October 6, 2025

S&P futures +0.3% after U.S. equities ended mixed on Friday, though the S&P 500 extended its winning streak to six sessions and all major indexes posted weekly gains of over 1%. Outperformers included pharma, semiconductors, China tech, utilities, builders, rails, and machinery, while big tech was mixed — NVDA stood out with a more than 5% gain.

Overseas, Asian markets were mixed, with Japan the standout — the Nikkei surged nearly 5% after Sanae Takaichi’s surprise victory in the LDP leadership race. Mainland China, Taiwan, and South Korea were closed for holidays. European markets traded lower, with France under pressure following the resignation of its prime minister. In macro markets, Treasuries weakened with curve steepening, the Dollar Index rose 0.7%, gold climbed 1.5%, Bitcoin added 1%, and WTI crude gained 1.7% following reports of only a modest OPEC+ production increase.

The path of least resistance remains higher, supported by expectations for Fed easing, a resilient U.S. economy, and optimism into Q3 earnings season. Key bullish themes include hyperscaler AI capex, tariff mitigation, and consumer resilience, while positioning remains broadly constructive. The government shutdown continues to be treated as background noise. Over the weekend, attention centered on political developments in Japan and France, which lifted global yields and pressured the yen and euro. Broader macro commentary also focused on labor-market softness, AI-related speculation, and tariffs pushing up consumer goods prices.

The economic calendar is light this week. Key events include the NY Fed inflation expectations survey (Tuesday), University of Michigan consumer sentiment and inflation expectations (Friday), and the release of the September FOMC minutes (Wednesday). Fed speakers will be active throughout the week — Bostic, Bowman, Miran, and Kashkari on Tuesday; Musalem, Barr, and Kashkari on Wednesday; Powell (video) and Bowman on Thursday; Goolsbee and Musalem on Friday. Treasury issuance also remains in focus with 3-, 10-, and 30-year auctions.

Corporate News

- OpenAI holds its Developer Day today.

- CMA to be acquired by FITB in a $10.9B all-stock deal.

- ABBV cut full-year profit guidance on a $2.7B charge tied to R&D expenses.

- BA plans to boost 737 MAX production later this month.

- SBUX is closing hundreds of stores and laying off thousands in North America as part of its turnaround plan.

- MMM reportedly weighing asset sales from slower-growth units.

- COST will offer discounted access to NVO’s Ozempic and Wegovy for members.

- STLA committed $5B in additional U.S. investment to support its North American turnaround.

- Financial press highlighted NWL’s U.S. cost efficiencies in Sharpie production without layoffs or price hikes.

- This week’s key earnings reports include STZ, MKC, PEP, and DAL.

U.S. equities ended mixed on Friday (Dow +0.51% · S&P 500 +0.01% · Nasdaq -0.28% · Russell 2000 +0.72%), with the S&P 500 eking out a sixth straight gain while the Nasdaq slipped, breaking a five-session winning streak. Major indices still posted strong weekly advances. The session was marked by a sense of drift in the absence of major catalysts as the government shutdown entered its third day. Rotation dominated trading, with small-caps, cyclicals, and value-oriented sectors outperforming, while big tech and momentum names gave back ground following another week where AI headlines had dominated sentiment.

The day’s macro data pointed to a slowing services sector. The September ISM Services Index fell to 50.0 (vs. 52.0 expected), its lowest level since May 2020, signaling near-stagnant activity. New orders remained in expansion at 50.4 but declined sharply from 56.0 in August, while employment stayed in contraction despite a slight improvement (47.2 vs. 46.5). Prices paid accelerated to 69.4, indicating renewed cost pressures, while inventories slipped back into contraction. Tariffs were a recurring concern across industries, cited for higher import costs and reduced visibility. The final S&P Global Services PMI came in at 54.2 (vs. 53.9 expected), with softer business activity but moderating output price inflation.

The bond market weakened, with yields up 2–4 bp and the curve flattening modestly. Gold rose 1.1%, settling above $3,900/oz for the first time, while Bitcoin gained 1.4%. WTI crude climbed 0.7% but still finished the week down more than 7%. The Dollar Index dipped 0.1%. Fed speakers provided a cautious backdrop: Governor Miran said the neutral rate has likely fallen, suggesting tightening in real terms; Governor Jefferson acknowledged pressure on both sides of the Fed’s dual mandate; Dallas Fed’s Logan reiterated that policy is only moderately restrictive; and Chicago’s Goolsbee warned that a prolonged lack of official data from the shutdown could leave policymakers “flying blind.”

Internationally, trade policy returned to focus. Bloomberg reported that China has proposed up to $1 trillion in U.S. investments in exchange for tariff and security concessions, including looser restrictions on Chinese investments and inputs. Trump and Xi are expected to discuss trade normalization later this month at the APEC summit in South Korea.

