February 3, 2026

S&P 500 futures +0.2% in early Tuesday trading after U.S. equities finished higher Monday, snapping a three-day losing streak. Cyclicals led the rebound with airlines, retail, and machinery outperforming, while energy and precious-metals equities lagged. Mag 7 performance was mixed.

Global markets are constructive. Asian equities rallied sharply overnight, led by South Korea (+~7%) and Japan (+~4%). European markets are higher by ~0.7%. Treasuries are slightly weaker with yields up ~1 bp following Monday’s data-driven backup. The dollar is little changed, though AUD strengthened after the RBA rate hike. Commodities are volatile: gold +6.2%, silver +12.1%, WTI crude little changed, and bitcoin futures modestly lower.

Markets are attempting to build on Monday’s bounce, largely attributed to renewed growth optimism after the strongest ISM manufacturing print since 2022. The data revived the “run-it-hot” macro narrative—one of the more constructive themes for 2026. Focus now shifts to the next wave of mega-cap earnings, with Alphabet (GOOGL) reporting Wednesday after the close and Amazon (AMZN) on Thursday.

Macro & Events

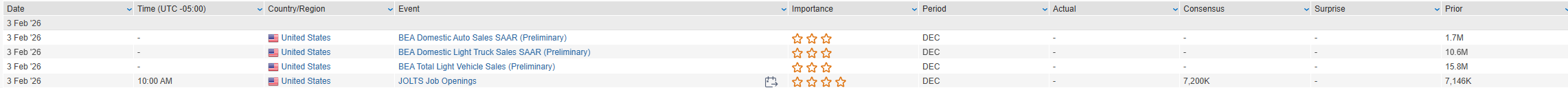

- JOLTS job openings will not be released today due to the partial government shutdown.

- Fed speakers: Barkin and Bowman scheduled today.

- January vehicle sales due this evening.

- Wednesday: ADP private payrolls, ISM services, and Treasury quarterly refunding announcement.

- Friday: Preliminary University of Michigan consumer confidence; January employment report delayed due to shutdown.

