November 5, 2025

S&P futures -0.4% in Wednesday morning trading after Tuesday’s sharp selloff, the largest one-day decline since October 10. Pressure remained centered in Big Tech, unprofitable tech, retail favorites, most-shorted names, crypto, and cruise lines.

Overseas markets are mostly weaker: South Korea -3%, Japan -2.5%, and Europe -0.7%. Treasuries were steady across the curve, the Dollar Index unchanged, while gold +0.3%, Bitcoin futures +1.5% after a steep 6% drop Tuesday, and WTI crude +0.8%.

No major shift in narrative: valuation concerns, AI-related capex scrutiny, and narrow breadth remain key market themes. Recent election results and ongoing government shutdown developments have had little market impact. While optimism has grown for a potential resolution to the now record-length shutdown, investor focus remains on the macro data vacuum and stretched equity valuations. Pullbacks tied to these factors have so far been brief and shallow, with dip-buying tendencies intact.

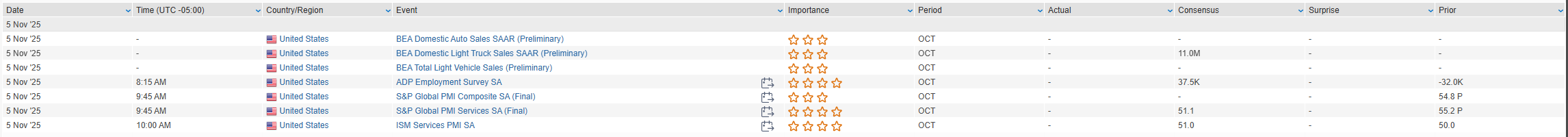

Today’s macro calendar is busy:

- ADP private payrolls expected +30K in October (vs. -32K prior).

- ISM Services seen ticking up to 50.8 from 50.0.

- Treasury quarterly refunding announcement and Supreme Court IEEPA hearing also in focus.

Thursday brings no major data but heavy Fed speak (Williams, Barr, Hammack, Waller, Paulson, Musalem), while Friday features University of Michigan sentiment and inflation expectations alongside remarks from Williams, Jefferson, and Miran.

Earnings season remains active with mixed results across sectors:

- Positive: AMD beat and guided Q4 higher on strong Data Center demand; Lumentum (LITE) beat and raised on supply-constrained demand; Toast (TOST) rose on strong net adds; Cirrus Logic (CRUS) gained on iPhone shipment strength; Amgen (AMGN) beat and raised; Corteva (CTVA) and Mosaic (MOS) both better than feared.

- Negative: Arista Networks (ANET) and Super Micro (SMCI) fell on high expectations; Pinterest (PINS) guided Q4 soft; Novo Nordisk (NVO) cut guidance for a fourth time; Live Nation (LYV) missed on Q3 sales; Cava (CAVA) slid on a Q3 miss and guidance cut; Trex (TREX) dropped sharply on weak guidance and commentary about softening end markets.

U.S. equities finished lower Tuesday (Dow -0.53% | S&P 500 -1.17% | Nasdaq -2.04% | Russell 2000 -1.78%) as valuation concerns and renewed pressure on megacap technology dragged major indices to session lows. The Nasdaq (-2.0%) and Russell 2000 (-1.8%) led declines, while defensive sectors held up better amid a shift toward yield and earnings stability. Market breadth remained narrow, with more than 60% of S&P 500 constituents declining, underscoring the fragility of leadership concentrated in a handful of AI and growth names.

The downturn followed cautious commentary from Wall Street CEOs at a Hong Kong summit, who flagged stretched valuations and inconsistent earnings growth across industries. Selling intensified as Palantir, Shopify, and Uber declined post-earnings despite solid results, reinforcing fatigue in high-valuation growth segments. Broader headwinds included a less dovish Fed, signs of labor market cooling, and elevated consumer caution, while dip-buying interest remained muted after several weeks of outperformance in tech and discretionary stocks.

Treasuries firmed across the curve (yields down ~2 bp), while the Dollar Index rose 0.4%. Gold slipped 1.3%, falling back below $4,000/oz, and Bitcoin futures declined 5.7%, nearing $100K for the first time since June. WTI crude fell 0.8%, extending losses as global demand concerns persisted.

In Washington, the U.S. government shutdown entered its 35th day, tying the record from 2018–19. Negotiations on a new continuing resolution gained limited traction, with bipartisan senators exploring extensions of ACA tax credits as a bargaining chip. The shutdown’s effects widened — including widespread air traffic delays and reductions in SNAP food assistance payments — as agencies continued to scale back operations.