Sector Highlights

Rotation defined Friday’s session. Utilities (+1.15%), Healthcare (+1.13%), and Financials (+0.74%) led gains, helped by defensive flows and select stock-specific catalysts. Energy (+0.67%) and Real Estate (+0.38%) also outperformed despite higher long-end yields. Materials (+0.20%) and Industrials (+0.14%) benefited from upgrades and tariff-relief headlines. On the downside, Consumer Discretionary (-0.81%), Communication Services (-0.64%), and Technology (-0.32%) lagged on profit-taking in large-cap growth. Consumer Staples (-0.06%) was little changed.

Technology (-0.32%)

- AMAT -2.7%: Guided to a ~$110 M hit to Q4 revenue and ~$600 M in FY26 from expanded export restrictions to China.

- NVDA: Reportedly frustrated by delays to its multi-billion-dollar chip deal with the UAE, initially announced in May.

- GOOGL: Said to be preparing a sale or spinoff of its Verily life-sciences unit.

- PLTR -7.5%: Declined after an Army memo labeled its battlefield system “high risk,” though company refuted claims.

- RUM +15.8%: Rallied on news of a partnership with Perplexity AI to enhance content discovery.

Healthcare (+1.13%)

- HUM: Medicaid MCOs and GLP-1 names outperformed; star-rating data in line with expectations.

- ABSI +13.4%: JPMorgan initiation at Overweight, citing pipeline and upcoming ABS-101 data.

- PLUG +34.3%: Surged after HC Wainwright raised target to $7 from $3, citing green hydrogen adoption potential.

Financials (+0.74%)

- CG +2.9%: Initiated Outperform at BMO; called growth drivers underappreciated.

- Credit bureaus (EFX, TRU): Continued underperformance following FICO’s credit-scoring overhaul earlier in week.

- Larger-cap banks and P&C insurers gained with the value rotation.

Industrials (+0.14%)

- BA: 777X program delayed to 2027; expected $2.5–4 B charge.

- KNX +3.8%: Upgraded to Buy at Stifel; cited tightening driver supply as catalyst.

- RCAT +11.7%: Initiated Buy at Needham; strong exposure to defense-grade drone demand.

- WMB: Gained after announcing $3.1 B investment in grid-constrained power innovation projects.

Materials (+0.20%)

- FCX +2.1%: Upgraded to Buy at UBS; said investor pessimism on Grasberg mine overdone.

- USAR +14.3%: CEO comments about ongoing White House talks boosted shares.

- Chemicals (CE): Continued strength following upgrade at Citi earlier in the week.

Energy (+0.67%)

- ETR +2%: Rose after deal to supply power for GOOGL’s planned $4 B Arkansas cloud-AI investment; also upgraded at Scotiabank GBM.

- OXY +1.4%: Upgraded to Buy at HSBC after sale of OxyChem unit to Berkshire; seen accelerating debt reduction.

- WTI +0.7%: Modest rebound, but energy sector still down sharply for the week.

Utilities (+1.15%)

- Outperformed on defensive rotation and renewable-power announcements (notably ETR deal with GOOGL).

Real Estate (+0.38%)

- Modest gains amid lower real yields and continued short covering in REITs.

Consumer Discretionary (-0.81%)

- F +3.7%: Rallied after Ohio Sen. Moreno said Trump considering tariff relief for U.S. auto production.

- BMBL -3.0%: Downgraded to Neutral at GS on declining downloads and weak visibility.

- DKNG: Rose despite critical short report; investors viewed fundamentals as intact.

- China travel/leisure and apparel: Weaker on soft Macau visitation and cautious retail commentary.

Communication Services (-0.64%)

- META, TSLA: Both lower on profit-taking; momentum rotation weighed on broader Mag 7.

- Z +2.6%: Upgraded to Buy at Gordon Haskett after sharp post-Compass-deal selloff.

- Media & telecom: Underperformed on weak ad-spend outlook.

Consumer Staples (-0.06%)

- Food & beverage: Mixed ahead of next week’s PEP, MKC, STZ earnings.

- Dollar stores and grocers: Continued softness on margin pressure and muted traffic.

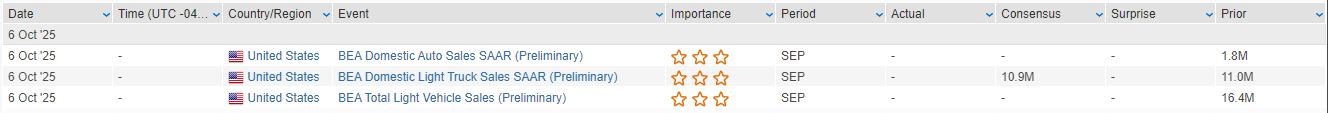

Eco Data Releases | Monday October 6th, 2025

S&P 500 Constituent Earnings Announcements | Monday October 6th, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.