December 10, 2025

S&P futures are down 0.1% in Wednesday morning trading after a mixed Tuesday session in which money-center banks, pharma, aerospace, builders, and biotech lagged, while most-shorted stocks, retail favorites, private equity, chemicals, networking, and airlines outperformed. Asian markets were mixed in a quiet overnight session, while Europe is modestly lower (~0.2%). Treasuries are weaker with yields up 1–2 bp. The dollar is off 0.1%, gold down 0.5%, Bitcoin futures down 0.3%, and WTI crude little changed.

Markets are largely in wait-and-see mode ahead of today’s final FOMC decision of the year. A “hawkish cut” remains the consensus, with uncertainty around the degree of division in the Committee and Powell’s guidance. Political attention on the Fed also persists as Trump reportedly conducts final interviews for Fed Chair, though Hassett remains viewed as the frontrunner. Broader macro focus continues to center on the hawkish global policy shift that has pushed bond yields to 16-year highs. AI newsflow remains limited ahead of ORCL earnings after the close, AVGO tomorrow, and the expected new OpenAI model release. Affordability concerns continue to surface in the press, while consumer and credit commentary out of the GS Financial Services Conference has been relatively steady.

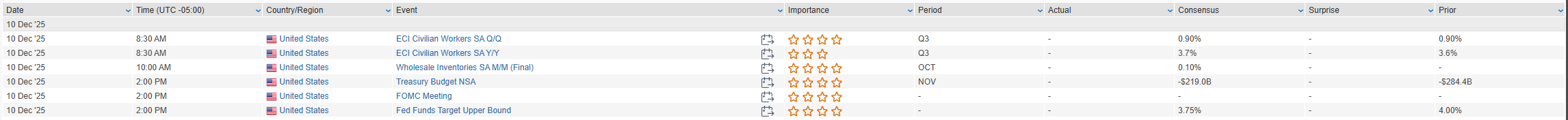

Q3 ECI prints this morning ahead of the 14:00 FOMC statement, SEP update, and Powell’s 14:30 press conference. Initial claims and the September trade balance follow Thursday, alongside a $22B 30-year auction. No data Friday, though Fedspeak resumes. A high-profile macro week begins 15-Dec with November NFP on 16-Dec and CPI on 18-Dec.

Company News

- PSKY reportedly gaining traction with WBD shareholders on its hostile bid and may raise the offer.

- MRVL CEO pushed back on reports of losses tied to MSFT and AMZN custom-chip efforts.

- GEV surged after raising 2028 guidance and boosting capital return.

- CPNG CEO departed following a major data breach.

- CASY saw slightly soft inside comps but beat on EBITDA/EPS and raised FY26 guidance.

- AVAV cited shutdown-related headwinds but emphasized supportive industry tailwinds.

- GME missed on sales and EBITDA.

- BRZE rallied on a beat-and-raise quarter, accelerating organic growth, strong customer adds, and reduced churn risks.

- PLAY missed comps but noted improving intra-quarter trends.

- CBRL fell on a miss and weaker guide, with execution and turnaround concerns highlighted

The Dow fell 0.38%, the S&P 500 slipped 0.09%, the Nasdaq edged up 0.13%, and the Russell 2000 gained 0.21% on Tuesday, with all indices closing near session lows. Trading remained muted ahead of Wednesday’s FOMC meeting and key AI events (AVGO, ORCL earnings and the new OpenAI model). Weakness was broad across financials, healthcare, machinery, homebuilders, packaging, and China tech, while high-beta/retail-favorite cohorts outperformed and Big Tech ended mixed. Treasuries flattened as short-end yields rose ~3 bp, the dollar ticked up 0.1%, gold gained 0.4%, Bitcoin rallied 2.8% (off highs), and WTI crude fell 1.1%.

