August 6, 2025

S&P futures +0.3%, following a quiet Tuesday where equities finished mostly lower on soft economic data. Tech lagged, while small caps, managed care, regional banks, airlines, and homebuilders outperformed.

Overnight, Asian markets were mostly higher with Japan, China, Australia, and Singapore all posting gains. Europe is modestly green, up ~0.2%. Treasuries weaker, with back-end yields up 3–4 bp ahead of today’s $42B 10-year auction. Dollar flat, gold -0.5%, Bitcoin +0.4%, and WTI crude +1.5% after early-week pressure.

Market tone remains cautious with few fresh macro drivers. While concerns persist around the labor market slowdown, tariff impacts, and structural yield pressures, bullish narratives continue to cite strong Q2 earnings, positive guidance, the AI growth theme, rising buybacks, M&A momentum, and expectations for Fed rate cuts. The buy-the-dip narrative is also gaining attention amid increasingly bearish strategist calls.

No major economic releases today, but Fed speakers (Cook, Collins, Daly) are on deck. Daly reiterated dovish views earlier this week. Thursday brings productivity, labor costs, jobless claims, inflation expectations, and a $25B 30-year bond auction.

Notable Earnings

- AMD: Data Center in line, EPS light; China uncertainty lingers, but MI350 ramp seen as a tailwind.

- ANET: Beat with strong AI and enterprise demand; cloud refresh traction noted.

- SMCI –: Dropped sharply after earnings miss and soft guidance.

- TOST: Beat and raised guidance; concerns around softer take rate and rich valuation.

- ALAB +: Surged on strong Q2 and upbeat Q3 guidance.

- SWKS: Outperformed on strong iPhone demand.

- SNAP –: Declined on demand-reduction (DR) ad headwinds.

- UPST: Beat and guided up, though investor expectations were already high.

- CRUS: Beat and raised; positive iPhone momentum cited.

- AMGN: Beat across the board; raised FY guidance.

- DVA: Beat, but concerns linger on treatment volume growth.

- RIVN –: Missed on EBITDA, cut FY production outlook.

- IFF: Rose on announced buyback and asset sales.

- MOS –: Pressured after softer EBITDA results.

- CC: Beat, but cautious Q3 guide due to operational headwinds.

- OpenAI: Reportedly in talks for a $500B valuation share sale.

- DIS: Will give NFL a 10% stake in ESPN in exchange for access to league’s TV channels.

U.S. equities slipped Tuesday (Dow -0.14%, S&P 500 -0.49%, Nasdaq -0.65%, Russell 2000 +0.60%), giving back a portion of Monday’s rally amid a lack of fresh catalysts and a disappointing July ISM services report. Most major indexes ended lower, led by weakness in tech, while small-caps and retail investor favorites bucked the trend to close higher. Treasuries were mixed with a flattening curve. The dollar index was flat, gold rose 0.2%, Bitcoin futures fell 1.2%, and WTI crude dropped 1.7%, extending its decline following OPEC+ production-cut unwinding.

The July ISM Services Index fell to 50.1 (vs. consensus 51.3), down from 50.8 in June, with declines in new orders and employment, while prices paid spiked to their highest level since October 2022 (69.9). Respondents flagged widespread tariff-related cost pressures, business delays, and lack of clarity impacting capital decisions. In contrast, the S&P Global Services PMI rose to a seven-month high of 55.7, supported by new business strength, though input cost inflation also accelerated.

Other data included a narrower-than-expected June trade deficit, the smallest since September 2023. Meanwhile, a $58B 3-year Treasury auction tailed 0.7 bp, though bid-to-cover ratios improved. Looking ahead, Fed speakers (Cook, Collins, Daly) are on deck Wednesday alongside a $42B 10-year auction. Thursday brings productivity, labor costs, jobless claims, inflation expectations, and a $25B 30-year auction. President Trump, in a CNBC interview, teased new pharma and semi tariffs, ongoing talks with China, and ruled out John Bessent as a Fed chair candidate.

With nearly 75% of S&P 500 companies having reported Q2 results, blended earnings growth is now 10.3% vs. the 4.9% expected at the start of the quarter. Around 82% of companies have beaten estimates, with earnings surprising to the upside by nearly 8%.

Sector Summary

Information Technology (S&P -0.91%)

- PLTR +7.9%: Beat and raised; revenue up 48% y/y; strong U.S. commercial and government growth; positive commentary on AI momentum and margin expansion.

- LSCC +15.2%: Results in line; upbeat tone on backlog, inventory normalization, and AI server traction.

- IT -27.6%: Beat on Q2, but trimmed full-year revenue and EBITDA guidance; flagged continued selling pressure in research.

- TDG -11.9%: Missed on earnings and revenue; OEM sales weakness led to lowered FY revenue outlook.

- ZBRA -11.4%: Q2 beat but underwhelming Q3 outlook and acquisition of Elo Touch Solutions raised concerns.

- GFS -9.3%: Beat, but cautious Q3 guide due to weak consumer-related end markets.

