August 10, 2025

Equities continue to shrug off challenges from escalating tariffs, wars in Ukraine and the Middle East, a rate-locked housing market and a sluggish economy. AI is living up to expectations as companies like Palantir synergize impressive results from AI and its data collection software. Semiconductor stocks are retesting highs. Mag7 stocks have rebounded sharply. But where is the average stock? Our concern with the bull trend is a lack of diversity in the types of businesses that are getting ahead. We are seeing the Mega Cap. Growers continue to be favored, the AI complex enthusiastically bought, but beyond that, what compels our enthusiasm as investors?

The S&P 500 (chart below) sits near all-time highs. The latest round of saber-rattling on trade took it down 2% for two days. What concerns us is the second panel on the chart below. The percentage of stocks above their 50-day and 200-day moving average is slipping. While we understand that certain business lines are likely becoming outmoded in the new technology paradigm, it’s concerning when investment becomes concentrated in just one or two sectors.

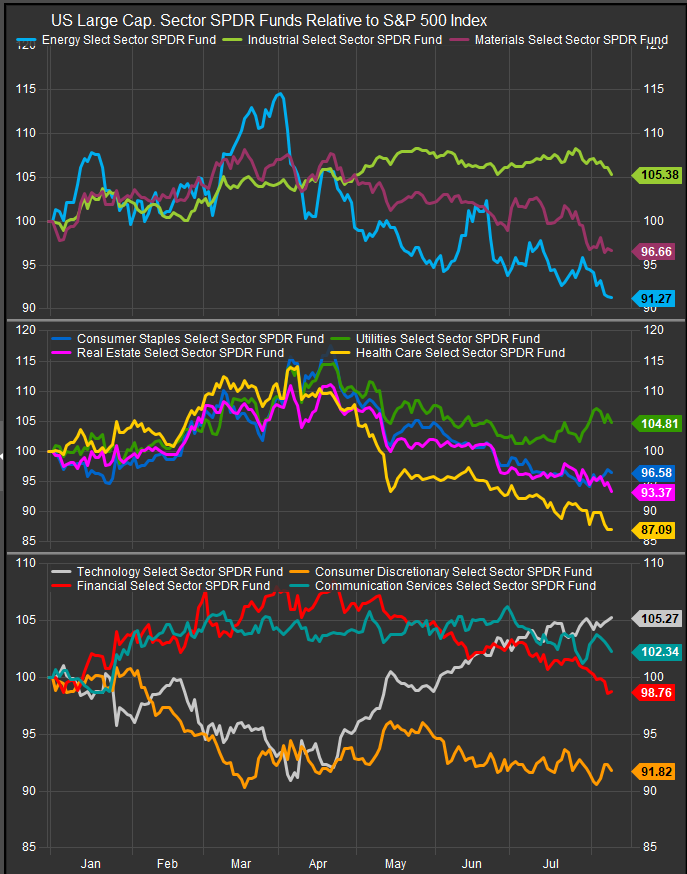

When we look at our sector performance chart (below), we can see year-to-date performance led by Technology stocks, resurgent after their Q1 correction. Industrials and Utilities have outperformed, but Financials and Comm. Services stocks have shown weakness despite the S&P 500 out to new cycle highs in July.

