November 4, 2025

S&P futures -1.0% in early Tuesday trading after U.S. equities ended mixed Monday, with narrow breadth again the dominant theme — over 60% of S&P 500 components declined even as Big Tech outperformed on AI partnership headlines.

Overseas markets are weaker: Asia saw sharp declines (South Korea -2.5%, Japan -1.7%) and Europe opened down ~1.8%. Treasuries are firmer across the curve (yields -2 bp), while the dollar index +0.1%, gold -0.3%, Bitcoin -3%, and WTI crude -1.6% in early trading.

The risk-off tone reflects growing valuation concerns, amplified by Wall Street CEO comments from the Hong Kong summit and a post-earnings pullback in Palantir (PLTR) despite strong results and guidance. Investors also cite a less dovish Fed, softening labor data, cautious consumer trends, and private-credit stress as ongoing headwinds. Still, prior dips tied to AI scrutiny and valuation fears have proven shallow amid strong retail inflows, favorable seasonality, and corporate buyback activity.

No major U.S. economic data today, with Fed Governor Bowman the lone scheduled speaker. The calendar turns busy Wednesday with the Treasury refunding announcement, Supreme Court IEEPA arguments, and key data including ADP private payrolls and ISM Services. Thursday features a heavy Fed lineup (Williams, Barr, Hammack, Waller, Paulson, Musalem), followed by University of Michigan sentiment and inflation expectations Friday alongside remarks from Williams, Jefferson, and Miran.

Stock Highlights:

- PLTR – Pulling back post-earnings despite strong U.S. Commercial growth.

- Laggards: VRTX, BWXT, LSCC, HALO, IAC.

- Gainers: CLX, FN, EXAS, SANM, UPWK, GT.

- Corporate news: Norway’s wealth fund to vote against Tesla CEO Musk’s $1T pay package; Starbucks (SBUX) selling a minority China stake for $4B; Netflix (NFLX) exploring video podcast licensing via iHeartMedia; Denny’s (DENN) to be taken private in a $620M deal.

U.S. equities were mixed on Monday (Dow -0.48% | S&P 500 +0.17% | Nasdaq +0.46% | Russell 2000 -0.33%) as markets digested a weaker manufacturing report, hawkish Fed commentary, and another wave of AI-related corporate news. The S&P 500 and Nasdaq both finished modestly higher, extending their multi-week winning streaks, though market breadth was negative for the fourth time in five sessions, with the equal-weighted S&P underperforming by about 40 bps.

The October ISM Manufacturing Index declined to 48.7 (consensus 49.6), marking the eighth straight month of contraction. While the headline missed expectations, new orders (49.4) and employment (46.0) improved sequentially, and prices paid (58.0) fell to the lowest since January — signaling disinflation within goods-producing sectors. Analyst commentary pointed to stabilization but emphasized that growth outside of the data-center ecosystem remains constrained.

Federal Reserve officials continued to stress caution around rate cuts. Governor Miran said policy remains “too restrictive,” Chicago’s Goolsbee noted the bar for a December cut “is higher,” and San Francisco’s Daly reiterated the need for a “slightly restrictive” stance given tariff-related inflation risks. Governor Cook added that the Fed is not on a pre-determined path but will act “forcefully” if trade and job market dynamics warrant it. Fed funds futures now imply ~65% odds of a December cut, down from ~70% last week, and ~68 bps of total cuts in 2026, versus ~75 bps prior.

The Treasury Department reduced its Q4 borrowing estimate to $569B, down $21B from July, and projected $578B for Q1-26. Yields were flat to slightly higher (+1 bp at the long end), the Dollar Index rose 0.1%, gold gained 0.4%, and WTI crude edged 0.4% higher following a routine OPEC+ update. Bitcoin futures dropped 3%.

Sector Performance

Leadership remained concentrated in large-cap growth, with Consumer Discretionary (+1.70%) and Technology (+0.39%) driving most of the day’s gains. Defensive pockets such as Utilities (+0.06%) and Health Care (+0.13%) were modestly positive, while cyclicals — Materials (-0.56%), Industrials (-0.42%), and Financials (-0.43%) — lagged. Consumer Staples (-0.47%) underperformed sharply due to M&A-driven weakness in Kimberly-Clark, and Communication Services (-0.32%) declined on weakness in media and China tech. The persistent gap between mega-cap leaders and equal-weighted benchmarks underscores continued concentration risk in the index.

Sector Highlights

Information Technology (XLK | +0.39%)

- Amazon (AMZN +4%) signed a $38B multiyear compute deal with OpenAI, granting access to AWS data centers and Nvidia chips.

- Micron (MU +4.9%) rose after reports that Samsung and SK Hynix delayed DDR5 pricing, driving a 25% spike in spot memory prices.

- Cisco (CSCO +1.8%) upgraded to Buy at UBS, citing a multiyear AI infrastructure growth cycle.