The macro narrative added little new information. October JOLTS job openings beat expectations at 7.67M, quits fell to a post-2020 low, and NFIB small business optimism improved to 99.0. Treasury’s 10Y auction cleared in line. Markets remain focused on the Fed’s “hawkish cut” setup, with attention on the SEP and Powell’s criteria for pausing cuts. Global central banks continue to lean more hawkish, underscored by Australia’s RBA dropping its easing bias. Trade headlines and the evolving WBD deal saga rounded out the broader news flow.

Sector Highlights

Energy (+0.69%), Consumer Staples (+0.38%), Tech (+0.17%), Consumer Discretionary (+0.16%), Communication Services (+0.11%), and Utilities (+0.01%) outperformed modestly. Weakness was concentrated in Healthcare (-0.98%), Industrials (-0.73%), Real Estate (-0.61%), and Financials (-0.39%). The defensive/cyclical softness reflected a lack of conviction ahead of the FOMC, while semis, energy, and selected discretionary names provided pockets of support.

Information Technology

- GOOGL: Pentagon selected Gemini to deploy AI capabilities across ~3M personnel.

- MSFT: Announced $23B in India/Canada AI investments.

- NVDA: Trump approved H200 chip sales to vetted China customers; FT reported Beijing may still impose restrictions.

- CFLT: To be acquired by IBM for $31/sh (~$11B EV).

- TFX: Selling three business units for $2.03B; launching $1B buyback.

- YOU: Won CMS identity-verification modernization contract.

- MKTX: Issued 2026–28 targets; initiating $300M accelerated buyback.

- CWAN: Starboard disclosed a 5% stake, pushing for a sale.

Communication Services

- WBD: Higher after PSKY launched a $30/sh hostile bid amid Trump’s antitrust concerns over NFLX’s competing offer.

- NFLX: Lower on increased bid competition and political scrutiny.

- GOOGL/Waymo: Robotaxi rides surpassed 450K weekly.

Consumer Discretionary

- HD: FY26 outlook disappointed; pressured housing-related retail.

- TOL: Missed on EPS and deliveries; cancellations rose; FY26 guide soft.

- AZO: FQ1 EPS missed; domestic comps below expectations though commercial remained strong.

- GIII: Beat margins and EPS; raised FY guidance; introduced dividend.

- VIK: Upgraded at GS on demand quality and pricing power.

Consumer Staples

- PEP: Announced cost actions and price cuts as part of Elliott settlement; sees revenue at high end of prior range.

- CPB: Earnings tone weighed on Staples sentiment.

Energy

- XOM: Updated 2030 plan pointed to stronger earnings/FCF without raising capex.

- Oil services: Outperformed on cyclical momentum.

Financials

- JPM: Guided 2026 expenses nearly 10% above 2025; Q4 IB fees softer; shares fell.

- KEY: Raised FY25 NII guidance; expects stronger Q4 IB; boosted buyback.

- SLM: Cut FY26–27 EPS outlook sharply; sees FY26 EPS down ~19% y/y.

- Banks/Brokers: Broader group supported by constructive commentary at GS conference.

Healthcare

- CVS: Raised FY25 EPS/OI/revenue; FY26 slightly light; medium-term view improved.

- PFE: Announced $2.1B obesity-drug licensing deal with YaoPharma.

- WVE: Upgraded at RBC on promising obesity-drug profile.

- NRIX: Released positive early leukemia-treatment data.

- INSP: Upgraded after favorable CMS reimbursement ruling.

Industrials

- FERG: Beat results; modestly raised margin outlook; bar was high after strong YTD rally.

- ALEX: To be taken private for $2.3B (~40% premium).

- MMM: Downgraded at Deutsche Bank on valuation.

Materials

- GPK: Cut FY25 EPS and EBITDA guidance; announced CEO transition and inventory actions.

Eco Data Releases | Wednesday December 10th, 2025

S&P 500 Constituent Earnings Announcements | Wednesday December 10th, 2025

Data sourced from FactSet Research Systems Inc.