July 27, 2025

The Bull remains in control of the tape as July winds down. A series of new all-time high prints for the S&P 500 (chart below) and the Nasdaq have printed. Our oscillators studies (chart, panes 2 and 3) have hit highs for the past 12-months as well, registering an overbought condition on the index. We’ve mentioned the calendar is progressing towards the softer seasonal period of the year between August and mid-October. Over the past 10 years, the S&P 500 has averaged returning -0.6% over those 3-months, the softest result of any 3-month period.

While the implications of overbought conditions and weak seasonals are somewhat obvious, there are mitigating circumstances that need to be considered. First, overbought readings are at 52-week highs, meaning there is no negative momentum divergence present. This means any near-term weakness from the seasonal pattern, or from profit-taking, should likely be accumulated as buyer enthusiasm is strong and growing. On way we measure this is by market internal strength. The chart below shows the % of S&P 500 constituents above their 50-day and 200-day moving averages in panel 2. Regular readers know that an uptrend with those series rising is a bullish development and shows the trend is healthy and likely to continue.

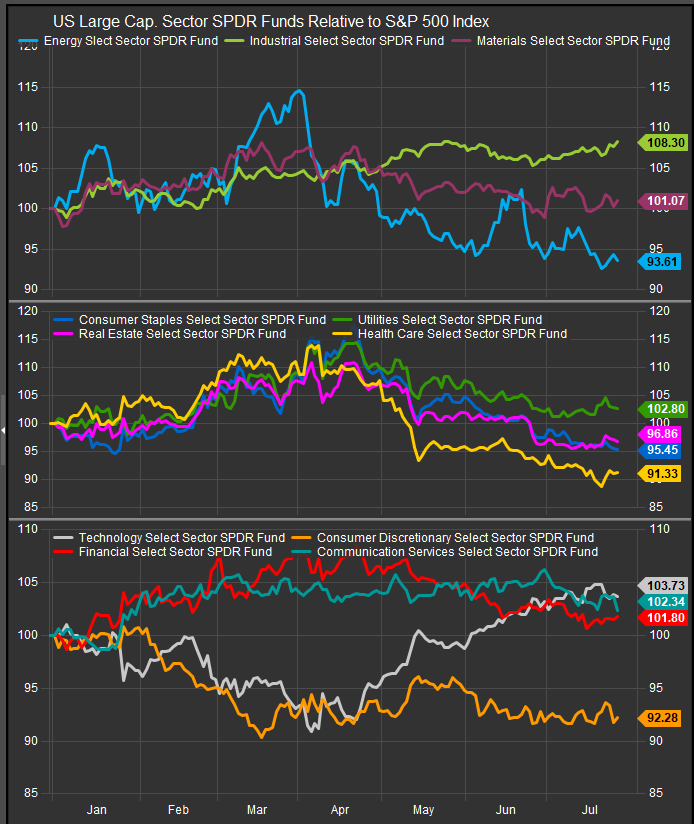

At the sector level (chart below), Industrial stocks have been a YTD winner, adding 8% above the S&P 500 return since the beginning of 2025. Technology shares have also traded into positive territory after a big correction into early April. Since equities pivoted higher, low vol. sectors have retraced YTD gains and sit at near-term lows for 2025. Recent price action has been in their favor. Cyclical growth sectors (bottom panel) have been a mixed bag since equities have pivoted. Tech stocks have led off the low while Discretionary stocks haven’t acted well, and Comm. Services stocks have shown some weakness in the near-term. This sets up an interesting call on sector positioning for August. Do we play the seasonal probability for profit-taking, or do we continue to follow the uptrend?

While the inputs to our Elev8 model will ultimately decide positioning, a big part of the decision revolves around how to think about NVDA and the semiconductor complex that is driving this bull market. NVDA (chart below) remains the key stock of the bull market. It recently broke out to all-time highs, and we have a price target near $220 on the stock at present. NVDA also reports Q2 earnings at the end of August, so monthly rebalance strategies will need to contend with that potentially market moving event.

Semiconductors in general have been revitalized since the bullish pivot for equities. It started slowly, with just NVDA and AVGO holding up the complex, but we’ve seen some signs of broader improvement. The Sox Index (chart below) is in a clear bullish reversal in both absolute terms and relative to the S&P 500.