Communication Services (S&P -0.88%)

- SBAC -4.9%: Beat and raised FY guide; positive tone, but noted delays in domestic leasing pickup.

Consumer Discretionary (S&P +0.29%)

- AXON +16.4%: Strong beat across the board; raised FY guide; highlighted momentum across product lines.

- CMI +3.2%: Beat on earnings and EBITDA; cited disciplined cost control; declined to reinstate full-year guidance.

- FOUR -15.4%: EPS miss and weak volume; CFO retirement flagged; raised FY guide.

- YUM -5.1%: Missed on comps and margins; Taco Bell and KFC underperformed.

Consumer Staples (S&P -0.16%)

- EPC -18.8%: Organic growth -4.2%; Sun & Skin category weak; blamed tariffs and FX for challenging outlook.

- PFE +5.2%: Beat and raised FY EPS guidance; strength in commercial portfolio and cost-cutting progress highlighted.

Health Care (S&P +0.39%)

- VRTX -20.6%: Beat on revenue and EPS, but pain trial discontinuation and weak Trikafta/Kaftrio weighed heavily.

- HIMS -12.4%: Beat on EPS, but light Q3 guide and subscriber slowdown; transition away from 503B GLP-1 flagged.

- STAA +46.1%: Agreed to be acquired by ALC for $1.5B, a 51% premium.

- LDOS +7.5%: Beat with strength in Health and Civil segments; raised FY EPS and margin guide.

- HSIC -7.4%: Revenue beat, EPS miss; concerns on back-end weighted guidance and GM softness.

Financials (S&P +0.40%)

- APO +2.5%: Beat on EPS; fee and spread-related earnings strong; $61B in total fundraising cheered.

Industrials (S&P -0.22%)

- ETN -7.4%: Beat and raised FY EPS guidance slightly, but Q3 outlook underwhelmed.

- BWXT +17.8%: Strong quarter; raised FY guidance; highlighted nuclear growth leverage and record backlog.

Materials (S&P +0.80%)

- DD +: Beat and raised; electronics segment highlighted as a standout performer.

Energy (S&P +0.11%)

- FANG -1.4%: Beat and raised FY production guide; lowered capex again; investors cautious on lower oil mix.

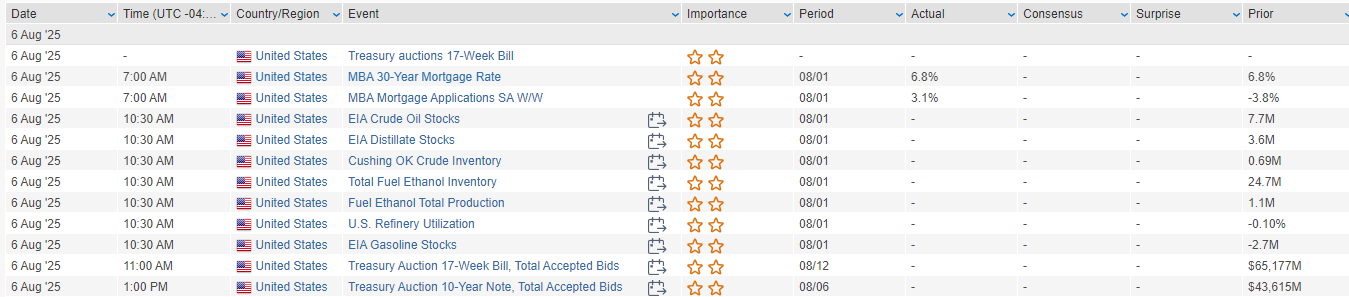

Eco Data Releases | Wednesday August 6th, 2025

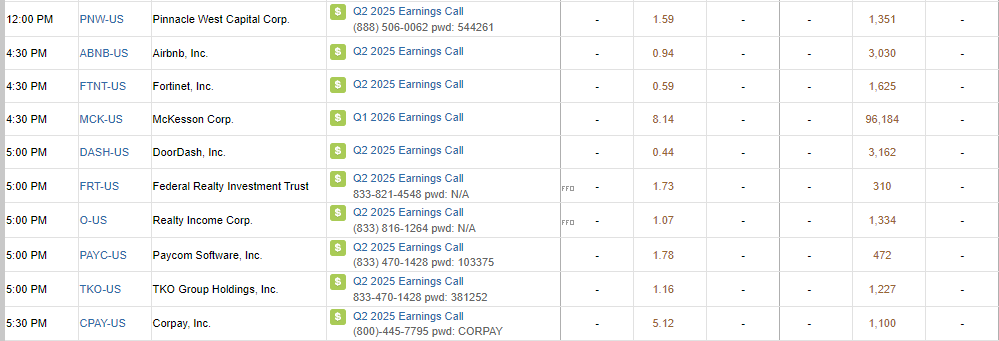

S&P 500 Constituent Earnings Announcements | Wednesday August 6th, 2025

Data sourced from FactSet Research Systems Inc.