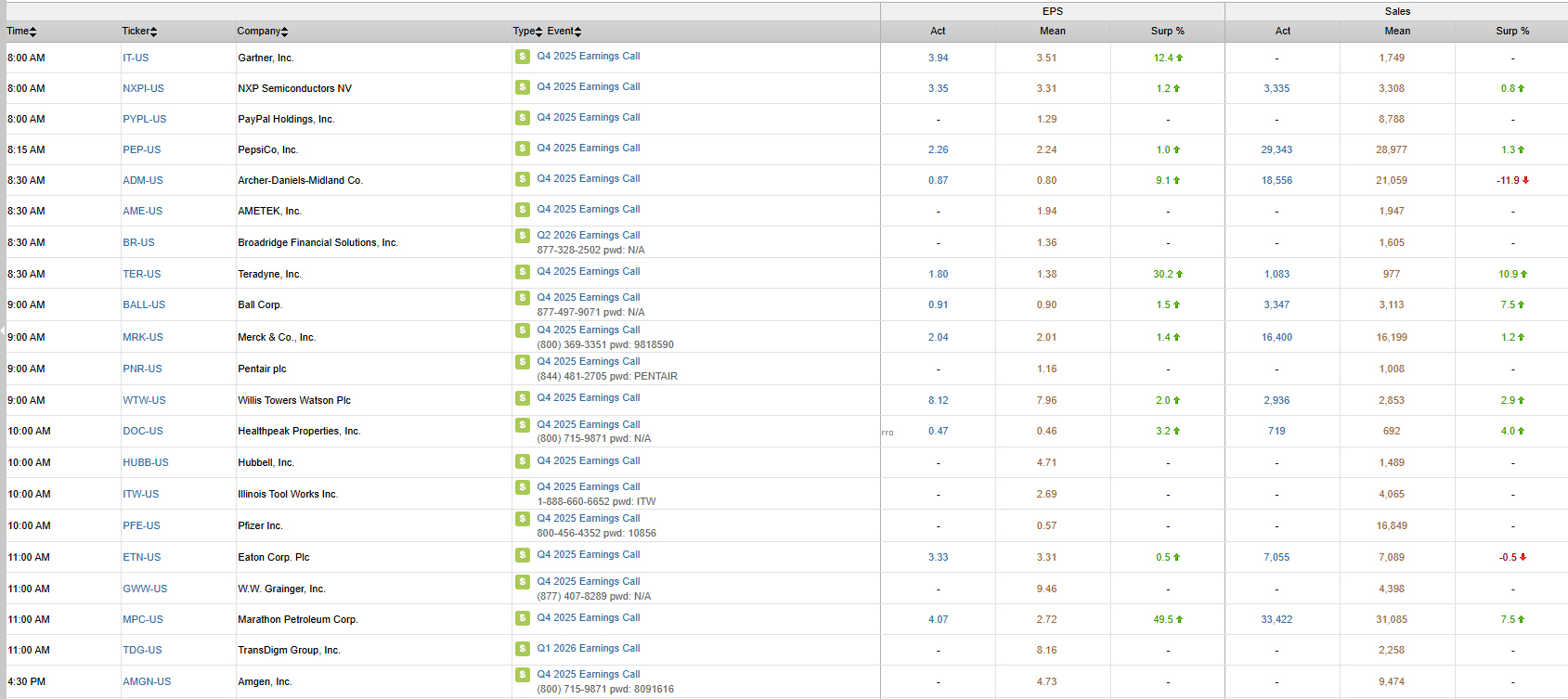

Company & Earnings Highlights

- Palantir (PLTR): Major post-earnings standout; revenue growth accelerated ~700 bp to ~70% y/y, U.S. commercial revenue beat by ~6%, margins expanded sharply (Rule of 127% in Q4), and guidance points to further acceleration tied to enterprise AI demand.

- NXP Semiconductors (NXPI): Lagged; March-quarter guidance exceeded expectations but still implied a sequential revenue decline, disappointing after last week’s TXN results.

- Teradyne (TER): Surged on a strong beat and raise; AI-related demand highlighted as a key driver.

- Fabrinet (FN): Shares weaker despite a beat and raise as investors focused on muted Datacom growth.

- Woodward (WWD): Rallied on a beat and raise with strong growth across Aerospace and Industrial end markets.

- DaVita (DVA): Beat expectations driven by strength in integrated kidney care.

- Rambus (RMBS): Q1 product revenue guidance came in light.

- **OpenAI / NVIDIA (NVDA): Reuters reported OpenAI is evaluating alternatives to Nvidia chips; OpenAI CEO Sam Altman later pushed back on the report.

U.S. equities finished higher on Monday (Dow +1.05% | S&P 500 +0.54% | Nasdaq +0.56% | Russell 2000 +1.02%, closing near session highs as investors leaned into a resilient macro narrative despite lingering positioning and sentiment concerns. The key macro catalyst was January ISM Manufacturing, which surprised to the upside at 52.6, moving back into expansion territory for the first time since mid-2022. New orders surged nearly 10 points m/m to the highest level since February 2022, while production and employment also improved. Prices paid ticked higher, reinforcing the “growth holding up, inflation sticky” backdrop.

Rates reacted accordingly, with Treasuries weaker and the curve bear-flattening; short-end yields rose 3–4 bp. Fed pricing now implies roughly 47 bp of rate cuts in 2026, down from 52 bp priced late last week. The dollar index rose another 0.7%, extending Friday’s rebound.

Commodities remained volatile. WTI crude fell another 4.7% amid reports of U.S.–Iran nuclear discussions and easing geopolitical risk. Precious metals were choppy but ended lower, with gold down 2% and silver down 1.9%, consistent with ongoing positioning-driven volatility rather than a clear narrative shift. Bitcoin futures fell sharply, down 6.9%, dropping back below $80K.

AI sentiment stabilized after cautious weekend headlines, while broader risk appetite was supported by constructive Q4 earnings commentary, slowing retail inflows, and renewed discussion of potential CTA and vol-control de-risking if markets flatten.

Sector and Industry Highlights

Semiconductors continued to outperform software by more than 200 bp, extending record chip leadership and reinforcing investor preference for tangible AI infrastructure over higher-multiple software. Cyclical and economically sensitive areas—banks, transports, machinery, industrial metals, and payments—led gains, while defensives and rate-sensitive groups such as utilities, REITs, managed care, and precious-metals miners lagged. Energy was the weakest sector as crude prices slid sharply.

