October 13, 2025

S&P futures +1.3% in early Monday trading, rebounding after Friday’s sharp selloff that marked the S&P 500’s worst session since early April’s “Liberation Day” drop. Asian equities were broadly weaker overnight, while European markets are posting modest gains. Treasuries are closed for the Columbus Day holiday. The Dollar Index is up 0.1%, gold +2.3%, Bitcoin -1.3%, and WTI crude +1.9% after last week’s 3.3% decline that pushed prices below $60/barrel—the lowest since early May.

Monday’s gains are driven by signs of easing U.S.–China trade tensions. On Sunday, President Trump told followers on Truth Social “not to worry about China,” saying “it will all be fine,” while Vice President Vance said Beijing had “chosen the path of reason.” These comments mark a softer tone after Trump’s Friday post-market threat to impose a 100% tariff on Chinese goods in response to Beijing’s rare-earth export curbs. The remarks come ahead of the Trump–Xi meeting at the APEC summit later this month and could signal tentative de-escalation, though tensions remain elevated following China’s new port fees, customs checks on NVDA chips, and antitrust probe into QCOM.

The U.S. government shutdown enters its 11th day, with no resolution expected before the Senate reconvenes Tuesday. Markets have largely shrugged off shutdown impacts, though concerns about delayed economic data and potential Fed implications persist. Futures pricing reflects a near-100% chance of a 25 bp rate cut in October, but total expected cuts for 2025 have been trimmed to ~42 bp following renewed trade and inflation uncertainty.

Weekend commentary focused on valuation risks, narrow market breadth, and credit-market strain, alongside AI and crypto volatility, a high bar for Q3 earnings, and political crosscurrents driving global bond volatility.

This Week’s Key Events

- Fed Chair Powell speaks Tuesday at NABE.

- Governor Miran speaks Wednesday and Thursday.

- Governor Waller speaks Thursday.

- Fed’s Beige Book released Wednesday.

- Macro data: NFIB Small Business Index (Tue), Empire State Manufacturing (Wed), Philly Fed & NAHB Confidence (Thu).

Corporate Highlights

- WBD (Warner Bros. Discovery): Reportedly rejected a ~$20/share offer from PSKY.

- META (Meta Platforms): Hired Thinking Machines Lab co-founder, reportedly offering a pay package worth up to $1.5B.

- AAPL (Apple): Nearing a deal to acquire Prompt AI, a home-security startup, in its latest AI-focused expansion.

- AZN (AstraZeneca): Plans to cut U.S. drug prices following White House pressure to lower pharma costs.

- JEF (Jefferies): Said losses from bankrupt First Brands are manageable, easing investor concern over credit exposure.

- Bank Earnings Preview:

- Tuesday premarket: C (Citigroup), GS (Goldman Sachs), JPM (JPMorgan), WFC (Wells Fargo).

- Wednesday premarket: BAC (Bank of America), MS (Morgan Stanley).

U.S. equities sold off sharply on Friday (Dow -1.90% · S&P 500 -2.71% · Nasdaq -3.56% · Russell 2000 -3.01%), closing near session lows after an abrupt escalation in U.S.–China trade tensions reignited geopolitical risk aversion. The S&P 500 logged its worst day since the early-April “Liberation Day” slide, with all major indices finishing the week lower. The selloff was broad, led by weakness in big tech, semiconductors, energy, financials, and China-exposed names, while defensives like staples, utilities, and telecom held up better. Treasuries rallied, with yields down about 9 bp at the long end and some curve flattening. The Dollar Index fell 0.6% but still ended the week higher. Gold rose 0.7%, reclaiming the $4,000/oz level, while Bitcoin dropped 3.6%. WTI crude plunged 4.2% to below $60/barrel—its lowest close since May—amid mounting demand concerns and a risk-off flight to safety.

The sharp market reversal was triggered by President Trump’s post on Truth Social, where he accused China of “sinister and hostile” trade actions and said he is weighing a “massive increase” in tariffs on Chinese imports, casting doubt on his expected meeting with President Xi at the APEC summit in South Korea later this month. His comments followed a series of moves by Beijing, including new port fees on U.S. ships, stricter customs checks on NVDA chips, rare-earth export controls, and an antitrust probe into QCOM. Investors interpreted the escalation as a reemergence of 2018–19-style trade frictions, overshadowing the otherwise constructive tone heading into next week’s Q3 earnings season.

The government shutdown entered its 10th day with no resolution in sight. Reports indicate both chambers of Congress are adjourned until at least Tuesday, Oct. 14, ensuring continued disruption. The Bureau of Labor Statistics announced plans to publish the September CPI report on Oct. 25, necessary for the Social Security COLA calculation, offering some relief to markets concerned about a data blackout. Meanwhile, University of Michigan’s October consumer sentiment came in at 55.0, slightly above expectations (54.0), while year-ahead inflation expectations ticked down to 4.6% and five-year expectations held at 3.7%.

