February 8, 2026

Equity markets entered February in a familiar late-cycle tension: corporate fundamentals are proving far more resilient than feared, while macro indicators are sending mixed signals that demand closer scrutiny. The result has not been wholesale risk aversion, but a continued rotation within equities, away from concentrated growth and toward value, income, and economically sensitive areas. This is not the behavior of a market bracing for imminent recession, but it is consistent with investors growing more selective about where they deploy capital.

Fourth-quarter earnings remain the most constructive feature of the current backdrop. With roughly 60% of S&P 500 companies reported, earnings growth is tracking close to +13% year over year, materially above expectations heading into reporting season. Revenue growth has been broad, margins have remained near record levels, and corporate sentiment around 2026 guidance has improved meaningfully. Historically, markets struggle to price a near-term recession when earnings momentum is accelerating rather than contracting, particularly when forward guidance is being revised higher rather than lower.

At the macro level, January’s manufacturing data reinforced the case for broadening economic momentum. The ISM Manufacturing Index rose to 52.6, marking its first expansionary reading after an extended contraction and the strongest print since 2022. The underlying details were equally important. New orders surged sharply, production improved, and employment stabilized. These dynamics typically support pro-cyclical positioning, particularly in industrials, transportation, machinery, and select financials. Markets responded accordingly, with continued leadership from small-caps, equal-weight indices, and domestic cyclicals.

That said, the labor market is no longer uniformly strong. Job openings declined to their lowest level since 2020, announced layoffs surged in January, and private payroll growth came in well below consensus. These data points have pushed markets to reprice rate expectations, with additional easing now priced into 2026. Importantly, however, this labor cooling remains gradual rather than disorderly. Hiring continues, wage growth has slowed but remains positive, and consumer sentiment has improved modestly. At present, the labor data look more consistent with late-cycle normalization than an outright collapse.

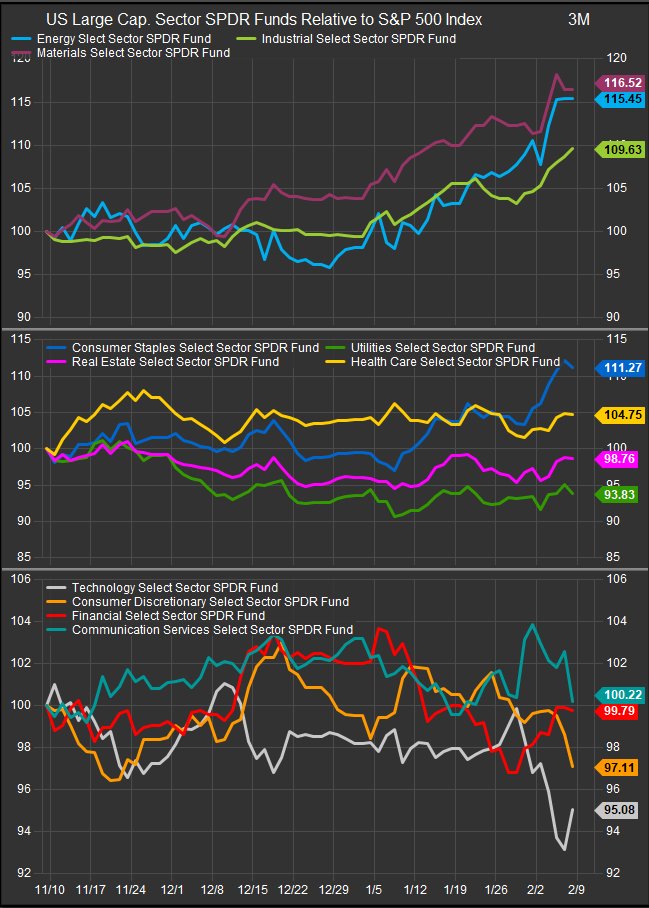

How Investors Are Positioning

Market performance and fund flows continue to reinforce this narrative. Capital has rotated away from mega-cap concentration and high-duration growth and toward value, dividends, and lower-volatility exposures. Small-caps and equal-weight benchmarks have outperformed cap-weighted indices, while sectors tied to the real economy—regional banks, retailers, restaurants, homebuilders, machinery, transports, chemicals, and energy—have delivered outsized gains. Defensive income strategies have also attracted consistent interest, suggesting that investors are seeking participation without excessive balance-sheet or valuation risk.

At the same time, enthusiasm for the AI theme has become more nuanced. Hyperscaler capital spending remains enormous, with major cloud providers guiding to sharply higher investment levels in 2026. This continues to support demand for semiconductors, networking equipment, power infrastructure, and data-center-related industrials. Credit markets have validated this narrative, as large AI-linked funding deals have been met with record demand and tightening spreads. The message is clear: the AI buildout is real, but investors are becoming more discerning about where the returns ultimately accrue.