- Alphabet (GOOGL) steady as it plans to issue $22B in bonds across the U.S. and Europe to finance AI investments.

Consumer Discretionary (XLY | +1.70%)

- Amazon’s strength buoyed the group and broader retail complex.

- Airlines, hotels, and auto suppliers gained on resilient travel and discretionary demand despite tariff headwinds.

- Positive read-through from credit card data and early holiday spending trends supported sentiment.

Consumer Staples (XLP | -0.47%)

- Kimberly-Clark (KMB -14.6%) fell sharply after announcing the $48.7B cash-and-stock acquisition of Kenvue (KVUE +12.3%), a 46% premium deal with expected $1.9B in cost synergies and $500M in incremental profits.

- Broader staples sector pressured by integration concerns and rising leverage among acquirers.

Health Care (XLV | +0.13%)

- IDEXX Laboratories (IDXX +14.8%) jumped after a strong Q3 beat and raised FY25 guidance.

- uniQure (QURE -49.3%) plunged as the FDA ruled Phase I/II Huntington’s data insufficient for BLA filing.

- Alvotech (ALVO -34.3%) declined after receiving an FDA Complete Response Letter over facility deficiencies.

Financials (XLF | -0.43%)

- Weighed by caution around corporate leverage as Goldman Sachs warned AI-related debt issuance now accounts for ~29% of total net supply, up from ~10% in 2024.

- Insurance and diversified financials underperformed; credit spreads widened modestly on re-leveraging concerns.

Industrials (XLI | -0.42%)

- Active M&A:

- Eaton (ETN) to acquire Boyd Thermal for $9.5B.

- SM Energy (SM) to acquire Civitas (CIVI) in a $2.8B all-stock merger.

- Vertiv (VRT) to purchase Purge Rite Intermediate for $1B in cash.

- Gains in engineering & construction and airlines offset by weakness in diversified industrials.

Energy (XLE | -0.19%)

- Oil services and refiners outperformed E&Ps.

- WTI crude rose 0.4% post-OPEC+ meeting amid stable output targets and muted demand outlook.

Materials (XLB | -0.56%)

- Coeur Mining (CDE) announced a $7B stock acquisition of New Gold (NGD), expanding its precious metals portfolio.

- Broader materials pressured by weakness in chemicals and global industrial demand concerns.

Communication Services (XLC | -0.32%)

- Media and China tech stocks dragged lower on trade tension and tariff-related uncertainty.

- Advertising and streaming names saw profit-taking following recent gains.

Real Estate (XLRE | -0.16%) & Utilities (XLU | +0.06%)

- Both sectors were little changed.

- Investors maintained defensive allocations amid stable yields and limited directional macro data.

Eco Data Releases | Tuesday November 4th, 2025

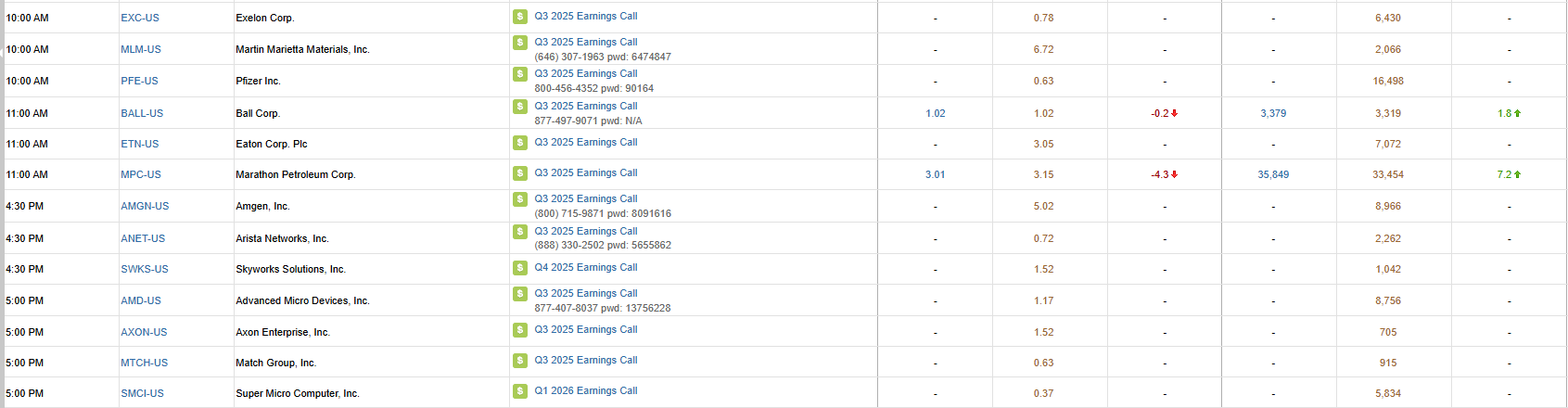

S&P 500 Constituent Earnings Announcements | Tuesday November 4th, 2025

Data sourced from FactSet Research Systems Inc.