January 21, 2026

S&P futures +0.3% after Tuesday’s sharp risk-off session, with the S&P 500 and Nasdaq down more than 2% as Big Tech drove the selloff. Retail favorites, high beta and momentum factors underperformed, while precious metals and energy were relative havens. Asian markets were mostly lower overnight, though Greater China and South Korea held up better; Europe is down more than 0.5%. Treasuries are modestly firmer with yields ~1 bp lower. The dollar is little changed. Gold +2.0%, Silver +0.4%, WTI −0.7%, and Bitcoin −0.3%.

Macro & Policy

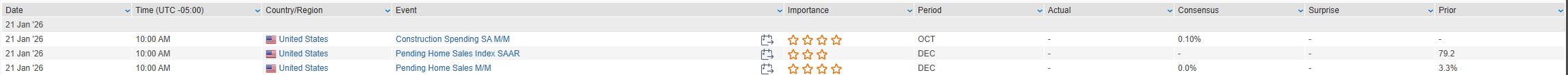

U.S. equity stabilization this morning is being attributed to hopes that President Trump’s meetings in Davos could offer a de-escalation path around recent tensions tied to Greenland, reinforced by a slightly more conciliatory tone on Tuesday about reaching an agreement that would keep NATO “very happy.” Global risk sentiment also found some support from overnight JGB stabilization, after Japan’s finance minister called for calm and speculation grew around potential intervention following recent volatility in Japanese rates. Earnings remain secondary to macro and geopolitics for now, particularly with investors still waiting on Big Tech results and questioning the muted reaction to recent beats, consistent with a high-bar earnings dynamic. On the policy front, today features Trump’s Greenland meetings and affordability speech in Davos, along with a Supreme Court hearing on Fed Governor Cook, while the Fed is in its quiet period ahead of next week’s FOMC. On the data side, construction spending (Sep–Oct) and December pending home sales are due this morning, alongside a $13B auction of 20-year Treasuries, with GDP, PCE, and claims later this week.

Company News (Selected)

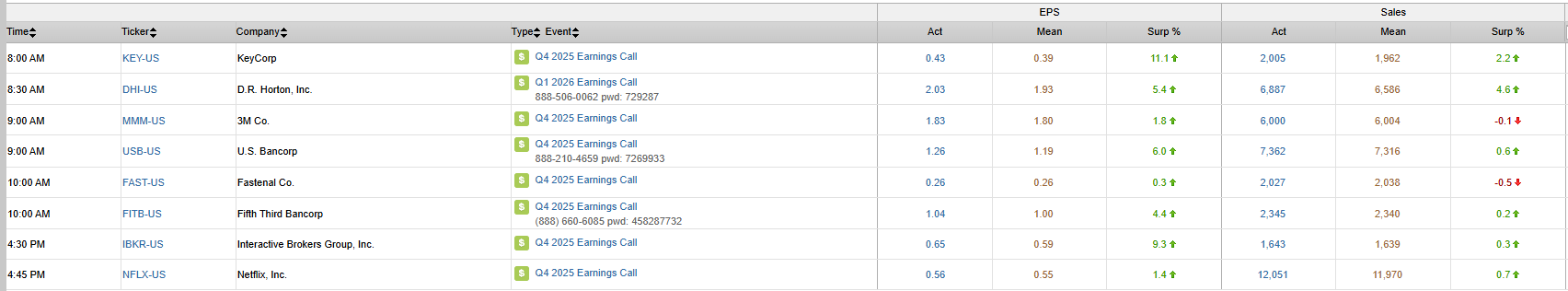

- NFLX – Q4 beat, though investors focused on softer operating margin guidance and incremental investment plans; M&A overhang remains in focus.

- UAL – Q4 results better than expected; early Q1 demand commentary upbeat and full-year guidance in line, described by management as conservative.

- ZION – Results highlighted firmer core PPNR, improved credit trends, and an upgrade to loan growth guidance.

- PRGS – Q4 EPS ahead of estimates; FY26 guidance midpoint raised.

- KHC – Shares weaker after BRK.B registered its entire 27.5% ownership stake for potential sale.

- GME – Back in focus following Ryan Cohen’s stock purchase and renewed speculation around a potential Bitcoin sale.

