February 1, 2026

The equity market is still moving forward, but it is doing so with less forgiveness and a sharper sense of consequence. Earnings growth remains real, AI investment is still accelerating, and consumer demand—at least at the upper end—is holding together. At the same time, inflation has stopped behaving, policy risk is back in focus, and geopolitics has reasserted itself as more than background noise. For sector investors, this is no longer about simply being “in equities,” but about being in the right parts of the market for the right reasons.

The nomination of Kevin Warsh to succeed Jerome Powell crystallizes that shift. Warsh’s reputation as a balance-sheet skeptic has forced markets to think beyond rate cuts and toward liquidity conditions more broadly. The initial reaction—stronger dollar, pressure on long-duration assets, selling at the long end of the curve—suggests investors are recalibrating for a Federal Reserve that may be less willing to cushion markets during periods of excess. Even if rates eventually move lower, the message is clear: capital will be priced more carefully.

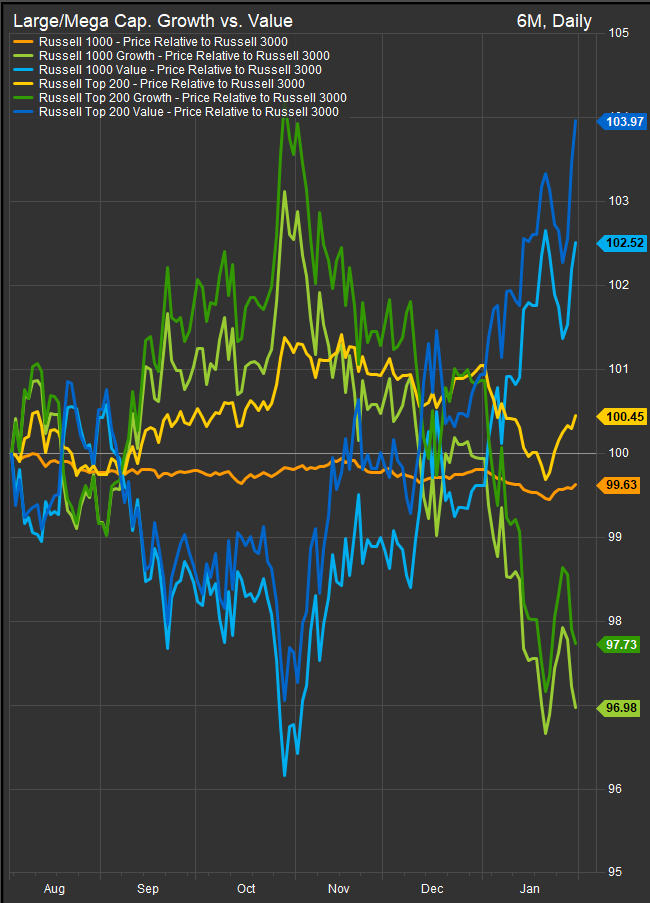

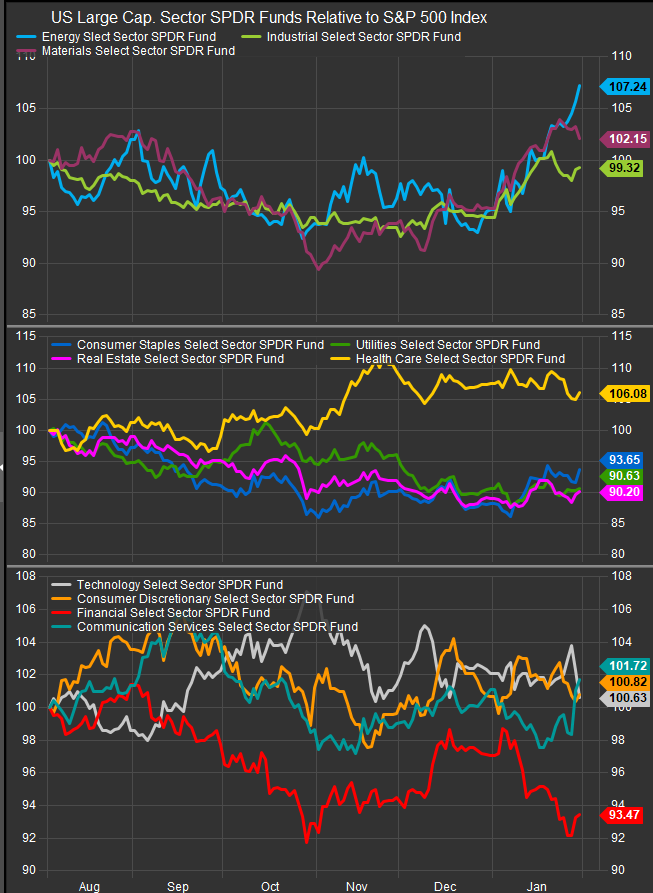

That backdrop is changing how investors interpret earnings. Two trends that are emblematic of the shift are the move from Growth style towards Value over the past 3-months and the shift towards commodity sector focus. We dive into some of the drivers of this behavior this week.