Sector Highlights

Tuesday’s trade reflected a clear rotation toward defensives and away from high-multiple growth exposures. Financials (+0.55%), Consumer Staples (+0.52%), and Health Care (+0.40%) outperformed on stable earnings and resilient balance sheets. Real Estate (+0.31%) also gained modestly on firmer Treasuries. The weakest sectors were Technology (-2.27%), Consumer Discretionary (-1.85%), and Communication Services (-1.53%), where profit-taking and valuation compression dominated. Cyclicals such as Industrials (-1.15%) and Energy (-0.93%) lagged on soft demand indicators, while Utilities (-0.36%) and Materials (-0.44%) were mixed. The pattern reinforced a familiar rotation dynamic: investors trimming exposure to AI and growth while leaning into yield, cash flow, and defensiveness ahead of midweek macro catalysts.

Technology

- Palantir (PLTR -8%) fell despite strong results and raised guidance, with analysts flagging valuation excesses and dependence on U.S. government contracts.

- Lattice Semiconductor (LSCC -13.2%) reported mixed results and cautious outlook as industrial and auto demand softened.

- Fabrinet (FN +3.9%) beat expectations on strong telecom demand and emerging AI infrastructure opportunities.

- Apple (AAPL) reportedly developing a low-cost Mac laptop targeted for early 2026 release.

- Microsoft (MSFT) committed $60B toward next-generation “neocloud” data-center development.

- Waters (WAT +6.3%) delivered revenue and EPS beats, raised organic growth guidance midpoint.

Consumer Discretionary

- Shopify (SHOP -6.9%) declined despite revenue and GMV beats; margins weighed by higher hosting costs.

- Uber (UBER -5.1%) posted better bookings but softer profitability and margin guidance.

- Papa John’s (PZZA -10%) fell after Apollo withdrew its acquisition bid.

- Denny’s (DENN +50.4%) surged on a $620M go-private deal at a 52% premium.

- Wingstop (WING +10.9%) beat on EPS and EBITDA; analysts positive on efficiency from Smart Kitchen rollout.

- Yum! Brands (YUM +7.3%) reported solid results and announced a strategic review of Pizza Hut.

Communication Services

- Netflix (NFLX) advanced its diversification strategy by exploring video podcast licensing with iHeartMedia.

- Meta and Alphabet both declined on profit-taking and valuation resets.

- Broader media and streaming names eased after strong recent performance.

Consumer Staples

- Clorox (CLX +3.9%) gained following reaffirmed full-year guidance.

- Molson Coors (TAP) exploring acquisitions to accelerate diversification beyond beer.

- Starbucks (SBUX) agreed to sell a minority stake in its China business for $4B to local partners.

Health Care

- Zoetis (ZTS -13.8%) fell despite an EPS beat as weaker arthritis drug sales led to a guidance cut.

- Sarepta (SRPT -33.7%) plunged after its confirmatory trial failed to meet primary endpoints.

- Henry Schein (HSIC +10.8%) beat estimates and raised FY guidance; KKR may increase its stake to 19.9%.

- Exact Sciences (EXAS +3.9%) beat Q3 expectations and raised FY25 outlook on strong Cologuard adoption.

- Metsera (MTSR +20.5%) jumped after Novo Nordisk raised its offer to $62.50/share plus $24 CVR, topping Pfizer’s revised bid.

Financials

- Apollo (APO +5.3%) reported strong Q3 results driven by spread-related and fee income growth.

- Insurance and payments firms outperformed on earnings momentum and defensive inflows.

- Norway’s sovereign wealth fund said it will vote against Tesla CEO Elon Musk’s $1T pay package.

Industrials

- Eaton (ETN -2.3%) reported mixed results, with soft organic sales offset by stronger margins.

- BWX Technologies (BWXT -7.2%) slipped despite an earnings beat amid concerns over high expectations after a strong YTD rally.

- Sanmina (SANM +16.6%) posted strong results and upbeat guidance tied to AI and communications markets.

- Hertz (HTZ +36.1%) returned to profitability with higher fleet utilization and stronger pricing.

- Xometry (XMTR +28.9%) raised guidance on accelerating enterprise adoption in supply chain solutions.

Energy

- Marathon Petroleum (MPC) traded lower as refining margins normalized post-earnings.

- Crude oil (-0.8%) declined amid global demand uncertainty and broad risk-off sentiment.

Materials

- Broader weakness in chemicals and industrial metals persisted on global manufacturing softness.

Real Estate and Utilities

- REITs and utilities were relative outperformers as investors rotated toward income-generating assets.

- Lower yields supported real estate pricing, though volumes remain subdued.

Eco Data Releases | Wednesday November 5th, 2025

S&P 500 Constituent Earnings Announcements | Wednesday November 5th, 2025

Data sourced from FactSet Research Systems Inc.