.1% lower after recovering from its intraday lows.

Market sentiment improved after former President Trump announced a reciprocal tariff plan. The proposal, which targets value-added taxes, subsidies, regulations, and currency manipulation as tariff equivalents, will be assessed on a country-by-country basis. Tariffs could be implemented as early as April 2 following Commerce Department studies set for release on April 1. Markets reacted positively to the delayed implementation timeline and potential negotiation opportunities.

January’s headline Producer Price Index (PPI) exceeded consensus estimates due to higher food and energy costs, while core PPI was in line with expectations at 0.3%. However, December’s core PPI was revised upward from 0.0% to 0.4%, and annualized core PPI came in at 3.6% year-over-year, surpassing the expected 3.3%. Final demand goods rose 0.6% month-over-month for the fourth consecutive month, reversing the 2024 trend of services outpacing goods inflation. Despite a hotter-than-expected January Consumer Price Index (CPI) earlier in the week, markets saw a slight relief rally on Thursday. The first expected Fed rate cut has now been pushed to October, following a reassessment of the central bank’s monetary policy path.

Labor market data remained resilient, with initial jobless claims for the week ending February 8 coming in at 213,000, slightly below the 215,000 consensus. Continuing claims also fell to 1.850 million, below the expected 1.881 million.

In fixed income, a $25 billion auction of 30-year bonds tailed by 1.2 basis points, rounding out a $125 billion issuance week. This followed a weaker-than-expected 10-year auction on Wednesday, which also tailed by more than one basis point.

GICS Sector Performance & Company News:

Information Technology (+1.52%)

- Cisco Systems (CSCO) +2.1%: Strong fiscal Q2 results, with AI traction, 30% growth in product orders, and increased FY25 revenue guidance.

- Arm Holdings (ARM) +6.1%: Meta reportedly the first customer under its new chip project.

- Datadog (DDOG) -8.2%: Beat on earnings but issued weak guidance for Q1 and FY25 due to ongoing sales and marketing investments.

Consumer Discretionary (+1.60%)

- Tesla (TSLA) +5.9%: State Department procurement forecast initially included a $400 million budget for Armored Teslas, later revised to remove mention of Tesla.

- Crocs (CROX) +23.9%: Strong Q4 results and FY25 guidance; share repurchase authorization of $1.3 billion.

- Dutch Bros (BROS) +29.1%: Q4 same-store sales exceeded expectations, driven by traffic and transaction growth.

- Hyatt Hotels (H) -9.1%: Weak Q4 EBITDA and EPS; FY25 guidance disappointed.

Communication Services (+1.08%)

- Meta Platforms (META): Achieved its 19th consecutive daily gain.

- Robinhood (HOOD) +14.1%: Blowout Q4 results, strong January metrics, and positive margin trends.

- Reddit (RDDT) -5.3%: Mixed Q4 results; DAUs missed due to Google algorithm changes but showed signs of recovery.

- Trade Desk (TTD) -33%: Q4 revenue miss, execution missteps, and weak guidance led to a significant drop.

Financials (+0.72%)

- Moody’s (MCO): FY25 guidance well received.

- Goldman Sachs (GS), JPMorgan Chase (JPM), and other large banks lagged.

Health Care (+0.40%)

- GE HealthCare (GEHC) +8.8%: Q4 sales in line, EPS exceeded expectations, and guidance factored in U.S. tariffs on Chinese products.

- Zoetis (ZTS) -5.2%: Weak FY25 guidance, disappointing results from its Librela product.

- West Pharmaceutical Services (WST) -38.2%: Weak contract manufacturing results; FY25 guidance below expectations.

Industrials (+0.09%)

- Deere & Co. (DE) -2.2%: Weak Q1 sales but EPS beat on tax benefits; inventory reduction remains a headwind.

- GXO Logistics (GXO) -15.1%: Q4 revenue beat but issued disappointing FY25 guidance.

Materials (+1.71%)

- Copper and containerboard stocks performed well.

Energy (+0.77%)

- Sector underperformed despite WTI crude stabilizing.

Real Estate (+0.84%)

- Equinix (EQIX): Q4 results and 2025 guidance fell short of expectations.

Consumer Staples (+0.97%)

- Molson Coors (TAP) +9.5%: Q4 earnings beat, strong EMEA and APAC performance, and robust FY25 guidance.

- Hanesbrands (HBI) -18.5%: Q4 revenue missed expectations; CEO departure and decision to discontinue Champion Japan raised concerns.

Utilities (+0.14%)

Eco Data Releases | Friday February 14th, 2025

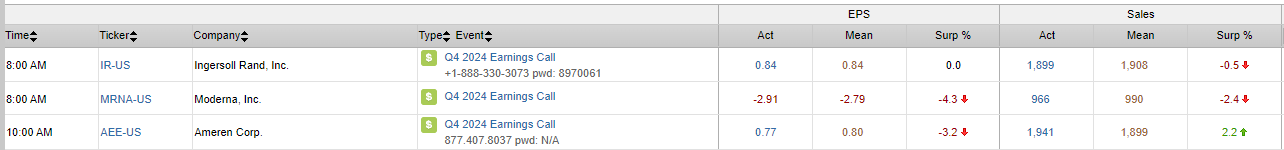

S&P 500 Constituent Earnings Announcements | Friday February 14th, 2025

Data sourced from FactSet Research Systems Inc.