Fedspeak remained active but balanced. Governor Waller reiterated support for 25 bp rate cuts in both October and December, consistent with the SEP, while Atlanta’s Bostic and St. Louis’s Musalem warned against cutting too aggressively amid persistent inflation risks. SF Fed’s Daly noted tariffs have not lifted inflation as much as feared but flagged rising labor-market weakness. Reports also indicated that Bessent’s shortlist for the next Fed Chair includes Waller, Bowman, Hassett, Warsh, and Rieder. Looking ahead, focus shifts to Powell’s NABE speech Tuesday, followed by Governor Miran midweek and Waller again Thursday. The Fed’s Beige Book is also due Wednesday.

Sector Highlights

Sector moves reflected a decisive risk-off rotation, with cyclicals and tech leading declines while defensives held up.

- Outperformers: Consumer Staples (+0.25%), Utilities (-0.44%), Real Estate (-1.12%), Healthcare (-1.49%), Materials (-1.82%), Financials (-2.16%), Industrials (-2.22%), Communication Services (-2.31%)

- Underperformers: Technology (-3.97%), Consumer Discretionary (-3.29%), Energy (-2.80%)

The day’s defensive tone was evident as utilities, staples, and grocers attracted inflows while high-beta tech, autos, and energy bore the brunt of selling pressure. Cyclicals such as industrials and materials also weakened on trade uncertainty, while financials fell in sympathy with risk assets.

Technology (-3.97%) — The hardest-hit sector as U.S.–China tensions and chip export headlines weighed on sentiment.

- NVDA: Pressured after reports Chinese customs are blocking imports of its AI chips.

- QCOM: Under scrutiny as Beijing launched an antitrust investigation into its Autotalks acquisition.

- IONQ -8.8%: Announced $2B equity raise with warrants at a premium to prior close.

- ESTC +6.1%: Rose on upbeat guidance and a $500M buyback announcement.

Consumer Discretionary (-3.29%) — Weakness across autos, apparel, and retail as trade concerns reignited supply-chain fears.

- TSLA: Declined sharply as renewed tariff risks clouded demand outlook.

- LEVI -12.6%: Posted solid Q3 results but Q4 EPS guide below Street; analysts cited lofty expectations.

- LEN +1.2%: Announced plan to swap its 20% stake in Millrose (MRP) for Lennar shares.

- RACE -15% (prior session carryover): Ongoing weakness after EV target reduction.

Energy (-2.80%) — Oil’s 4% drop dragged the group lower.

- MOS -9.2%: Reported weaker-than-expected preliminary Q3 volumes.

- VG -24.9%: Plunged after losing a $1B arbitration case to BP over LNG contracts.

Financials (-2.16%) — Banks and asset managers underperformed amid yield compression and risk aversion.

- LEN: Financial tie-in as part of exchange structure; muted market response.

- Bessent’s Fed Chair shortlist: Included Waller, Bowman, Hassett, Warsh, and Rieder, reinforcing financial policy uncertainty.

Healthcare (-1.49%) — Managed care and biotech names mixed.

- HUM -3.6%: CMS 2026 STARs data in line with guidance but less favorable details dampened sentiment.

- ALGN -4.6%: Downgraded on market-share concerns.

Industrials (-2.22%) — Airlines, logistics, and construction equipment lower on growth worries.

- APLD +16.1%: Beat on earnings; analysts positive on HPC leasing and hyperscale customer pipeline.

- ARMK: Flat; secured major hospital system contract earlier in the week.

Materials (-1.82%) — Underperformed amid renewed tariff anxiety.

- MP +2.4% (carryover): Earlier gains on rare-earth control headlines faded.

Communication Services (-2.31%) — Media and China-linked tech weighed on the group.

- CMCSA: Reported to be considering bid for Warner Bros. Discovery.

Consumer Staples (+0.25%) — One of few bright spots as investors rotated toward defensives.

- PEP: Continued momentum after strong Q3 results earlier in the week.

Utilities (-0.44%) — Outperformed on safe-haven flows; sector benefited from falling yields.

Real Estate (-1.12%) — Weak but modestly better than the broader market as rates stabilized

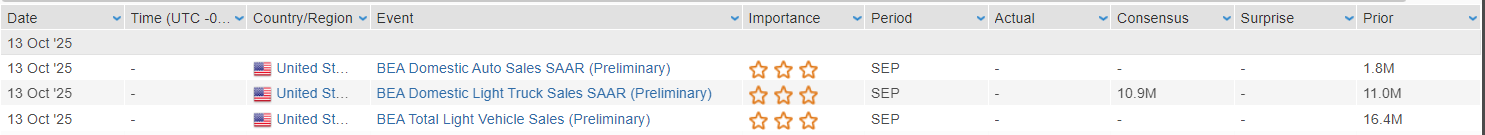

Eco Data Releases | Monday October 13th, 2025

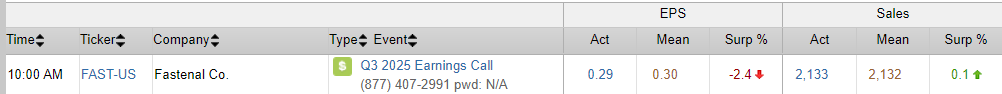

S&P 500 Constituent Earnings Announcements | Monday October 13th, 2025

Data sourced from FactSet Research Systems Inc.