January 16, 2026

S&P futures +0.3% Friday Morning after U.S. equities finished higher but off best levels on Thursday. Small caps, high beta, momentum, and growth led factor performance, with AI and investment banks among the bright spots. Asia mixed overnight (South Korea and Taiwan higher; Japan and China modestly lower). Europe −~0.2%. Treasuries and dollar little changed. Gold −0.3%, silver −1.3%, bitcoin −0.1%. WTI +1%.

No clear directional driver into the weekend. Ongoing focus on broadening leadership, small-cap/cyclical outperformance, better growth sentiment, a high bar for Q4 earnings, the White House affordability/Main St. over Wall St. push, geopolitical uncertainty, Fed independence noise, stretched sentiment/positioning, and elevated retail participation.

Company News

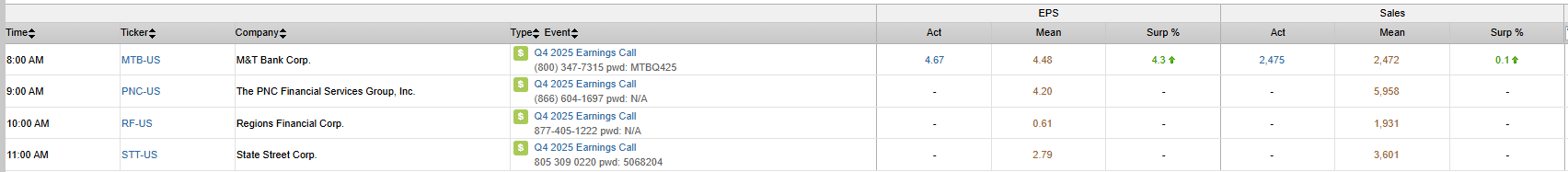

- STT, RF, PNC, MTB — Reporting earnings this morning.

- JBHT — Q4 earnings beat after the close Thursday on Intermodal upside; some disappointment company did not raise cost-savings targets.

- JPM — CEO Jamie Dimon said he plans to remain CEO for at least five more years.

- WMT — Said International CEO Kathryn McLay will step down.

- F — Reportedly in talks with multiple battery suppliers following reports of discussions with BYD.

- WS — To acquire Germany-based metal processor KCO for $2.4B in cash.

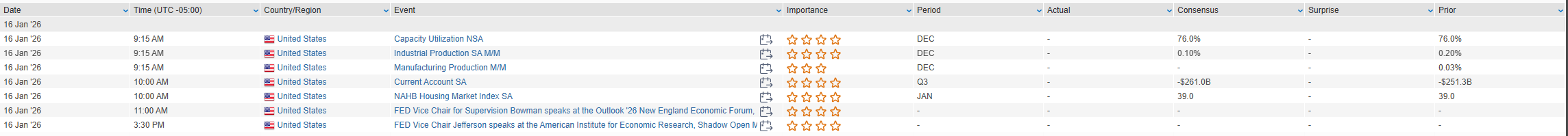

Data & events: December industrial production and January NAHB housing index due today; Fed Bowman and Jefferson speak. Next week is light—PCE inflation (Thu) and flash PMIs (Fri). A SCOTUS decision on IEEPA tariffs could arrive early next week.

U.S. equities finished higher Thursday (Dow +0.60% | S&P 500 +0.26% | Nasdaq +0.25% | Russell 2000 +0.86%), with leadership continuing to rotate beneath the surface. Small caps extended their outperformance for a second consecutive week, while the S&P 500 and Nasdaq remained modestly negative on a week-to-date basis. Sentiment was supported by improving AI fundamentals, notably from TSMC, and better-than-feared investment bank earnings, while easing geopolitical risk weighed on crude prices.

Macro data reinforced the better growth / higher-for-longer rates narrative. Initial jobless claims fell to 198K, well below consensus, while January Empire State (+7.7) and Philly Fed (+12.6) manufacturing surveys surprised sharply to the upside, driven by stronger new orders and shipments. Firmer growth data pushed yields higher at the front end, with markets now pricing roughly 45 bp of Fed cuts in 2026.

Markets: Treasuries saw mild bear flattening (2Y yield highest since Dec-10). Dollar +0.3%. Gold −0.3%, silver +1.1%. Bitcoin −2.7%. WTI −4.5%, snapping a five-day rally as Trump signaled he would hold off on Iran strikes.

Sector Highlights

Outperformers: Utilities +1.04%, Industrials +0.93%, Real Estate +0.68%, Technology +0.50%, Financials +0.43%, Consumer Discretionary +0.41%, Materials +0.33%

Underperformers: Energy −0.91%, Healthcare −0.58%, Communication Services −0.43%, Consumer Staples −0.03%

Information Technology

- TSM (+4.4%) – Beat and raised across the board; lifted long-term revenue CAGR to ~25% and guided 2026 capex to $52–56B, well above consensus.

- ASML (+5.4%) – Strong read-through from TSMC’s elevated capex outlook.

- ENTG (+9.1%) – Upgraded on expectations for a broader MSI recovery and favorable 2026 technology inflections.

- NVDA (↑) – Outperformed within megacap tech on improved AI sentiment.

- GOOGL (↓) – Pulled back amid ongoing megacap rotation.

- NTNX (−5.4%) – Downgraded on slower expected bookings and elongated deal cycles.

- FFIV (+2.5%) – Management said FY26 outlook assumptions remain conservative following prior security incident.

Financials

- GS (↑) – Earnings beat; Global Banking & Markets strength offset one-time Apple Card transfer impact.

- MS (↑) – Beat consensus in both Investment Banking and Wealth Management.

- BLK (+5.9%) – Strong Q4 with record inflows, ~12% organic base-fee growth, and a 10% dividend hike.

- FHN (+1.6%) – Beat on EPS, NII, and NIM; FY26 revenue outlook ahead of expectations.

Energy

- TLN (+11.8%) – Acquired additional PJM natural-gas assets for $3.45B, expanding generation footprint.

- CVGW (+13.5%) – Jumped on agreement to be acquired by AVO in a cash-and-stock deal valuing shares at ~$27.

- Energy equities broadly (↓) – Pressured by sharp pullback in crude prices.

Industrials

- HON (+1.3%) – Filed for IPO of majority-owned quantum computing unit Quantinuum.

- MTN (↓) – Flagged weather-related revenue headwinds.

Healthcare

- BSX (↓) – Announced $14.5B acquisition of PEN; expected to be dilutive in year one post-close.

- GEHC (−3.3%) – Downgraded on valuation and competitive pressures.

- OCUL (+1.9%) – Rose on reports of renewed takeover interest.

- NVO (−3.0%) – Slipped amid antitrust lawsuit tied to compounding pharmacies.

Consumer Discretionary

- DKNG (+3.3%) – Upgraded on expectations for robust 2026 profit growth.

- CART (−2.6%) – Weighed by grocery-delivery competition following KR/UBER announcement.

- SPOT (↑) – Announced subscription price increase.

Eco Data Releases | Friday January 16th, 2026

S&P 500 Constituent Earnings Announcements | Friday January 16th, 2026

Data sourced from FactSet Research Systems Inc.