January 20, 2026

S&P futures −1.6% Tuesday morning, with Mag 7 under pressure, following a week where three of four major U.S. indexes fell. Beneath the surface, breadth held up: the equal-weight S&P +0.7% and Russell 2000 +2%+ last week. Rates moved higher with a bear steepener (long-end +7–10 bp). USD −0.9%, gold +3.1%, silver +7.2%, bitcoin −1.9%, WTI +0.3%.

Drivers: Risk-off sentiment after the holiday on Trump’s 10% Greenland tariff threat (and possible EU responses). Offsetting chatter centers on buy-the-dip given de-escalation paths and Davos meetings Wednesday. Additional pressure from a jump in JGB yields tied to Japan election/tax-cut speculation. Focus also on White House affordability messaging (Main St > Wall St) and potential AI trade dispersion as buzz builds around new developer tools.

Week ahead: Key events include Greenland meetings and affordability speech at Davos (Wed), SCOTUS hearing on Fed Governor Cook (Wed) and a possible tariffs ruling. The Fed is in a quiet period ahead of next week’s FOMC; a Fed Chair pick could come soon. Data is light today; construction spending & pending home sales (Wed), 20Y auction ($13B), Q3 GDP (3rd), income/spending incl. PCE & claims (Thu), and flash PMIs + final U. Mich (Fri).

Corporate highlights (selected):

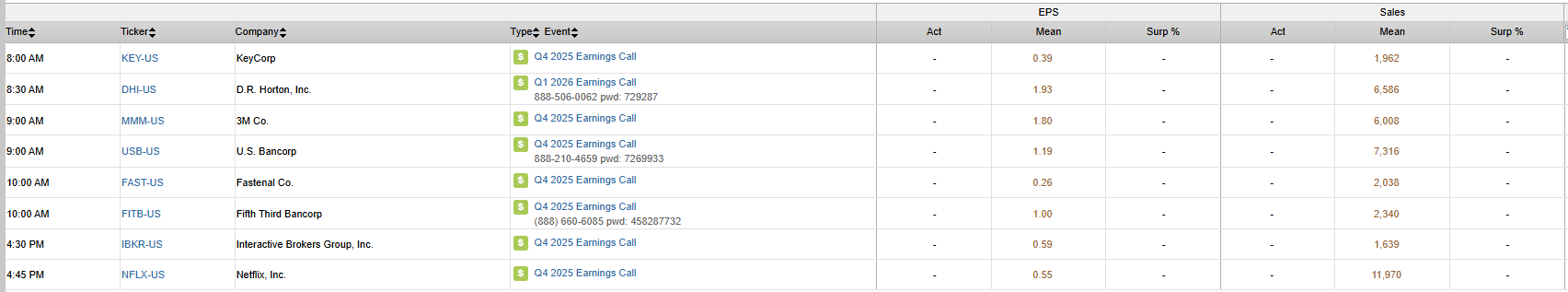

- Earnings today: MMM, DHI, FAST, FITB, KEY, USB; NFLX after the close.

- NVDA supply chain: Reports suppliers paused H200 parts after China blocked shipments.

- AAPL: Regained top spot in China on strong holiday quarter.

- JPM: Trump threatened legal action over alleged debanking.

- MU: Buying a Taiwan chip fab site for $1.8B.

- KVUE, KMB: Lancet study found no link between acetaminophen use in pregnancy and neurodevelopmental disorders.

- LULU: Proxy fight intensifying; founder reportedly pushing to remove Advent from the board.

U.S. equities were mostly lower (Dow −0.17% | S&P 500 −0.06% | Nasdaq −0.06% | Russell 2000 +0.12%), though moves were very limited into the close. The session capped a week of modest declines for the S&P 500 and Nasdaq, while small caps outperformed again, extending their streak of beating the S&P 500 to 11 consecutive sessions (longest since the 1990s). Breadth was negative and the equal-weight S&P lagged the cap-weighted index, underscoring continued dispersion.

