September 24, 2025

S&P futures up 0.1% Wednesday after U.S. equities slipped Tuesday, led lower by big tech and AI names (AMZN, NVDA). Energy outperformed while defensives also held up. Treasuries little changed with 2Y yields down ~2 bp. Dollar index +0.3%, gold -0.6%, Bitcoin +0.8%, WTI crude +1.1%.

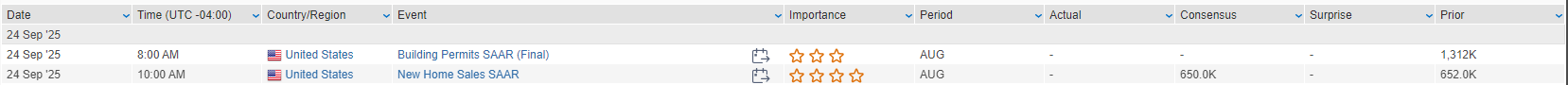

Macro narrative remains steady: bulls cite AI growth, Fed easing, and solid corporate/consumer balance sheets, while bears highlight seasonal/quarter-end headwinds, buyback blackouts, AI competition/ROI risks, and tariff overhang. Market continues to discount U.S. government shutdown risk. Focus today on new home sales and a $70B 5Y Treasury auction; Fed’s Daly speaks after the close.

Corporate highlights:

- MU: Earnings beat, HBM revenue +30% q/q (nearing $8B run rate); Street positive on capacity outlook.

- BABA: Rallied on plans to expand AI investment, unveiled new Qwen3-Max model.

- VRT: Rebounded after pushback against MSFT cooling-tech concerns that triggered Tuesday’s selloff.

- PFGC: Announced cooperation deal with Sachem Head, granting activist a board seat.

- MLKN: Beat on earnings, citing stronger markets and strategic growth progress.

- LAC: Surged on report White House considering up to 10% stake

U.S. Market Recap: Dow (0.19%), S&P 500 (0.55%), Nasdaq (0.95%), Russell 2000 (0.24%)

U.S. equities ended lower Tuesday, though off worst levels, with breadth positive as equal-weight S&P (RSP) outperformed the cap-weighted index by ~65 bp. The reversal from Monday’s action saw big tech lead to the downside, while defensive assets such as Treasuries and gold gained. Treasuries firmed modestly with yields down 2–4 bp across the curve, helped by a solid $69B 2Y auction. Dollar index fell 0.1%, gold rallied another 1.1% to fresh highs above $3,800, Bitcoin slipped 0.5%, and WTI crude gained 1.8%.

Macro focus remained on the Fed. Powell largely reiterated last week’s FOMC messaging, citing inflation risks tilted to the upside and labor market risks to the downside. Bowman followed up dovishly, warning the Fed risks falling behind the curve if it doesn’t cut decisively, while Goolsbee argued for gradualism. Bostic highlighted persistent inflation risks. Markets continue to price in ~40 bp of cuts through year-end, with another ~75 bp expected in 2026, though dispersion in Fed views adds uncertainty. On data, U.S. flash PMIs were broadly in line, with tariff-driven cost pressures noted, while the Richmond Fed Index weakened further on declines in shipments, new orders, and employment.

Sector Highlights

Tuesday’s trading saw defensive and cyclical groups outperform as tech and growth reversed. Energy (+1.71%) led on oil strength, joined by gains in Real Estate (+0.81%), Utilities (+0.54%), and Staples (+0.36%). Healthcare (+0.24%) also fared better, supported by McKesson and Johnson & Johnson upgrades. In contrast, Tech (-1.14%) and Consumer Discretionary (-1.44%) lagged on pressure in semis, software, and post-IPO names. Financials, Materials, and Industrials were little changed.

Information Technology

- NVDA: Shares slipped as scrutiny built on its $100B OpenAI investment, with concerns over “circular” funding dynamics echoing dotcom-era vendor financing.

- ONTO: +5.1% after Jefferies upgrade to Buy; sees growth reaccelerating in 2H-26 and regaining lost chip-on-wafer-on-substrate share.

- SYM: -10.7% after UBS downgrade to Sell, citing valuation and growth concerns.

- ASM International: Cut its annual revenue forecast, citing weaker demand for semi equipment.

Consumer Discretionary

- AZO: Earnings and comps missed, though analysts highlighted better merchandise margins.

- OPEN: -15.5% after major shareholder sold $95M in stock.

- FLY: -15.3% post-IPO earnings miss; Q2 revenue down 26% y/y though backlog rose with new NASA contract.

- AMZN: Announced closure of all 14 Amazon Fresh UK stores; five to be converted into Whole Foods.

- DIS: Raising Disney+ subscription prices by $2–3/mo; affiliates Nexstar and Sinclair said they will boycott Jimmy Kimmel’s TV return.

Industrials

- BA: +2% on reports U.S. and China in final stages of talks for a major aircraft order.

- Mercedes-Benz: Contract manufacturer to cut ~1/3 of its workforce.

- Jaguar Land Rover: Cyberattack fallout extended; plants to remain shut another week.

Healthcare

- MCK: +6.4% after raising FY26 EPS and longer-term guidance at Investor Day.

- KVUE: +1.6% rebound after Monday’s sharp drop on Tylenol-autism claims; management reaffirmed science shows no causal link.

- JNJ: +1.4% on Guggenheim upgrade to Buy; positive on product pipeline and outlook.

- Humana (earlier): Sued HHS over phone-call issues tied to star ratings, potential $4B revenue risk.

Communication Services

- AAPL: EU regulators requested info on financial fraud oversight; stock had outperformed Monday on iPhone demand commentary.

- META: Reported to launch PAC to oppose AI regulation; also announced new AI-driven dating features, pressuring MTCH (-5.4%).

- GOOGL: Admitted to censoring during COVID; EU seeking info on fraud oversight.

- TMUS: Named new CEO Gopalan, effective Nov 1.

Financials

- CXT: +14.7% after guiding high-single-digit 2026 revenue growth in currency business.

- OMC: +2.4% after Wells Fargo upgrade; played down AI risks and highlighted secular media ad strength.

Industrials / Aerospace & Defense

- PLTR: +1.8% after BofA raised PT to $215; upbeat on Maven Smart System adoption and government sales trajectory.

Eco Data Releases | Wednesday September 24th, 2025

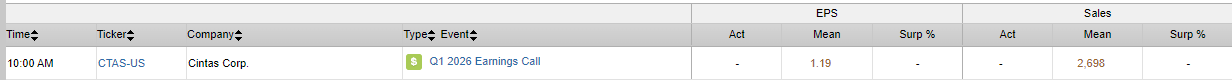

S&P 500 Constituent Earnings Announcements | Wednesday September 24th, 2025

Data sourced from FactSet Research Systems Inc.