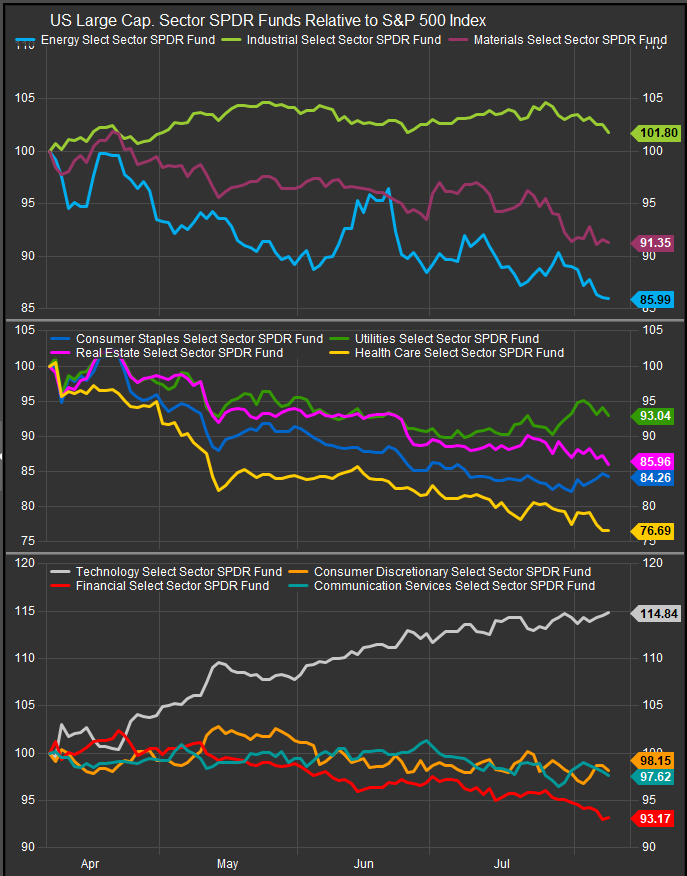

When considering sector performance off the April 7, 2025, low for the S&P 500 (chart below), the conundrum of higher index level prices and narrow upside participation becomes clear. More than 90% of the excess returns accrue to the Tech. Sector since the market low. The Industrial Sector is the only other rea above the market. And even there, we are seeing gains concentrated in 3 of the 11 industries within the sector.

Which themes can bolster the market to new heights? Or will we be repeating last year’s waiting game with the Federal Reserve. Will a dovish intervention bring mortgage rates down and unlock the housing market? How are we getting affordability out of 20% price hikes on this and 50% on that?

From our view, we think rates hold the key. The US consumer is facing headwinds with high mortgage rates, and lackluster home affordability large among them. When considering the 10yr chart (below), one can at least say the yield has spent more time at the bottom of its 1yr range than the top. Last year’s discounting took the yield to 3.6% only to see inflationary scenarios start to get priced in almost immediately. Since then, 4.1-4.2% has become the pivot point. We think the 10yr Yield needs to move lower to give the consumer new life.

Homebuilding has been one of our barometers and is at potential pivot. As we mentioned at the beginning of our letter, we like the stock level to help us see what’s happening. On the promising side, here’s DHI (chart below). A textbook bullish reversal forming with some near-term outperformance.

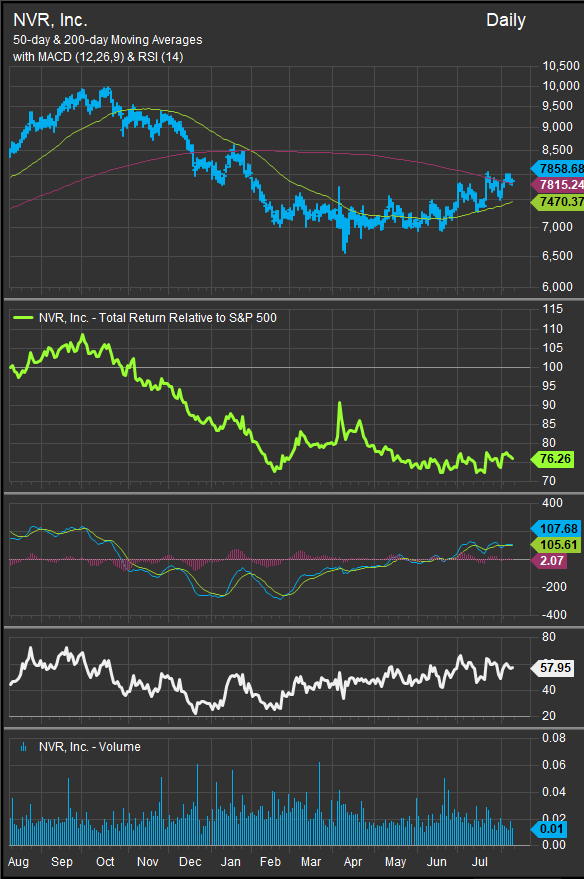

On the other hand, we have NVR (chart below) which is having trouble turning the corner.

LOW is promising in the near-term, but now faces a potential pivot point just shy of overbought conditions. LOW (and its foil HD) have been emblematic of a sagging consumer. These don’t have to be the stocks that reinvigorate the trend, but our point remains, it needs to come from somewhere.

As the bull trend continues to mature, investors need to consider in broad terms the health of the underlying trend. AI Investment is a motivating theme of this bull market over the long-term, but other stock level themes need to bolster the trend. Put another way, if it’s only AI stocks that are pulling the market higher, we may have a sustainability issue. Whether its housing as we’ve touched on here, expanding alternative energy, regional infrastructure, fintech credit expansion or other, breadth of stock level participation is a key indicator of trend health. Our patient needs could use some exercise and a few vitamins to go along with all the Artificial Intelligence its been ingesting.

Patrick Torbert, Editor & Chief Strategist, ETFSector.com

Data sourced from FactSet Research Systems Inc.