Policy headlines were the primary macro input. President Trump said he wants to keep Kevin Hassett in his current White House role, shifting prediction-market odds toward Kevin Warsh as the likely next Fed Chair. Warsh is viewed as more hawkish/independent, helping push Dec-2026 rate-cut expectations down to ~43 bp, the lowest since the December FOMC. Trade and tariffs returned to focus after Trump said tariffs could be imposed on countries not aligned with the U.S. on Greenland, alongside renewed comments from USTR Greer on China/Canada.

Data was mixed but not market-moving. December industrial production beat expectations. January NAHB housing index missed, tied for the lowest level since September and the first decline since August; all sub-indices fell, and 40% of builders reported price cuts for a third straight month (first time since May-2020).

Markets reflected a mild risk-off tone in rates and commodities: Treasuries sold off modestly (belly yields +5–6 bp; curve steepening), USD flat, gold −0.6%, silver −4.1% (still up on the week), WTI +0.4%, bitcoin −0.1%.

Sector Highlights

Outperformers: Real Estate +1.20%, Industrials +0.65%, Energy +0.21%, Financials +0.12%, Technology +0.09%, Consumer Staples ~0.00%

Underperformers: Healthcare −0.84%, Communication Services −0.72%, Utilities −0.51%, Materials −0.44%, Consumer Discretionary −0.17%

Information Technology

- MU (+7.8%) – Continued strength in memory stocks; Director Mark Liu disclosed $7.8M of insider buying.

- HON (+2.1%) – Upgraded on expectations for strong order momentum and aerospace margin recovery.

Financials

- PNC (+3.8%) – Q4 EPS and revenue beat; NII and fees better, deposit growth ahead; Q1/FY revenue guidance above consensus.

- STT (−6.1%) – EPS, NII, and revenue beat, but shares fell on 12% y/y expense growth and repositioning charges.

- MTB – EPS beat; FY26 NII and fee income midpoints below Street.

- RF (−2.6%) – EPS missed; guided Q1 NII down LSD; FY26 NII midpoint ~1% below consensus; later downgraded.

- JPM – CEO Dimon reiterated plans to remain CEO for at least five more years.

Energy

- GEV (+6.1%) – Benefited from expectations that Trump’s proposed wholesale power auction would push tech companies to fund new generation.

- CEG (−9.8%) – Weighed by reports the administration wants big tech to contract directly with utilities, pressuring independent power producers.

Industrials

- RKLB (+6.1%) – Upgraded on a more constructive 2026 outlook for space technology (launch cadence, policy support).

- WS – Announced acquisition of KCO.GR for $2.4B cash.

Healthcare

- IBRX (+39.8%) – Advanced first-line NMIBC program with enrollment exceeding expectations and positive interim analysis.

- ASTS (+14.3%) – Awarded a prime contract position under the U.S. Missile Defense Agency’s SHIELD program.

Consumer Discretionary

- YETI (+2.9%) – Upgraded on U.S. drinkware stabilization, international growth, and category expansion.

- VAC (−4.2%) – Downgraded on sales-force turnaround challenges and elevated loan-loss provisions.

- MGM (−1.2%) – Downgraded on softer Las Vegas trends, Macau share loss, and muted U.S. online gaming growth.

- WMT – Announced the departure of its International CEO.

Consumer Staples

- KHC (−2.9%) – Downgraded on competitive pressure and private-label exposure.

- SJM (−2.6%) – Downgraded on valuation and competitive risks.

Materials

- MOS (−4.5%) – Preliminary Q4 phosphate and potash volumes below expectations; cited weaker North American demand and pressure in Brazil.

Eco Data Releases | Monday January 20th, 2026

No releases today

S&P 500 Constituent Earnings Announcements | Monday January 20th, 2026

Data sourced from FactSet Research Systems Inc.