Information Technology

- NVIDIA: Shares lagged after CEO Jensen Huang downplayed media reports around a stalled $100B OpenAI investment, clarifying that no such commitment was ever made; reiterated intent to remain involved at a smaller scale.

- Oracle: Announced plans to raise up to $50B to fund AI infrastructure, roughly half via equity; Street framed move as a positive signal of AI demand visibility rather than monetization stress.

- Apple: Press scrutiny increased around gross margins amid rising memory and component costs.

- Revvity: Earnings beat aided by tax benefits; margins missed and Life Sciences organic growth disappointed, though FY guidance improved.

Communication Services

- Walt Disney: Earnings beat with strength in Experiences; Sports and Entertainment softer. Domestic attendance impacted by weaker international travel; FY guidance reiterated.

- Yext: CEO withdrew prior $9/share take-private proposal; company announced a $150M self-tender, driving sharp downside.

Consumer Discretionary

- McDonald’s: Upgraded at BTIG on improved traffic trends driven by value and promotions; CosMc beverage platform seen as a potential upside catalyst.

- Peloton: Announced an 11% workforce reduction as part of cost-cutting efforts.

- Ford: Reportedly held discussions with Xiaomi regarding a potential U.S.-based EV manufacturing joint venture.

Consumer Staples

- Church & Dwight: Upgraded at JPMorgan; analysts cited portfolio cleanup, divestitures, and acquisitions positioning company for a return to faster growth.

- Hain Celestial: Announced sale of North American Snacks business for $115M in cash.

Financials

- Peakstone Realty Trust: Shares surged after agreeing to be acquired by Brookfield Asset Management for ~$1.2B in cash, representing a ~34% premium.

Health Care

- Humana: Downgraded at Morgan Stanley on valuation and concerns around 2026–27 earnings risk; analysts prefer peers.

Energy

- Coterra Energy: Fell after announcing an all-stock merger with Devon Energy, creating a ~$58B enterprise-value company to be named Devon Energy.

- Devon Energy: Shares also pressured following merger announcement amid oil price weakness.

Industrials

- ESAB: Announced $1.45B acquisition of Eddyfi Technologies, expanding exposure to advanced inspection and sensing technologies.

Eco Data Releases | Tuesday February 3rd, 2026

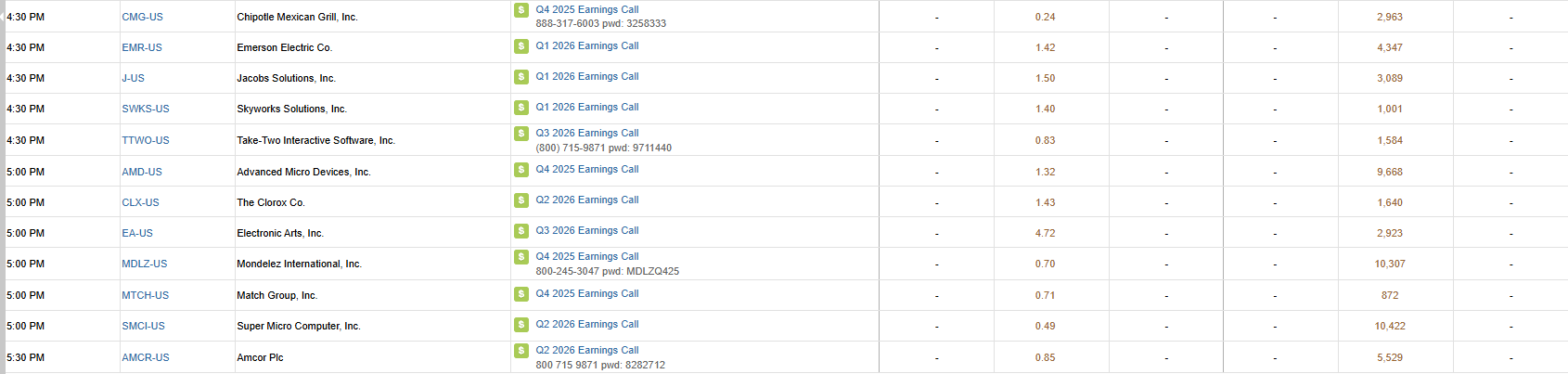

S&P 500 Constituent Earnings Announcements | Tuesday February 3rd, 2026

Data sourced from FactSet Research Systems Inc.