Software Weakness: A Structural Repricing, Not a Panic

Software has emerged as the clearest area of stress. The sector experienced a sharp drawdown as markets grappled with the tangible implications of AI-driven disruption. Increasingly capable AI agents have raised legitimate questions around pricing power, seat expansion, and long-term margin durability for many application-software models. Valuations have compressed dramatically, with forward multiples now near decade lows, but the market remains unconvinced that earnings estimates fully reflect the competitive landscape ahead.

Based on the multi-year chart, we would expect the buyer to defend $350.

This is not a liquidity-driven selloff; it is a structural repricing of risk. Until there is clearer evidence that software vendors can defend margins and monetize AI rather than be disrupted by it, the sector is likely to remain a funding source for rotations elsewhere. Tactical rebounds are possible, but sustained leadership appears unlikely in the near term.

Crypto Weakness: High Beta in a Risk-Selective Market

Crypto assets also struggled during the week, experiencing sharp declines and elevated volatility. Unlike previous episodes, the weakness did not appear driven by systemic stress but rather by a combination of reduced retail participation, profit-taking, and a lack of fresh catalysts. In the current environment, crypto continues to trade as a high-beta risk asset, not as a defensive hedge or alternative store of value. Flows into gold and low-volatility assets during the same period reinforce this interpretation.

$48000 is a key level for Bitcoin

Longer term, the adoption narrative remains intact, but near-term performance is likely to remain sensitive to liquidity conditions and broader risk appetite. Without renewed policy easing or a compelling adoption catalyst, crypto leadership is likely to remain episodic rather than sustained.

Recession Forecasting: What the Data Would Look Like if Risks Were Escalating

While recession concerns have resurfaced in parts of the market, the data do not yet support that conclusion. Historically, recessions are preceded by a clear and persistent deterioration across multiple dimensions: collapsing new orders, broad earnings downgrades, accelerating job losses, tightening credit availability, and a sharp pullback in consumer spending.

If the economy were slipping into recession, we would expect to see ISM manufacturing and services indices fall decisively back below 48, with new orders and employment components deteriorating in tandem. Corporate earnings revisions would turn sharply negative, not merely slow, and margins would compress meaningfully rather than remain near cycle highs. Job openings would fall rapidly, initial claims would trend persistently higher, and wage growth would decelerate abruptly. Credit spreads would widen across investment-grade and high-yield markets, signaling rising default risk and tightening financial conditions.

Importantly, those conditions are not present today. Manufacturing is improving, earnings are beating expectations, credit markets remain orderly, and consumer spending—while increasingly bifurcated by income—is holding up. The current environment looks far more like a late-cycle slowdown with rotation and repricing, rather than the early stages of a recessionary unwind.

The Bottom Line

The equity market is not signaling imminent recession, but it is demanding discipline. Leadership is broadening beneath the surface, favoring value, income, and real-economy cyclicals, while long-duration growth and speculative assets face a higher bar. Earnings strength and improving manufacturing data argue for staying invested, but rising labor-market fragility and persistent inflation risks counsel selectivity.

This is a market rewarding cash flows over narratives, balance-sheet strength over leverage, and tangible demand over optionality. Until the data begin to resemble a true recessionary setup, the path of least resistance remains rotation—not retreat.

Conclusion: Sector Positioning for the Remainder of February

The macro and earnings backdrop argues against a binary risk-on or risk-off stance. Instead, the market is rewarding durable cash flows, real-economy exposure, and selective cyclicality, while continuing to penalize high-duration and disruption-exposed growth. With earnings momentum intact and manufacturing data improving—but labor and inflation risks lingering—the optimal posture for the remainder of February is balanced, quality-tilted participation.

Among the 11 GICS sectors, Industrials stand out as one of the most attractive areas to own. Improving ISM data, a rebound in new orders, and sustained infrastructure and AI-related capex support earnings visibility across machinery, transportation, and capital-goods exposures. Energy also remains well positioned, benefiting from disciplined supply, resilient demand, and geopolitical risk premia, while continuing to offer strong free-cash-flow yields.

Overall, the market is not positioning for recession, but it is pricing a more discriminating growth regime. For the remainder of February, the highest-conviction allocations favor Industrials, Energy, Financials, and Staples, complemented by selective exposure to Staples and AI infrastructure within Technology, while maintaining caution toward software and speculative growth.

Sources

- FactSet, Earnings Insight: Q4 2025 Reporting Season

- Institute for Supply Management (ISM), January Manufacturing PMI

- U.S. Bureau of Labor Statistics (BLS), JOLTS Job Openings and Labor Turnover Survey

- Challenger, Gray & Christmas, January Job Cuts Report

- Reuters, Big Tech Capex and AI Infrastructure Coverage

- Federal Reserve, Senior Loan Officer Opinion Survey (SLOOS)

- University of Michigan, Consumer Sentiment Index (Preliminary February)

- Bloomberg L.P., Sector Performance, Valuation, and Flow Data

- Goldman Sachs, Software Valuation and AI Disruption Commentary

- JPMorgan, Morgan Stanley, and UBS research notes on sector rotation, labor trends, and AI capex dynamics