Growth vs. Value

Large Cap. Sectors vs. S&P 500

Earnings Strength Is Real—but Leadership Is Narrower and More Conditional

Q4 earnings are tracking toward a fifth consecutive quarter of double-digit growth, with upside surprises well above historical norms. On the surface, this looks like a broadly constructive environment. Under the hood, however, growth is increasingly concentrated in a small number of themes—AI infrastructure, AI monetization, and productivity gains—while many other areas are struggling to keep margins intact.

Results from Apple are emblematic of this environment. iPhone demand is clearly strong, gross margins came in better than feared, and guidance moved higher. Yet the stock failed to fully capitalize on that good news. Investors are no longer willing to extrapolate demand strength if supply constraints, component cost inflation, or capital intensity remain unresolved. In other words, good fundamentals still matter—but they must be clean.

AAPL

This same dynamic explains the divergence within mega-cap tech. Meta Platforms was rewarded for demonstrating a credible path from AI investment to revenue and monetization. Microsoft, meanwhile, was punished for elevated capex and weaker free cash flow optics, even as its strategic position remains intact. AI enthusiasm is not fading—but it is becoming more discriminating.

META

MSFT

Inflation Is No Longer Cooperative—and That Matters for Sector Positioning

December PPI reaccelerated, driven primarily by services and margin expansion rather than goods inflation. This is an important distinction. It suggests that pricing pressure is increasingly embedded in labor-intensive and service-oriented parts of the economy, which limits how quickly inflation can normalize. For markets, this complicates the path for rate-sensitive sectors and keeps pressure on valuation multiples tied to falling yields.

At the same time, rising input costs—from wages to commodities—are showing up more frequently in earnings commentary. Companies with pricing power, scale advantages, or automation leverage are absorbing these pressures. Others are not. This divide is becoming one of the defining drivers of sector performance.

Energy Reemerges as a Risk Variable, Not a Growth Story

Oil’s move toward multi-month highs reflects geopolitical risk far more than demand optimism. Iran-related tensions, OPEC+ supply discipline, and regional disruptions have injected upside skew back into crude prices. Yet longer-term forecasts still point to a potential supply glut later this year, limiting enthusiasm for chasing Energy as a pure growth trade.

For equity investors, Energy is functioning primarily as a hedge against geopolitical escalation and inflation surprises. That makes it uncomfortable to own when markets are calm—and painful to be without when they are not.

The Sector Landscape: Where Strength Is Building—and Where It Isn’t

Sectors with Clear Tailwinds

Information Technology remains the primary earnings engine of the market. AI infrastructure spending, enterprise productivity gains, and secular digitization continue to support above-market growth. While leadership is concentrated, the fundamental tailwinds are strong and durable.

Communication Services benefits from AI-driven monetization, advertising recovery, and platform scale. The sector is increasingly tied to cash-flow generation rather than speculative growth, which improves its standing in a higher-scrutiny environment.

Industrials are seeing tangible demand from data centers, power generation, HVAC, automation, and infrastructure investment. These are multi-year projects with visible backlogs, providing earnings support even if growth slows elsewhere.

Energy is supported by capital discipline, shareholder returns, and geopolitical risk. While not a secular growth story, it remains a critical portfolio stabilizer when inflation or geopolitics flare.

Materials are supported by infrastructure, energy, and select industrial demand, but remain exposed to global growth risks and commodity price volatility. Performance is highly dependent on the macro path.

Sectors with Mixed Signals

Financials benefit from a steeper yield curve and resilient consumer balance sheets, but face growing uncertainty around credit quality, regulation, and policy direction. The sector works best as a tactical exposure rather than a broad bet.

Consumer Discretionary remains bifurcated. Higher-income consumers are still spending on travel, experiences, and premium goods, while affordability pressures weigh on lower-end demand. Rate sensitivity keeps the sector volatile.

Sectors Facing Structural Headwinds

Health Care is increasingly dominated by policy risk, particularly in managed care and reimbursement-sensitive segments. Earnings visibility has deteriorated, and regulatory uncertainty caps upside.

Consumer Staples are losing pricing power as volumes soften and consumers become more price-sensitive. Margins are under pressure, and the sector’s defensive appeal is less compelling in a sticky-inflation environment.

Real Estate continues to struggle under higher-for-longer rates, refinancing risk, and weak transaction activity. Even high-quality assets face valuation and funding challenges.

Utilities remain constrained by rate sensitivity, rising capital costs, and limited earnings growth. Until rates move decisively lower, relative performance is likely to remain challenged.

Bottom Line

This is a market that still rewards growth—but only when it is backed by earnings, cash flow, and credible returns on capital. AI-linked sectors and infrastructure beneficiaries sit firmly in the driver’s seat. Defensives and yield-oriented sectors are losing relevance as inflation and rates refuse to fully cooperate. Policy and geopolitical risks argue for balance, but not retreat.

The bull case is alive. It is just narrower, more conditional, and far less tolerant of sloppy execution than it was in the recent past.

Sources

- Bloomberg

- Reuters

- Wall Street Journal

- Financial Times

- CNBC

- FactSet Earnings Insight

- U.S. Bureau of Labor Statistics (PPI data)

- International Energy Agency (IEA)

- Citi Research

- Federal Reserve statements and FOMC materials

Additional charts and data sourced from FactSet Research Systems Inc.