ETF Insights| December 1, 2024 | Financial Sector

Price Action & Performance

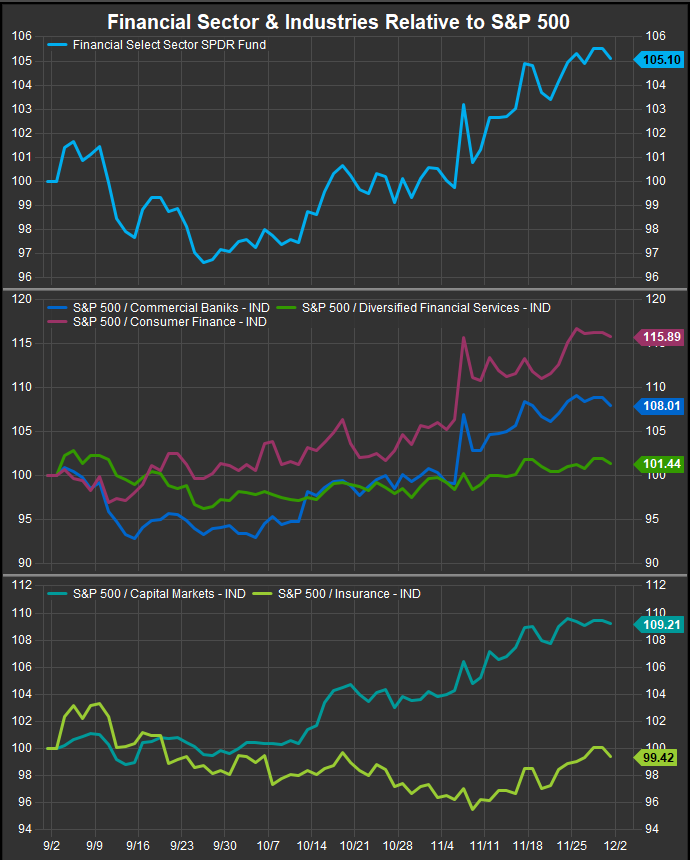

The Financial Sector proxy XLF gapped higher post-election and is now the best performing sector over the trailing 12-month period. The shift to high-beta, cyclical leadership has benefitted the sector as have some stock and sector specific dynamics. Oscillator work on the XLF shows the sector is near-term overbought, and that is one of the few concerns for the sector at present. Industry level performance shows improvement is broad based within the sector and our aggregated stock level

At the Industry level, Banks, Consumer Finance and Capital Markets industries represent leadership while Diversified Financials Services (primarily Berkshire Hathaway) and Insurance industries saw performance flat to down for the month. This fits with the general “risk on” tone in October, though as we write this, the month is ending with a thud. That said, looking back longer term, sustained underperformance in 2023 has furnished a setup for the sector that implies more upside in performance going forward.

At the stock level we have noted steady improvement from commercial banks, with the regionals showing strong charts. Among money-center banks, JPM is clearly the best over BAC, C and WFC. Our favorite stocks reside in the Consumer Finance and Capital Markets industries. Our best ideas include AXP, COF, SYF, KKR, BX, GS, FI and FIS. Insurance names, which had been leadership until recently now look like they are rolling over in aggregate which may be a sign that investors are moving up the risk curve to align with Fed policy and the sustained bull trend in equities.

Economic and Policy Drivers

The U.S. Financial Sector outperformed in November, buoyed by a mix of resilient economic data and policy developments that created a favorable backdrop for banks, insurers, and asset managers. Robust consumer spending trends and an improving labor market were key economic tailwinds. While October’s nonfarm payroll growth was modest at +12K, upward revisions to prior months and a rising labor force participation rate highlighted ongoing economic strength. This, combined with declining inflation, supported loan performance and credit quality, reducing concerns about defaults. Additionally, durable goods orders and personal spending growth pointed to continued consumer and business activity, which bolstered demand for lending, credit cards, and investment products.

Policy developments amplified the sector’s rally. Optimism surrounding the Trump administration’s pro-business stance, including proposed tax reforms and deregulation, bolstered investor sentiment. Notably, reports that Wells Fargo’s asset cap may be lifted in early 2025 provided a significant boost to regional banks, signaling a potential easing of regulatory headwinds. The Federal Reserve’s dovish positioning, with markets pricing a high likelihood of another December rate cut, further fueled optimism by suggesting a supportive interest rate environment conducive to economic growth. Meanwhile, easing U.S.-Mexico trade tensions after constructive talks between Trump and Mexico’s President Sheinbaum reduced geopolitical uncertainty, particularly benefiting financial institutions with cross-border exposure.

Despite the strong performance, risks tied to elevated valuations, tighter regulatory scrutiny on large asset managers, and potential fallout from global geopolitical tensions remain key factors to watch as the sector enters December. While we note the near-term overbought conditions, momentum remains strong, and we expect prevailing trends to continue into year-end for Financials.

In Conclusion

The Financial Sector persists in a strong YTD uptrend and stock and industry level performance continues to show broad participation to the upside. Our Elev8 Sector Model continues with an OVERWEIGHT Position in XLF of +3.65% vs. the benchmark S&P 500

XLF Technicals

- XLF daily (200-day m.a. | Relative to S&P 500 | MACD | RSI )

- Price and Relative curves have broken out to the upside decisively

XLF Relative Performance | XLF Industry Level Relative Performance | 3-Months

- 4 out 5 industries are outperforming over the past 3-months and all of them outperformed in November

Data sourced from FactSet Research Systems Inc.