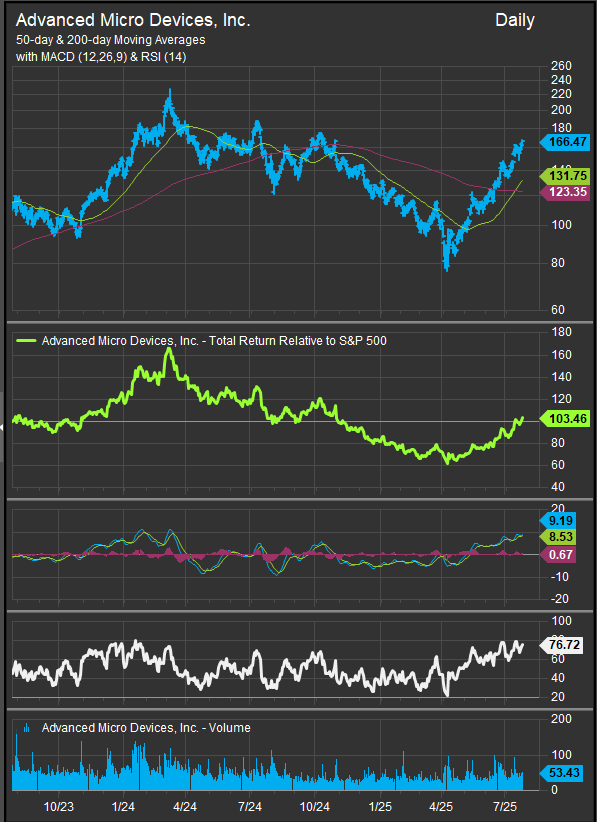

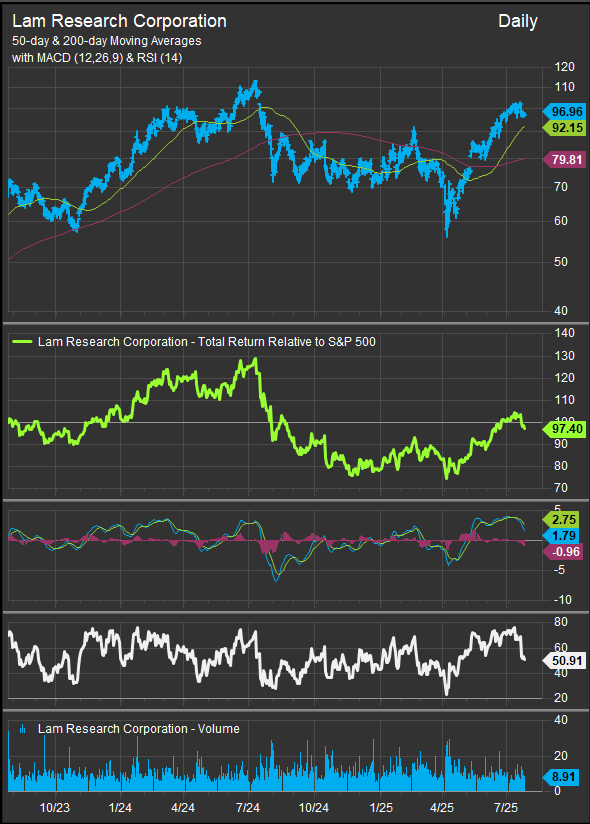

Many large cap. names have been acting well beyond the AI specialty names. AMD, LRCX, MU, ON, KLAC for example are all in bullish reversal structures while smaller names like SMTC, ALGM and MTSI are also in recovery.

AMD

LRCX

ALGM

MTSI

We’d also note that Taiwan Semiconductor AND Foxconn Industrial Internet co. (charts below) have been bid since the equity market low. The takeaway here is that tariffs are not only a potential headwind due to higher prices, but also a potential source of new demand as the global supply chain will need to be built out in duplicate as long as US/China tensions bifurcate global trade.

TSM

Foxconn

With strength in semiconductors and equities in general balanced out by overbought conditions and seasonal weakness, we advise that investors may want to take some risk exposure off the table but need to respect the bull’s ability to attract the FOMO investor, particularly as the world’s most important stock reports at the end of August. While we think its appropriate to add some lower vol. exposure on oversold conditions, we would keep our Tech sector exposure near or just above market weight, given the strength of the trend. If prices came in over the last week of July, we’d feel even better about maintaining tech sector exposure into August.

Patrick Torbert, Editor & Chief Strategist, ETFSector.com

Data sourced from FactSet Research Systems Inc.