U.S. equities sold off sharply Tuesday (Dow −1.76% | S&P 500 −2.06% | Nasdaq −2.39% | Russell 2000 −1.21%), posting the worst session since October, as markets repriced trade and geopolitical risk alongside a renewed global rates shock. Over the weekend, President Trump threatened 10% tariffs on eight European countries, potentially escalating to 25% by mid-year, while Europe signaled €93B in counter-tariffs and possible use of its anti-coercion tool. Attention now turns to Trump’s Davos address and follow-up EU deliberations.

Rates volatility compounded the move. A sharp selloff in Japanese government bonds (snap-election chatter, weak auctions, fiscal concerns) spilled into U.S. Treasuries, driving a bear-steepening and pushing long-end yields to their highest since late summer. Volatility spiked (VIX highest since November), the dollar fell, gold (+3.7%) and silver (+6.9%) surged to records, and crypto sold off. The market now prices just ~44 bp of cuts in 2026. Additional overhangs include stretched positioning, limited downside hedging, Fed independence uncertainty, and renewed Main St. > Wall St. affordability messaging.

Sector Highlights

Relative Outperformers: Utilities (+1.03%), Industrials (+1.99%), Real Estate (+1.95%), Materials (+0.78%), Energy (−0.17%), Healthcare (−0.20%).

Underperformers: Technology (−2.94%), Consumer Discretionary (−2.82%), Financials (−2.23%).

Bottom line: The tape reflected a decisive risk-off rotation—away from crowded growth and momentum toward defensives and real assets—as trade escalation, global rates volatility, and policy uncertainty dominated sentiment.

Information Technology

- ServiceNow (NOW): Announced AI agent integration with OpenAI (shares pressured with software de-risking).

- Nvidia (NVDA): Suppliers reportedly paused H200 component production after China blocked shipments (NVDA −4%+).

- Apple (AAPL): Regained top smartphone share in China on strong holiday quarter (stock resilient vs. peers).

- Micron (MU): Buying a Taiwan chip fabrication site for $1.8B (shares higher earlier in the week).

- Intel (INTC): Upgraded; benefited from AI server demand (+3.4%).

- Software broadly lagged amid AI-agent competition concerns.

Consumer Discretionary

- D.R. Horton (DHI): Revenue/closings beat; flagged affordability headwinds (shares lower).

- Lululemon (LULU): Proxy fight intensified; governance overhang (shares pressured).

- Netflix (NFLX): Revised WBD bid to all-cash ahead of earnings (NFLX down with growth selloff).

- Domino’s Pizza (DPZ): Downgraded on growth visibility (−3.2%).

- Travel/leisure, homebuilders, retail favorites broadly weak.

Financials

- U.S. Bancorp (USB) & KeyCorp (KEY): Q4 beats but guidance underwhelmed (stocks lower).

- Fifth Third (FITB): Beat with better fees/expenses (relative outperformance).

- JPMorgan (JPM): Targeted by Trump rhetoric on “de-banking” (shares lower).

- Cards, asset managers, and banks broadly sold off.

Healthcare

- Rapt Therapeutics (RAPT): Agreed to be acquired by GSK (+64%).

- ImmunityBio (IBRX): FDA resubmission optimism (+17.4%).

- Acadia Healthcare (ACHC): CEO appointment; guidance reaffirmed (+21.9%).

- Kenvue (KVUE) / Kimberly-Clark (KMB): Benefited from Lancet study on acetaminophen (KVUE +2.3%).

- Incyte (INCY): Downgraded on valuation (−3.4%).

Industrials

- 3M (MMM): Organic growth decelerated; FY26 EPS midpoint light (−7.0%).

- Fastenal (FAST): Margins/operating income soft (−2.6%).

- Leggett & Platt (LEG): Rejected Somnigroup bid (shares weaker).

Communication Services

- Via Transportation (VIA): Analyst upgrade citing platform differentiation (+8.0%).

- Warner Bros. Discovery (WBD): In focus on NFLX all-cash bid (WBD volatile).

Energy

- Energy was a relative outperformer as WTI +1.7%; select E&Ps/refiners held up.

Materials

- Precious metals miners surged with bullion (gold +3.7%, silver +6.9%).

- Copper/aluminum and ag chemicals outperformed.

Real Estate

- REITs declined but outperformed growth sectors amid defensive rotation.

Utilities

- Utilities were among the few groups higher, reflecting risk-off demand.

Eco Data Releases | Wednesday January 21st, 2026

S&P 500 Constituent Earnings Announcements | Wednesday January 21st, 2026

Data sourced from FactSet Research Systems Inc.